Polyus Gold: Why The Underperformance?

Polyus is underperforming despite strong cost dynamics.

Significance of Fosun deal is not enough to outperform the stock market.

Favorable outlook is imminent with attractive dividends and diverse range of growth projects.

Image source: TRUST.UA

Investment Thesis

Polyus Gold International Limited (LON:PGIL) delivers stable earnings due to higher production, despite wobbly trends in the Russian currency. However, Free Cash Flow (FCF) was modest due to high capital expenditures resulting from increased spending at the Natalka deposit, and additional payments for Sukhoi Log.

In the investment research that follows, we will try to determine what causes PGIL stock to underperform despite its good fundamentals. We will also look at its recent Fosun deal and whether it will serve as price catalyst for stock outperformance or not.

Lastly, we will go through the quality of its projects and determine how its dividend policy will contribute to its financial flexibility.

Stock Performance

PGIL is down 14% in December versus closest peer Polymetal which is only down 4% while gold prices fell by 2%. There is no company-specific news driving the sell-off and we attribute it to sentiment around the Fosun transaction.

Polyus is the eighth largest gold producer in the world generating 2 million ounces of gold per year. It has a notable gold resource base translating into over 30 years of potential "life of mine".

The company's satisfactory operating performance is overshadowed by a lack of certainty around the completion of the Fosun deal. The market appears to be favoring PGIL until clarity emerges.

According to Goldman Sachs, there are two key changes linked to the completion of the Fosun deal:

Minimum annual dividend payment (that is minimum mandatory dividends, which imply 0.5% higher dividend yields in 2018 as opposed to the current dividend policy).

Composition of Board of Directors (the Board of Directors will include 9 to 11 directors along with at least 3 independent non-executive directors).

Share Price Catalyst

There are three share price catalysts identified here to outperform the U.S. stock markets: the Fosun deal, Natalka and Sukhoi Log.

PGIL entered into an agreement to sell 12.6 million of its ordinary shares at $70.60 per share to a consortium led by Fosun International Ltd. PGIL similarly granted the Consortium an option to acquire. It is subject to the completion of the acquisition of the Initial Stake as part of agreement.

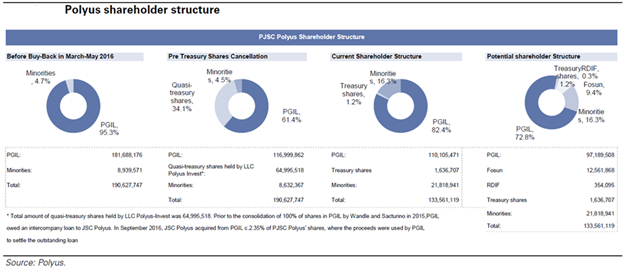

Image source: Polyus

Along with it, an additional number of shares are required to increase its stake in the share capital of PGIL of up to 15%. It includes newly issued shares in the Open Subscription of PGIL's share capital at $77.66 per share (referred to as Option Exercise Price). The share options are exercisable not later than May 2018.

Image source: Polyus

Goldman Sachs remained positive on PGIL stock. The broker believes that the Fosun deal does not have actual operating implications on PGIL's cash generation. Competitive positioning of PGIL remains strong versus global gold peers. Competitors exude volume growth, hefty margins and a healthy balance sheet in the near term.

Meanwhile, majority of analysts favored the developments in the Natalka project. A key share price catalyst to watch out is the ramp up of this project along with accompanying cost control on this asset, which is expected to be finished by 2018. Natalka accounts for 70% of Polyus' operational growth.

Other share price catalysts that will allow PGIL shares to outperform the market would be the consolidation of ownership in Sukhoi Log. In 2017, PGIL entered into an agreement to acquire the remaining 25% interest in Sukhoi Log deposit from Rostec.

Total consideration was arranged to pay for 5 tranches of Polyus shares. PGIL initially held 51%, after winning the auction in a joint venture with Rostec at the onset of 2017. It is already a party to a separate agreement to purchase 24% back from Rostec via cash option agreements running from 2017 to 2022.

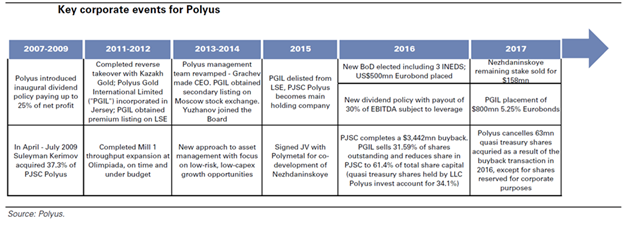

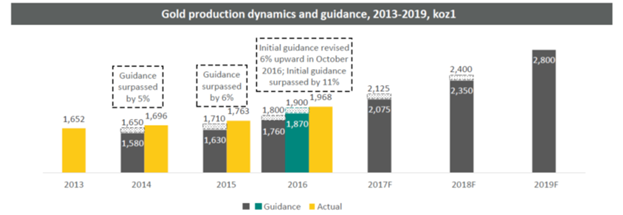

Volume Growth & Project Pipeline

Polyus has a good track record of delivering volume growth with a compounded annual growth rate (CAGR) of 6% from 2012 to 2016. PGIL is the lowest cash cost producer in Russia, and among global peers (included in top 10 gold producers globally), thanks to: (1) its large-scale operations (economies of scale), (2) a robust reserve grade, (3) Russian currency (RUB) depreciation, (4) 100% open-pit operations, (5) access to the power grid, and (6) management efforts to lower costs.

Image source: Polyus

However, we are not confident of the expectations that PGIL can produce 2.77 million ounces of gold by 2019. In order for this to materialize, we expect a longer ramp-up of the Natalka project.

However, the promising growth outlook presented by the development of Sukhoi Log or perhaps the additional production from Chertovo Koryto will help augment the production lags.

Natalka is the key growth project for Polyus that is still at the construction stage. The initial plan was to develop the mine as a large-scale open pit, utilizing a gravitation flotation processing scheme. The proposed mine is being groomed to be the largest gold mine in Russia in terms of gold output.

Capital Management

The combination of higher negative FCF after dividends and other smaller cash outflows is partially mitigated by receipt of $400 million of share proceeds from Secondary Public Offering. Management utilized the proceeds to pre-pay outstanding maturities. Hence, net debt is expected to increase by $170 million, which will cause leverage to move back to 2.0X in 2017 from 1.9X in 2016.

The dividend policy included dividend floors that are to be added following the closure of the Fosun transaction. To satisfy these payouts and avoid a shortfall, PGIL will need to successfully deliver on its production capacity.

The Russian Ruble and gold prices will be supportive in the long run. As a result, we believe the fundamental upside of PGIL shares would remain constrained. But in terms of cash flows and debt profiles, it has potential upside to outperform relative to peers within the sector.

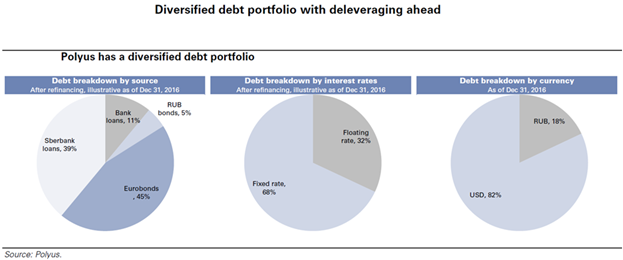

Image source: Polyus

Our Takeaway

PGIL offers an attractive combination of growth, profitability, dividends and deleveraging. The company is one of the few gold miners in the world which has only open pit operations with substantial life of mine.

The transaction with Rostec would have a significant impact on PGIL share price. Hence, investors are advised to keep their radars for any updates on asset reserves, timing of delivery and total capital expenditures.

Fundamentals are constrained by an aggressive dividend policy, which is driven in part by an indebted shareholder. We believe the company's dividend policy is aggressive and restricts financial flexibility.

We believe operations are already mature but supported by well-established mining assets. It has adequate mining capacity to support the run-rate.

We note that PGIL has only generated more than 30% EBITDA in FCF in three of the last six years. Furthermore, PGIL has generated more than $550 million in FCF in two of the last six years. As a result, we believe there is a high risk that a material proportion of PGIL's future debt payments will require to be funded through debt.

As a result of higher debt, PGIL will need to structurally increase its EBITDA to prevent increases in leverage, and has become vulnerable to adverse moves to Russian Ruble and gold prices.

Although, the current capex run-rate will potentially decline, it will provide some additional flexibility to make payments. However, this will not fully offset the inherent gold price risks.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article was written by Hans Centena, our business journalist. Gold News is not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes. Investing involves risk, including the loss of principal. Readers are solely responsible for their own investment decisions.