Post: Silver Breaks US$100!

Michael Ballanger of GGM Advisory Inc. shares his update on the silver market, as well as shares one of his favorite stocks.

You will no doubt have noticed that the title of the January 30 missive is almost identical to the title of the January 23 missive and that both are describing the events of those two days. "Silver breaks $100!" was the title of last week's missive only because I felt it necessary to join the long and never-ending line of newsletter gurus all chiming in simultaneously on the topic of silver breaking out and above the mystical $100 level. Joining this esteemed group were a bevy of victory-lappers all congratulating themselves with silver coins in eye sockets sending laser beams screaming out into ionosphere while reminding anyone with a social media feed that they had been recommending silver throughout the entire rise.

There are perennial silver bulls out there like my friends Bill Murphy and Chris Powell, founders of The Gold Anti-Trust Action Committee otherwise known as "GATA" that have done exemplary work on the subject of high-level interference in the pricing mechanism for gold and silver. Also in the camp of "solid researchers" lie legendary silver proponents like Eric Sprott and David Morgan whose comments must always be taken to heart largely because they wear their hearts on their sleeves like badges while ensuring that their moneys are always where their mouths are.

Alas, alongside them are the cheerleaders, the unabashed promoters of not only silver as a store of value but of their advisory services that lay claim to being full, true, and plain disclosers of the "real story" behind silver. While this crowd shall remain nameless, they serve an important function of being the advertising arm of the hard asset community. The only noteworthy champion of the blogosphere is Michael Oliver who, to his sincere credit, has been chirping the silver mantra since the lows in 2016 but since he has now taken complete control of the "Silver to $500" narrative, he just came out with his new forecast seen in the graphic shown above. The picture of Michael Oliver telling the unsuspecting world that silver is going to $500 per ounce "within hours" is not only dripping with the two bastions of heroism - bravery and honour - it is now the face of the term "blow-off top" and one that may go down in perpetuity.

The guy shown to the left is the face of the phrase "I listened to Michael Oliver" and was only this afternoon seen wandering through Nathan Phillips Square in downtown Toronto rifling through garbage cans with his pockets hanging out of his designer jeans uttering in non-descript vernacular sentences like "Why did I listen?" and "I will KILL him when I see him." or "Hell hath no fury like a margin clerk avoided." From the looks of the poor chap, one might think him as the "wounded client" whereas in reality, he is the "financial advisor" that was finally given the green light by his compliance officer to allow clients to own hard assets while being urged by his branch manager to employ "margin" in order to "enhance returns" (meaning commissions) all in the interest of "Best Practices" and "Corporate Governance". They were all granted absolution over the silver allocation thanks to experts like Michael Oliver that afforded "cover" for the fees associated with the trade, in the same manner that Bitcoin graduated from "toxic waste" to "investible asset" once the investment bankers were allowed into the room.

The reason I repeated last week's title in this missive was because it is the first time in over forty years of writing missives to clients that I have been shown the opportunity to use the same title two week in a row! Falling under the category of "small things excite small minds", I seized upon the moment tonight and decided to ignore the millions of shares I own in small silver producers but instead celebrate the final and inevitable reckoning that accompanies anyone that goes against the bandwagon-jumping throng and actually sells silver. It is a true fact that as of the close of business tonight the title "Silver breaks $100!" actually rang true with the March silver contract going out at $84.10 after trading as low as $74.15 earlier into the session. The only difference between last week and this week was direction.

And how about that CNBC headline? Silver has been on a rip-roaring tear since the summer of 2025 yet every day we have been forced to watch one of the anchors interviewing a long line of crypto shills, lobbyists for the Bitcoin/Ethereum insiders that spend hundreds of millions of dollars buying ad space for their industry while pumping the "wonders of Bitcoin's performance" that was non-existent until Wall Street got the "green light" on cryptocurrency ETF's. With Bitcoin off over 30% from its 2025 peak, not once have I seen a headline that featured its "30% decline". Instead, CNBC trots out a banner like the one shown above. Silver was trading at $35 per ounce back when Bitcoin hit its peak at $126,110 in the summer of 2025. Every newsletter writer on the planet was then trying to glide gracefully and under cloak of darkness adorned with fake nose and moustache into the world of "crypto analysis" but I and a few others stayed conspicuously silent while other gold bulls decided to either embrace it or reject it.

The results are unanimous. The winner since the end of the pandemic has been silver. It has blown the doors off every asset class since the summer of 2025 yet all CNBC can do is put out a headline designed to scare the skin off anyone within striking distance of an ounce of silver. As it has been adorned since the dawn of financial reporting, the hatred of precious metals began when the first boatload of fiat-worshipping banksters arrived at Jekyll Island in 1912, hell-bent to establish a network of banks whose sole purpose was to control the legislative arms of every

nation on the planet. Through two world wars and several pandemics, famines, recessions and one major depression, the bankers have sought to destroy sound money principles while dangling the promise of unchallenged and under-collateralized credit as their modicum of exchange all anchored by the "full, faith, and credit" of the American government.

The quote "Let me issue and control a nation's money and I care not who writes the laws" is often wrongly attributed to Mayer Amschel Rothschild, the founder of the Rothschild banking family and while there is no proof he ever said it, and it has been the clarion call of the global bankers since December 23, 1913.

The action in the precious metals on Friday had all the classic and oh-so-familiar characteristics of a bullion bank raid, aided and abetted by the LME, the Comex, and the New York Fed. The traders swooped down into the trading pits just after the Comex opening on Thursday morning and after watching March silver trade up to $121.755 literally minutes prior to the pit session opening, they bludgeoned it down to $106 within the first hour.

After the bulls tried valiantly to rally it for most of Thursday, the hammer came down in earnest on Friday morning when the behemoths laid on the lumber with brute force and full malevolence taking it down to $75 by shortly after noon hour. It was coordinated beautifully with the release of the news of a new Fed chairman in the form of Kevin Warsh, a former Fed Governor who is seen a somewhat of a monetary "hawk" that had an immediate bullish impact on the U.S. dollar index futures which naturally impacted the algobots that sprang into action (along with a battery of N.Y. Fed traders) hammering out every bid that could be seen between $118 and $75 with robotic dispatch and vengeful intent.

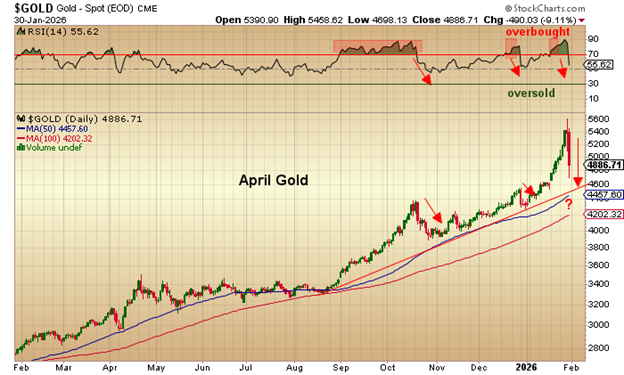

I sent this chart out to all subscribers a few days before silver crashed highlighting the egregiously overbought RSI readings and the "vertical" incline in price that was beautifully "gradual" right up until November of last year when for some ungodly reason it decided to steepen. Not only did March silver begin to go parabolic, it did so in record time and with little space left for speculators to catch their breath. It was up 140% within a month which undoubtedly invited the short sellers of which I was a card-carrying member having got my fingers burned twice, once in the mid-$50's and again around $75 as the wunderkind called March silver had its way with me.

I promised subscribers that I would refrain from ever again attempting to short silver (whether or not it is disguised as a "hedge") until last weekend right after I wrote the first "Silver breaks $100!" missive after which I kept staring at the picture of the silver chart where I had placed a bubble with the Latin phrase "Caveat Emptor". There is a part of the human brain called the amygdala, a small, almond-shaped structure in the limbic system, which is the primary brain part that controls the "fight-or-flight" response. It detects threats, processes fear, and instantly triggers the nervous system to release hormones like adrenaline, preparing the body to flee or fight before the logical brain reacts. It also forced grizzled old veteran traders like me to initiate trades without the need for a spreadsheet full of corroborating reasons.

I went into battle on Monday morning of last week doing my utmost to ignore my social media feeds that had every silver bull in existence congratulating a) themselves, b) their subscribers, c) their wives, children and in-laws, and d) the family parakeet for giving them "inspiration" all the while calling for silver to hit $200, $300, and even $500 per ounce. I was ignoring them because my amygdala was telling me that silver should be sold if you owned it and shorted if you didn't. So I sent out an email alert which laid out my "scale-in" approach for the week where I would take a 25% position in the ProShares UltraShort Silver 2X's ETF (ZSL:US) every day for the next four session but only if prices kept softening (which they did). Starting at $1.95, I was filled on the final tranche on Thursday morning at $1.45, coming away with an average cost of $1.7175 for what amounted to a peanut of a position, capable of hedging a very small portion of my large junior silver holdings but more importantly, fully capable of repairing my wounded pride and savaged ego caused by the two failed shorts from earlier in the advance. I can tell you unequivocally that watching the crash of Friday was financially painful but psychologically blissful (if that makes any sense.)

OK, now that you allowed me to take my own personal "victory lap" around the track, torch in hand and laser beam eyes in full force, where, pray tell, do the precious metals go from here?

The rumour going around a few weeks back was that the bullion banks were in serious trouble

due to out-of-control hedge books and the losses being carried on their balance sheets. I thought at the time that if there ever was a time for the regulators to hold up a sign that said "Stand By for a Slight Change of Rules", it would be now. Well, that is exactly what they did as there were five maintenance margin increases imposed by the CME during silver's moonshot until the final move to "percentage-based" margin calculations that rescued the bullion banks and allowed them to bomb the metals markets on Friday with nary a fear in the world of regulators ever levying a margin call. In other words, they got a blank cheque to take the metals down and that is precisely what they did (which is outright manipulation and interference). Did I predict a bullion bank raid prior to the crash? Of course not, but since I have the grey hair in my beard to prove my "veteran" status, you had to be an active precious metals advocate like me and around in 1980 and in 2013 when the regulators stepped in to rescue the banks. Sadly, while they saved the bullion banks from dissolution and bankruptcy in 1980 and 2011, what the history books fail to reveal is the follow-through after those tops were made that took thousands upon thousands of speculators (who thought they knew the rules) directly into insolvency. I know people my age that put their life savings into silver in the $45-50 per ounce range that only just recently got their money back, fifty-six years later!

In both 2011 and 1980, the initial crash in metals prices did not end as a one-day event; the markets then had to deal with margin calls being sent out not to the bullion banks but to the thousands upon thousands of customers now hit with margin calls against their long positions. For that reason, I expect follow-through selling to begin Sunday at 6:00 p.m. EST in the electronic access market and then accelerate into the Monday opening of the pit sessions where there are certainly going to be body bags and resuscitators in broad use.

March silver might find support briefly at the 50-dma at $73.38 which was just below Friday's crash low of $75.00 but more than likely, the 100-dma at $60.65 will serve as the life preserver for the current bull market. In fact, silver could correct all the way to the 200-dma at $48.95 and still be technically sound which is a testimonial to the violence of the ascent from last November. Holder of the hedges put on last week will be advised to take advantage of the follow-through and reduce exposure on any such move to the 100-dma which would correspond to the 100-dma for the ZSL:US at $$6.22.

As for April gold, I wrote last week at $5,300 that "gold could easily correct to the $4,450 level and still be in a powerful bull market." No sooner had those words hit the word processor than an 8% haircut arrived erasing $862 from the peak.

As in March silver, April gold went out well below the price shown above ($4,886) closing in the electronic session at $4,763 which is roughly $300 from its 50-dma. I will bank on an intraday move toward the 100-dma at $4,202 before the serious money starts to accumulate.

Copper prices were also whacked but given the more moderate rate of ascent in price, downside risk is probably contained to the 100-dma around $5.22/lb. although it held the uptrend line around $5.90 despite hitting $5.76 earlier in the session. If I had to hazard a guess, copper will be back above $6.00 before silver is above $100 and gold above $5,000.

Of the metals discussed here today, I maintain my preference to copper as a core holding in this secular transition to the commodities bull with a close second being oil. You will note that yesterday's turmoil did not faze oil one iota as it finished down a mere $.21 on the day and up 7.24% for the week.

Many of the copper names that I like but have been unable to buy got hit hard late week as late-comers were suddenly punished for their tardy entries to the sector. For this copper advocate, I have been cringing every time I saw my beloved Freeport-McMoRan Inc. (FCX:NYSE) tick up another dollar or two. The disgust crested on Friday morning when the company I exited at $46 last fall after the Grasberg Mine "mud rush" curtailed operations hit a high of $69.44, forcing me to hurl one of my obsolete ashtrays directly at the monitor in a fit of totally-undisciplined rage.

However, by the afternoon on Friday, the stock had touched $58.66, a full $10.78 off its record high print. I vowed last week that I would bite the bullet and buy back my all-time favourite blue-chip company (FCX) at any price under $60 so assuming that we get some additional downside follow-through on Monday, I intend to scale in to a 25% position because whenever I go more than a few weeks flat this position, I break out in hives and have regular panic attacks that usually frighten my wife and my dog who both wind up locked in a room in the basement for hours on end with the sound of agonized wailing permeating the house.

| Want to be the first to know about interestingGold,Copper andSilver investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Michael Ballanger: I, or members of my immediate household or family, own securities of: Freeport-McMoRan Inc. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.