Rare Stock Signal About to Flash for First Time Since 2001

The S&P 500 Index (SPX) last week suffered its worst week since 2016. However, U.S. stocks have been on a tear since then, with the major market indexes pacing for their sixth straight gain, and the SPX on track for its best week since December 2011, up 4.7% so far. Should these gains hold, it would send up a stock market signal not seen since 2001.

S&P Pacing for 10th Signal Ever

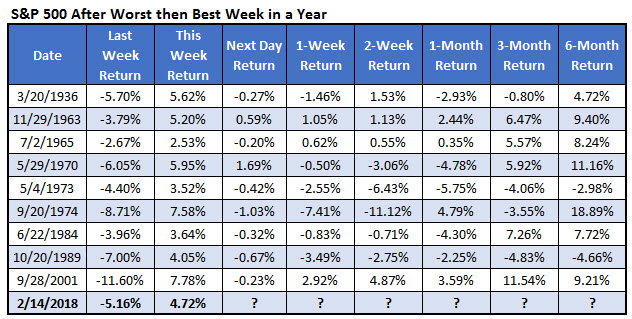

Specifically, the last time the S&P suffered its worst week in a year followed by its best week in a year was September 2001, according to data from Schaeffer's Senior Quantitative Analyst Rocky White. Prior to that, you'd have to go back to October 1989 for a signal. In fact, since 1928, there have been just nine other massive weekly swings of this magnitude.

Short-Term Pain, Long-Term Gains May Be Ahead

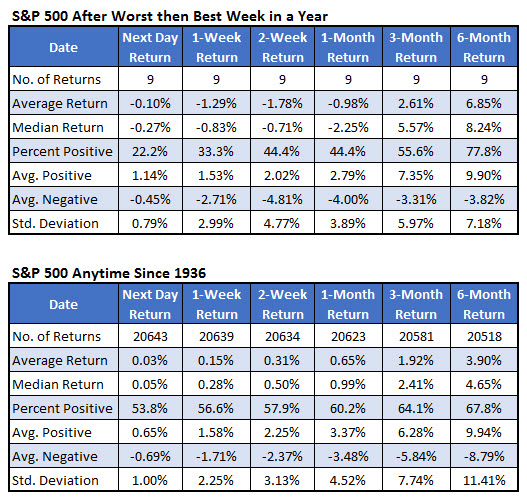

Historically, these roller-coaster rides have been short-term bearish signals for stocks. The next day, the S&P was down 0.1%, on average, and higher just 22.2% of the time. That's compared to an average anytime one-day gain of 0.03%, with a win rate of 53.8%, looking at data since 1936 (when the first signal occurred).

One week out, the SPX was down 1.29%, on average, and higher just one-third of the time. Again, that's compared to an anytime one-week gain of 0.15%, with 56.6% positive. What's more, Wall Street will also be battling some post-Presidents Day blues early next week, if recent history is any indicator.

That downward trajectory has continued up to one month after a signal, with the S&P higher only 44.4% of the time two weeks and four weeks out, and averaging notable losses over both time frames. For comparison, the index has averaged two-week and one-month anytime gains, with a win rate of 57.9% and 60.2%, respectively.

However, three and six months after signals, the index has outperformed. Specifically, three months later, the S&P was up 2.61%, on average, and higher 55.6% of the time. Six months later, the SPX was up a whopping 6.85%, on average -- handily exceeding its average anytime six-month gain of 3.9% -- and higher nearly 78% of the time.