Red Hat Options Trader Just Made Millions

The speculator placed a very well-timed bet late Friday

The speculator placed a very well-timed bet late Friday

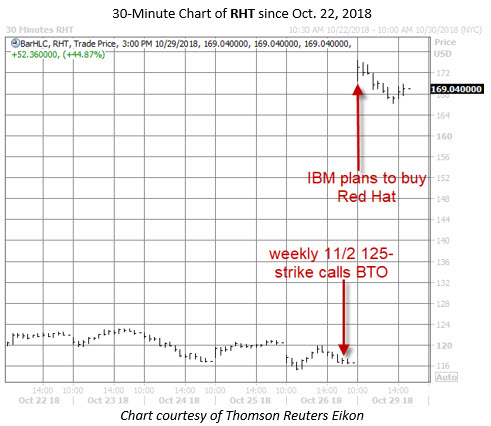

Red Hat Inc (NYSE:RHT) stock has skyrocketed today, after IBM Corp (IBM) announced plans to purchase the software concern for about $34 billion. At last check, RHT stock was up 44.9% to trade at $169.04 -- and one recent options trader made a killing with a well-timed call purchase last week.

In the last half-hour of Friday's session, a block of 359 weekly 11/2 125-strike calls were apparently bought to open for 45 cents apiece, or $16,155 total (premium paid x number of contracts x 100 shares per contract). At the time, RHT was trading around $116, meaning the weekly calls were roughly 9 points out of the money, with just a week of shelf-life left.

Today, that same weekly call option is now more than 40 points in the money. As such, the aforementioned buyer's weekly calls were closed for $48.63 today -- in just a few trading hours -- according to Trade-Alert. That's a massive profit of 10,700%, or about $1.73 million. For reference, the average daily volume at this strike on Thursday, Oct. 25, was just three contracts, and open interest was just 67 contracts.