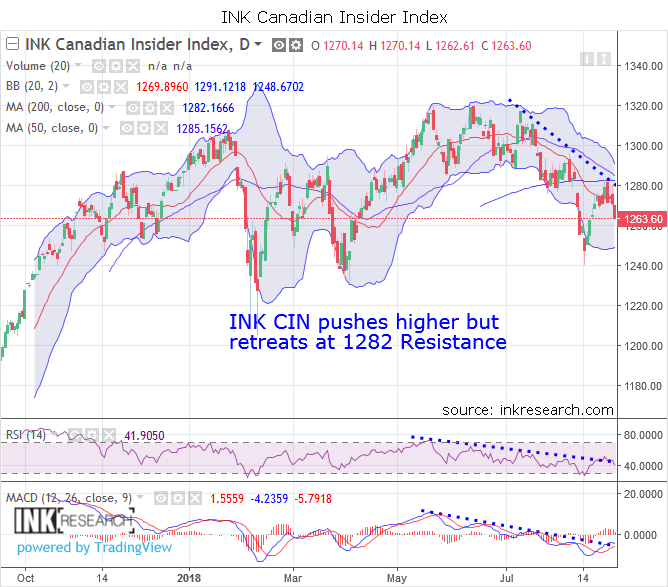

Resistance at 1282 turns back INK Canadian Insider Index

Thank you for joining us in a weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. Last week, the INK Canadian Insider Index saw recent momentum push its price as much as 11 points higher (reaching as high as 1282.17 on an intraday basis), before strong resistance turned it back by week's end for a loss of 7.3 points and a close of 1263.60.

RSI retreated 4 points to 41.9. MACD, our long-term momentum indicator which dipped slightly from 2.33 to 1.55 still remains on a technical buy signal. Both RSI and MACD are now pushing up against their own respective resistance lines (see dotted lines) which they will need to overcome before the INK CIN can advance.

Support remains at 1250 and 1263. Resistance is at 1269 and 1282 (200-day moving average).

This week's minor pullback seems more a pause for the Index ahead of a bigger advance rather than a setback of any sort. The INK CIN appears to be on a slow boil alongside copper and other commodities, awaiting its turn to embark on a strong upside move. The US dollar remains elevated and continues to provide a headwind for the INK CIN, as it has for several months now. However, the long dollar trade remains very crowded and is at great risk of reversing.