Russia, Tax Concerns Sink Stocks

The Dow Jones Industrial Average (DJIA) and S&P 500 Index (SPX) are trading lower, after former Trump campaign manager Paul Manafort was charged with "conspiracy against the United States" and "seven counts of failure to file reports of foreign bank and financial accounts," among other indictments. Rick Gates, a Manafort business partner, was also indicted by a special counsel investigating Russia's interference in the 2016 presidential election. Manafort and Gates are expected to appear before a judge at 1:30 p.m. ET.

In addition, stocks are reeling on reports that the House is weighing a plan that would gradually reduce the corporate tax rate, and Merck (MRK) stock is dragging the Dow lower after the company withdrew its European application for Keytruda. And despite an extended rally for tech stocks, the Nasdaq Composite (IXIC) is also in the red at midday, after earlier touching fresh record highs.

Continue reading for more on today's market, including:

Analyst: This pharma stock could triple.The semiconductor stock nearing oversold territory.Plus, Host Hotel's unusual pre-earnings volume; CalAtlantic's big merger; and the swooning aluminum stock.

Among the stocks with unusual options volume is hotel and resort concern Host Hotels and Resorts Inc (NYSE:HST), with over 4,500 call options traded -- eight times the average intraday norm, and on pace for the 96th percentile of its annual range. The December 20 calls arethe most popular, withover 3,300 contractstraded. Most of the action is attributable to a sweep of 3,000 calls likely bought to open ahead of Host Hotels' earnings release on Wednesday. At last check, HST stock was down 0.3% at $19.36.

The biggest gainer on the New York Stock Exchange (NYSE) is homebuilder CalAtlantic Group Inc (NYSE:CAA). The shares of CAA are soaring after real estate concern Lennar Corporation (NYSE:LEN) agreed to buy CalAtlantic for $9.3 billion. The stock was last seen up 23% at $49.69, and earlier notched a 10-year high of $50.48 -- just shy of the $51.34 per-share offer price.

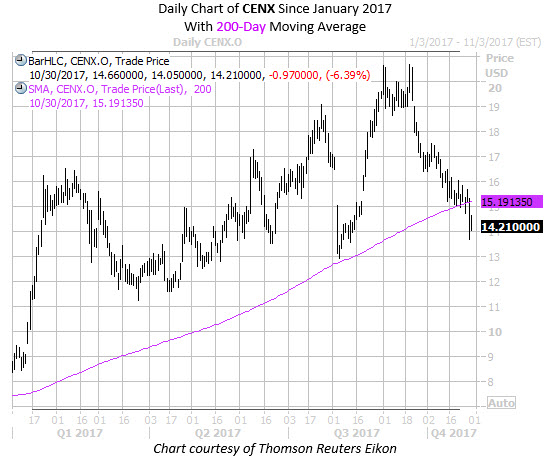

One of the worst stocks on the Nasdaq today is aluminum producer Century Aluminum Co (NASDAQ:CENX), with the shares 6% lower to trade at $14.24. J.P. Morgan Securities downgraded the stock to "neutral" from "overweight" after last week's earnings miss, and cut its price target to $14.50 from $22. CENX stock is now trading back below the $15 area, and is set to end beneath its 200-day moving average for the first time in 2017.