SLVO: Hedge Against Deficits And Generate Income With This Silver Play

Silver prices have been getting decimated due to a strengthening dollar.

The dollar is strengthening because of the Fed's rising interest rate policy.

The horrid shape of the US Federal Budget will likely limit interest rates and dollar strength, and will most likely cause the dollar to fall long term.

SLVO allows investors to make a long-term bet on rising silver prices and collect an income while they do it.

The note pays 6.19%, which is not a bad rate to receive while waiting for the thesis to play out.

Over the past week or two, I have seen an abnormally high number of articles posted to this site discussing the improving positive outlook for precious metals. I even chimed in myself on this topic in an article on the Sprott Physical Gold and Silver Trust (CEF). While I do remain optimistic on both precious metals going forward despite the current overwhelmingly bearish sentiment in the market, of the two I am more optimistic about silver due to its use as an industrial metal and its incredibly low price relative to gold. Fortunately, there is actually a way to invest in silver and generate an income off of it at the same time, which provides cash that can be reinvested into other assets. The easiest way to do this is by investing in the Credit Suisse Silver Shares Covered Call ETN (SLVO).

Bearish Case For Silver

As I mentioned in the introduction, the bearish view has dominated silver prices for much of the past five years, with spot silver prices being down 33.35% over the period. The voices against the metal seem to have gotten louder over the past year though.

The primary argument given by silver bears has to do with the Federal Reserve. As the Federal Reserve has been involved in an interest hiking cycle, the U.S. dollar has strengthened relative to other currencies. This is one of the reasons for the carnage that we saw in emerging markets over the summer. It also had a negative impact on silver prices. This is because precious metals like silver are often viewed as a hedge against a falling dollar. When the dollar strengthens, capital flows come out of precious metals and into the dollar, which causes precious metals to decline.

There is some question about how much further the Federal Reserve will actually raise rates. The Fed Watch Tool sponsored by the CME strongly suggests that rates will be in the 2.5-3.0% range a year from now, which compares to today's 2.0-2.25% rate. In addition, the Federal Reserve itself has stated that it is not currently planning to raise rates much beyond 3%.

With that said, accurately predicting the moves of the Federal Reserve is somewhat of a fool's errand. If the measures that the Federal Reserve uses to measure the economy continue to stay strong, the central bank may opt to keep raising interest rates past its 3% level. There is, however, one thing that might constrain it.

The Federal Debt

As I discussed in my article on CEF, the United States Federal Government spent $523 billion in fiscal year 2018 to service the national debt. This is the result of rising interest rates and years of very high budget deficits. There are also no signs that the government will even reduce its deficits going forward, let alone start reducing the national debt. It is also admittedly somewhat questionable what it can do as 70-75 million Baby Boomers retire and start to draw down on the severely underfunded Social Security and Medicare trust funds.

The need to make interest payments on the current $21.6 trillion in federal debt, future growth of the debt, and state government debt will likely put some constraints on how high interest rates can go. The U.S. government's servicing rate on the national debt is usually around the 10-yr. Treasury rate, which is 3.205% as of the time of writing. At this interest rate, the U.S. government can be expected to pay $692 billion to service the national debt over the next twelve months assuming a balanced budget. As that is very highly unlikely, debt service costs alone will likely be much higher than that.

As the odds of a more fiscally responsible budget occurring are somewhere between zero and zero, at some point it seems almost certain that the Federal Government will be unable to pay its debt servicing costs. At that point, it may have no choice but to print money and drive down the value of the dollar. This scenario would prove beneficial for precious metals.

About SLVO

In the introduction to this article, I stated that one way to invest in silver and collect an income while waiting for our bullish argument to play out is by purchasing SLVO. This is due to the strategy that this asset uses, which generally involved writing covered call options against silver.

First of all, it is important to note that SLVO is an exchange-traded note. As such, it is actually a senior unsecured debt obligation of Credit Suisse (CS), the second-largest Swiss bank. Unlike an exchange-traded fund, SLVO does not have any physical assets backing it and is therefore subject to the risk of default. With that said though, Credit Suisse is a very large and well-capitalized bank and it seems highly unlikely that it actually will default on any of its obligations.

The ETN is designed to track the performance of the Credit Suisse Nasdaq Silver FLOWS 106 Index. This index is basically a strategy of selling 6% out-of-the-money call options against the iShares Silver Trust ETF (SLV). Every month, the holders of the ETN get a variable payment that corresponds with the option premium received from such a strategy. In addition, the price performance of the note should roughly match the price performance of SLV, with one exception.

This exception comes from the use of the covered call strategy. The strategy is one that produces income but it does require that the investor sacrifice any upside beyond the strike price of the calls sold. As the index is essentially a strategy in which out-of-the-money calls are sold with a strike price 6% higher than the price of SLV, we can assume that the note will underperform the ETF if silver rebounds strongly and goes up more than 6% in a single month.

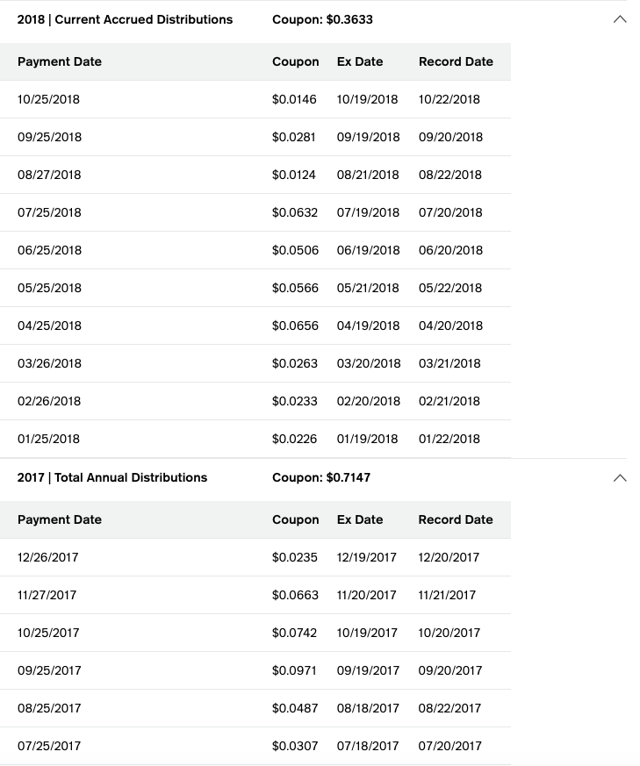

There are several factors that determine call premiums and, in fact, nobody has published an accurate model for option pricing. The most commonly used model, Black-Scholes, has attracted significant amounts of criticism and has not always proven correct. One factor that does certainly affect premium pricing though is expected volatility. If the market generally expects that the price of the underlying asset will be volatile, options against it will fetch a higher price. This sentiment can change on a monthly basis, which affects the premiums received from a covered call strategy. This causes SLVO's monthly distribution to vary, as seen here:

As of the time of writing, SLVO pays an annualized distribution of 6.19%, which is certainly not a bad rate to receive while we wait for our silver thesis to play out. It is important to keep in mind though that the income received can vary significantly from month to month, so this may not be a good investment for someone that would need the monthly income to pay their bills.

One final thing to keep in mind here is that the distributions received from SLVO are considered to be interest payments for taxation purposes. This is due to the note structure. Therefore, in the United States at least, these payments are taxed at ordinary income rates and not at the favorable capital gains rate. For this reason, U.S.-based investors may want to consider holding SLVO in an IRA or other tax-advantaged account as opposed to an ordinary brokerage account.

Conclusion

In conclusion, silver prices have been decimated over the past few years and especially over the past year as the dollar's strength has been negatively pressuring precious metals pricing. However, there are signs that this may be beginning to change. In particular, it is hard to see how the dollar can continue to remain strong over the medium to long term, given the horrid financial shape of the United States government. Given this, one method that investors may wish to employ is getting income for holding precious metals while we wait and see how this all plays out. SLVO offers an easy way to do that.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Power Hedge and get email alerts