Shorts go shopping at book and clothing retailers

According to the latest IIROC short report for the period ending February 28th, shorts appear to be pressing against insiders at Indigo Books & Music (IDG). The bookseller had a negligible short position in mid-February, but that soared to 3.1% of the stock's float by month end. Short sellers may be betting that the stock is vulnerable to seasonal factors with the busy Christmas shopping season now in the rearview mirror.

Longer-term, shorts may want to be cautious given that the company ranks in the top 30% of insider commitment. Generally, we expect short bets to have a better chance of success when insider commitment is low. When shorts and insiders go head-to-head, on average we would put our money on the insiders.

Canadian stocks* with the largest change in short position from last report (Feb.15)

| Stock | Ticker | Short to Float | Change | Industry | Insider Outlook | |

| 1 | TerraVest Industries | TVK | 5.0% | 3.3% | Oil Related Services and Equipment | Mixed |

| 2 | OrganiGram Holdings | OGI | 8.9% | 3.2% | Pharmaceuticals | Mixed |

| 3 | Indigo Books & Music | IDG | 3.1% | 3.1% | Other Specialty Retailers | Mostly Sunny |

| 4 | Titan Medical | TMD | 5.2% | 2.9% | Advanced Medical Equipment & Tech | Mixed |

| 5 | Aritzia | ATZ | 3.9% | 2.9% | Apparel & Accessories Retailers | Cloudy |

| 6 | CannTrust Holdings | TRST | 4.1% | 2.5% | Pharmaceuticals | Mixed |

| 7 | Village Farms Intl | VFF | 3.9% | 2.0% | Fishing & Farming | Sunny |

| 8 | Firm Capital Mortgage Inv | FC | 2.2% | 1.4% | Banks | Rainy |

| 9 | Lundin Gold | LUG | 1.2% | 0.9% | Gold | Mixed |

| 10 | Wesdome Gold Mines | WDO | 2.8% | 0.8% | Gold | Mixed |

*Companies with share prices $3 or higher.

Based on our insider commitment rankings, shorts may have better luck against Firm Capital Mortgage Investment Corporation which ranks in the bottom 10% on insider commitment. We would note, however, that the company just completed a $23 million bought deal financing on March 1st. We will have to see if any of those shorts cover with that news out of the way.

Short selling seems to be in fashion at retailer Aritzia (ATZ) which has dropped to the bottom 30% in our insider commitment rankings. On February 19th, the company announced a secondary offering of securities by certain shareholders.

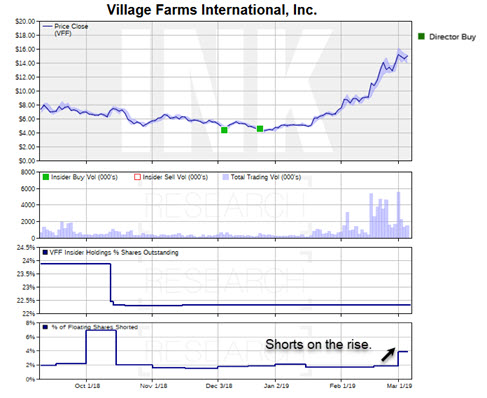

Village Farms International (VFF) was the stock with the 7th largest jump in short-sales during the last two weeks of February. While short-sellers may be betting that the stock valuations of the greenhouse operator with hemp growing ambitions are too high, the company ranks in the top 10% in terms of insider commitment. However, there could potentially be technical factors at work in this case. On March 1st, shares of the Village Farms were halted on the Nasdaq market while the company deals with administrative issues in getting its shares eligible for the Depository Trust Clearing Company DRS/DWAC system. The stock continues to trade on the TSX.

The remainder of the ten stocks with the biggest uptick in shorting have mixed insider commitment outlooks. As such, insider signals neither validate nor invalidate short-selling strategies.

It is also worth noting that Lundin Gold is another example of where short positions have jumped and a bought deal financing was in motion. The $46.6 million transaction also closed on March 1st. Finally, on February 27th OrganiGram Holdings (OGI) started the process of converting $98 million worth of debentures. It was the stock with the second biggest jump in short positioning.

This is based on a post that first appeared on INKReseach.com.