Shorts still taking aim at Badger Daylighting

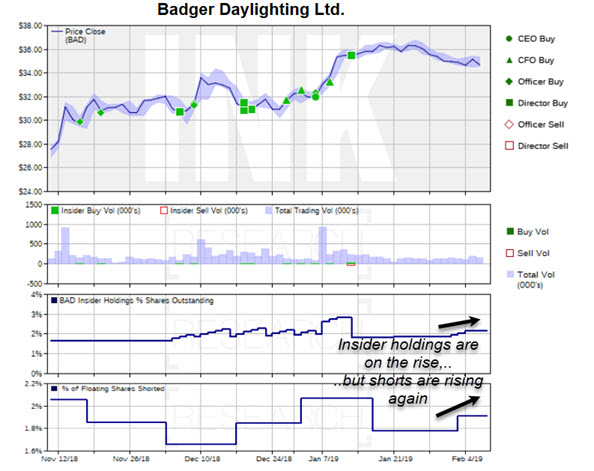

According to the January 31st IIROC short-selling report published Tuesday, the short-selling position at Badger Daylighting (Sunny; BAD) stands at 1.94% of the company's float (estimated shares outstanding available for trading), up 0.014% from where it was in the January 15th report. Short-sellers may have their work cut out for them, however, as insider commitment at the firm remains strong. On that front, insiders have spent a net $1,886,058 picking up shares in the public market over the past 90 days. That amount does not include share repurchases which also took place to the tune of $37.1 million worth of Badger shares during the period.

Generally, we would characterize Badger stock as having a short-squeeze bias as short sellers are increasing their bets against a stock with relatively high insider commitment. Badger Daylighting is expected to release their 2018 annual and Q4 results after the close on March 12th.

INK Edge outlook ranking categories (Sunny, Mostly Sunny, Mixed, Cloudy, Rainy) are designed to identify groups of stocks that have the potential to out- or under-perform the market. However, any individual stock could surprise on the up or downside. As such, outlook categories are not meant to be stock-specific recommendations. For background on our INK Edge outlook, please visit our FAQ #5 at INKResearch.com.

This post originally appeared on INKResearch.com.