Silver Miner Changes Way it Derives All-In Sustaining Cost

The result is a lowering of costs, greater transparency and better alliance with industry standards for this growth-focused company. Learn about its projects and how it is advancing them.

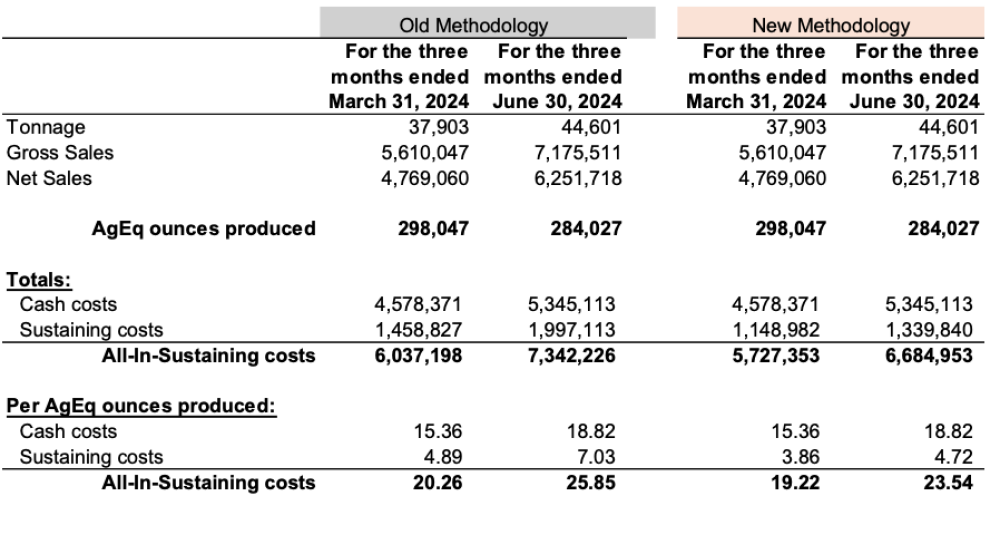

Silver X Mining Corp. (AGX:TSX.V; AGXPF:OTC) changed the methodology and metrics it uses to determine its all-in-sustaining cost (AISC), a news release noted.

"This revision in our AISC methodology provides a clearer, more accurate view of our costs and operational efficiency, enhancing transparency and aligning Silver X with industry standards," Chief Financial Officer David Gleit said in the release. "We believe this change will allow investors and stakeholders to better assess our operational performance as we continue advancing our projects in Peru."

The change also will better reflect the company's operating performance and allow for easier comparison to peers, the release indicated.

Specifically, Silver X revised the specific types of costs included in the AISC's general and administrative expense component. From this expense category, the Canadian miner excluded discretionary costs for business development, investor relations, and share-based compensation. It is applying the change retroactively to the start of 2023. An overall financial effect is lower costs.

Impact of Methodological Change

Impact of Methodological ChangeThe AISC fully reconciles with amounts reported under International Financial Reporting Standards (IFRS), upholding transparency and complying with them.

Revenues reported under IFRS are net of concentrate treatment and refining charges and penalties, the release explained. Under the new methodology for calculating AISC, these costs are added back when determining AISC. When assessing operating margins, gross sales (before treatment and refining charges and penalties) should be compared to AISC. To enable this comparison going forward, the company will report both gross and net sales.

Cash costs (dollar per ounce sold) and AISC (dollar per ounce sold) are non-IFRS financial measures and non-IFRS ratios. Because these measures lack standardized meaning prescribed under IFRS, they may not be comparable to other issuers.

Growing Production in Peru

Headquartered in Vancouver, British Columbia, Silver X is "an emerging silver producer in Peru, targeting a fourfold increase in production with a 12-year mine life and new unit planned for 2025," Fundamental Research Corp. analysts wrote in a Nov. 4 research note. The company aims to become a 6,000,000-ounce (6 Moz) producer, driven by a robust organic exploration, development, and production pipeline.

Currently, Silver X is producing metals (silver, gold, lead, and zinc) at the Tangana Mining Unit, one of the three units in its Nueva Recuperada silver district (the other two are Plata and Red Silver), after having achieved commercial production in January 2023, according to the company's website. Nueva Recuperada is a 20,472-hectare (20,472 ha) fully permitted, district-scale land package covering 230 mining concessions and about 500 outcrop veins.

Q3/24 production at Tangana totaled 42,849 tons, in line with the previous quarter and Red Cloud Securities' estimates, Analyst Timothy Lee reported in an Oct. 25 research report. For the first nine months of 2024, metal production was up 30%, and tonnage mined was up 52% from 2023.

As for Plata, boasting the highest grades in the district, Silver X is advancing it toward a production start in 2025, and a new resource for the project is on track for release by year-end, according to the company's October 2024 Investor Presentation. The current resource, from 2022, stands at 448,812 tons of 16.71 grams per ton (16.71 g/t) Ag eq. Spanning 3,829 ha, Plata encompasses 17 known silver-polymetallic mineralized veins at surfaces with widths of 0.6-1 meters (0.6-1m). Higher-grade mineralization has been identified below 4,460m above sea level, highlighting untapped exploration potential.

"While Plata is a secondary project for the company, we believe it could play an important role in Silver X's future growth plans," Lee wrote in a prior research report.

The miner's exploration-stage projects include the Red Silver Mining Unit in Nueva Recuperada, with an Inferred resource of 1,900,000 tons (1.9 Mt) of 496.1 g/t silver, 0.21% lead and 0.34% zinc.

Silver "Wildly Undervalued"

After reaching a high of US$35 per ounce (US$35/oz) last month, the silver price dropped off to the US$32/oz range. "Technically, silver is at a key support level; a close above US$32.60 could signal renewed upward momentum," Market Pulse noted on Nov. 5, and the price surpassed this level by day's end, reaching US$32.78/oz. Year to date, silver is up 36%.

Mitchell Krebs, Coeur Mining Inc.'s (CDE:NYSE) Chief Executive Officer (CEO), told Kitco News recently, "I have never seen a better outlook for silver. It's an extremely exciting time to be in the silver market."

InvestingHaven wrote in a recent article that silver's hidden indicator, the silver miners to silver junior miners ratio, is breaking out after some years of consolidation. This is confirming that "strong bullish momentum is about to hit the silver market."

All of the other data point to the same conclusion, InvestingHaven noted, that silver is about to have "an upward revision." The 50-year silver price chart is looking "insanely bullish," and the 20-year silver price chart is looking "very bullish." The silver adjusted for Consumer Price Index metric indicates that silver is "wildly undervalued," and the increasing imbalance in supply and demand of the metal supports this.

When silver moves, it does so quickly, as Dominic Frisby pointed out in The Flying Frisby recently. "There is not a lot standing in the way of silver and US$50," he wrote. "In that scenario, the miners will go to the moon. If it breaks above US$50, there is nothing but blue sky above."

Technical Analyst Clive Maund wrote in an Oct. 30 report that silver is "now on course to run at US$50/oz as an initial objective, and it could get there quickly." Further out, silver is expected to surge upward in a slingshot manner, taking it to a price few people now can imagine is possible, he added.

The Silver Investor's Peter Krauth thinks the silver price could actually reach triple-triple digits, or US$300/oz, based on the technical and historical indicators, he said in a recent video. "I don't believe it will stay there, but I do think that it could be in our future."

The current and forecasted supply-demand imbalance of silver is impacting the metal's price.

"The fundamental picture is a positive one for silver with the gap between global supply and physical demand remaining wide," Market Pulse wrote. "If demand continues to outpace supply as is expected, silver should continue to rise."

Worldwide demand for silver, valued as an industrial and a precious metal, is expected to increase 2% this year over last, to 1,200,000,000 ounces, yet supply is projected to drop 1%, according to The Silver Institute. This year, the global silver market is forecasted to face a deficit of 759 Moz, the equivalent of about three-fourths of one year's supply, Money Metals reported Krauth, saying in a recent presentation.

Most, or 61%, of silver demand is for industrial applications, including electrical, electronics, printing, plastics, and photography. Given its use in electric vehicles, photovoltaic panels, and batteries, silver is critical to the global green energy transition. Demand for use in photovoltaic panels alone this year will be about 232 Moz, nearly three times the 80 Moz needed in 2020, according to The Silver Institute.

The remaining 30% of total global silver demand breaks down like this: 17% for jewelry, 5% for silverware, and 17% for investments.

New applications of silver continue to be discovered in biotech, for example, according to The Pure Gold Co. As technology and the global economy evolve, so will silver's industrial uses, Matt Watson, founder and president of Precious Metals Commodity Management, told Kitco. Expansion of the artificial intelligence industry will boost demand for silver, too, for use in energy storage, transportation, nanotechnology, and more.

"[Silver] is the do-it-all metal on the Periodic Table," Watson said. "I don't see any fundamental downside to silver."

The Catalysts

Silver X has great leverage to higher silver prices, which could catalyze the stock, according to Chen Lin, asset manager and writer of What is Chen Buying? What is Chen Selling?

One operational event that could boost Silver X's stock is the company increasing production at the Tangana Mine Unit to 750 tons per day (750 tpd) from 600 tpd, as planned, the Investor Presentation noted. This would take annual production there to about 2 Moz of Ag eq.

Other internal catalysts pertain to the company's Plata project. By year-end, Silver X plans to release an updated resource estimate and, sometime next year, bring the mine online.

208% Return Potential

Red Cloud's Lee has a Buy rating on Silver X and a target price, implying a 208% upside.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Silver X Mining Corp. (AGX:TSX.V)

*Share Structureas of 7/11/2024Source: Silver X Mining Corp."Looking forward," he wrote on Oct. 25, "we are looking for further production ramp-up from the company's ongoing development work in the Tangana Mining Unit as well as potential development at Plata, which could provide a second ore source. Silver X could benefit significantly from further production ramp-up in this strong precious metals price environment."

Ownership and Share Structure

According to the company, Silver X has 200.4 million shares outstanding.

Silver X said management and insiders own approximately 15% of the company. According to Reuters, President and CEO Jose Garcia owns 7.10% of the company.

The company said institutional investors own 10%, including Baker Steel Resources Trust Ltd., which owns 9.73%. The rest is in retail.

Silver X has a market cap of CA$47.08 million and a 52-week trading range of CA$0.16 and CA$0.35 per share.

| Want to be the first to know about interestingBase Metals,Silver andGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Silver X Mining Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver X Mining Corp.Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.