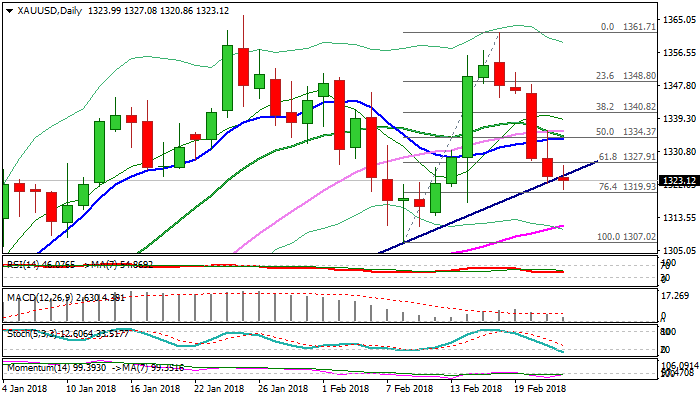

Spot Gold – Bearish outlook with consolidation preceding fresh weakness

GOLD

Spot Gold is consolidating above new 1 1/2 week low at $1320 (Fibo 76.4% of $1307/$1361 upleg) posted on Thursday, but maintains negative tone and holds in red for the fifth consecutive day. Hawkish tone from Fed minutes released on Wednesday pointed towards further rate hikes and sent the greenback higher, to further depress gold price which moves in steep descend from $1361 (16 Feb high). Wednesday's close below pivotal support at $1328 (Fibo 61.8% of $1307/$1361 upleg) was bearish signal which was boosted by break below trendline support at $1325 (bull trendline connecting $1236 and $1307 lows). Daily techs are bearishly aligned and maintain strong negative momentum, favoring further weakness. Break below $1320 handle would expose rising 55SMA ($1311) and key near-term supports at $1309/07 (top of rising daily cloud / 08 Feb trough). Meanwhile, the metal may hold in extended consolidation before bears resume as slow stochastic entered oversold territory on daily chart and signals pause in steep descend from $1361. Converged 10/20SMA's offer solid resistance at $1334 which should limit upticks.

Res: 1328; 1334; 1336; 1340 Sup: 1320; 1317; 1311; 1309

Interested in Gold technicals? Check out the key levels

R3 1347.5 R2 1341.85 R1 1333.09 PP 1327.44 S1 1318.68 S2 1313.03 S3 1304.27