Stock Market Stabilizes as Tech Shares Surge

All three benchmarks are still heading for their worst week since March

All three benchmarks are still heading for their worst week since March

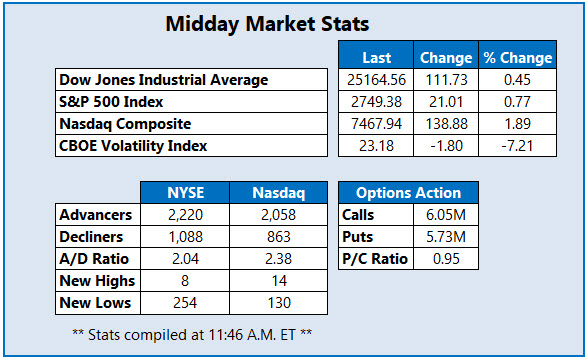

The U.S. stock market is stabilizing, with the Dow Jones Industrial Average (DJI) up triple digits and the S&P 500 Index (SPX) set to snap its six-day skid. The Nasdaq Composite (IXIC) is higher, too, as FAANG stocks rally. Today's upside comes after two days of sharp selling, with traders also watching the start of earnings season -- with big banks JPMorgan Chase (JPM), Citigroup (C), and Wells Fargo (WFC) all reporting this morning. However, even with today's impressive gains, all three benchmarks are still staring at their worst weekly losses since late March.

Continue reading for more on today's market, including:

2 drug stocks boosted by bull notes.Analyst: This tech stock could pop on a FAANG partnership.Plus, options traders target more gains for Turtle Beach stock; Nvidia stock rallies with tech; and Abiomed stock scales the S&P 500.

Turtle Beach Corp (NASDAQ:HEAR) is seeing unusual options volume today, with nearly 7,300 calls on the tape, five times the average intraday pace. Most active is the October 20 call, where it looks like new positions are being purchased. The headset maker made popular by Fortnite is up 15.6% to trade at $20.82 today, bringing its 2018 gain to 1,009%.

Nvidia Corporation (NASDAQ:NVDA) is up 4.6% to trade at $245.87, one of the top stocks on the S&P 500 today. The broader tech and semiconductor sectors are powering the rally today after the extensive sell-off earlier this week. For NVDA, its pullback found support at its 200-day moving average. The chip stock has added 27.6% in 2018, and is a favorite in the analyst community.

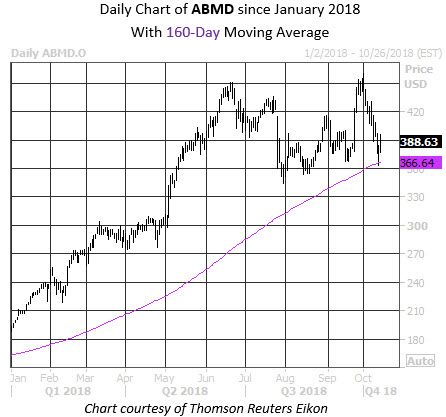

Also outperforming on the SPX today is ABIOMED, Inc. (NASDAQ:ABMD), up 5.9% to trade at $388.63, after Morgan Stanley issued a price-target hike to $396 from $370. The medical device maker pulled back this week amid the broad-market sell-off, but found support at its 160-day moving average. Longer term, ABMD has more than doubled in 2018.