Stocks Higher on Positive Earnings, Tax Reform Hopes

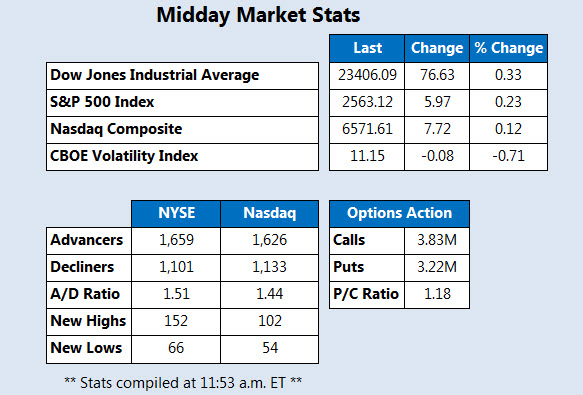

The Dow Jones Industrial Average (DJIA), S&P 500 Index (SPX), and Nasdaq Composite (IXIC) are trading higher after a bout of impressive earnings, headlined by Twitter (TWTR) and Ford (F). The market is also reacting to fresh rumors that President Trump is leaning toward Fed Governor Jerome Powell or economist John Taylor to head the Fed, as well as the European Central Bank's (ECB) bond-buying plans. In addition, a narrowly passed budget in the House is fueling hopes for tax reform.

Continue reading for more on today's market, including:

Among the stocks with unusual options volume is diversified mining company Teck Resources Ltd (NYSE:TECK), with 18,300 put options traded -- 14 times the average intraday norm, and on pace for the highest percentile of its annual range. The January 21 puts are among the most popular, withover 10,000 contracts traded, with Trade-Alert pointing to sell-to-open activity. At last check, TECK stock was down 7% at $21.30 -- finding support atop its 200-day moving average -- after the company reported earnings below forecast, and issued soft guidance for coal prices.

The biggest gainer on the New York Stock Exchange (NYSE) is aluminum producer Constellium NV (NYSE:CSTM). The shares of CSTM are soaring after the company reported a third-quarter earnings beat, and earlier touched a more than two-year high of $12.45. The stock was last seen up 13.5% at $11.80.

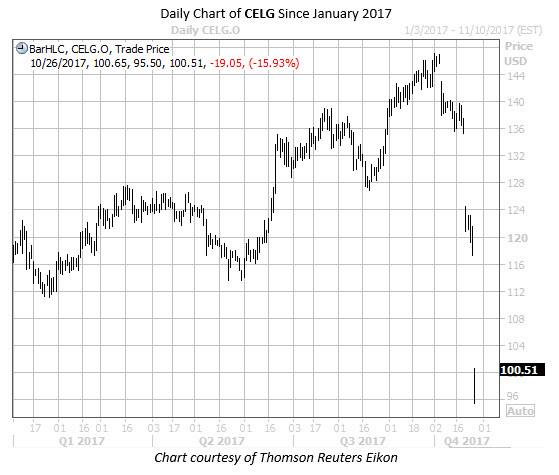

One of the worst stocks on the Nasdaq today is pharmaceutical company Celgene Corporation (NASDAQ:CELG), with the shares gapping 16% lower to trade at $100.28,after the company reportedlackluster third-quarter sales and lowered its full-year forecast. It's the second major bear gap for CELG stock in the past week, and the shares earlier touched an annual low of $95.50.