Stocks Ignore Shutdown Talks, Continue Record Run: Markets Wrap

HSBC's Major Says He Would Sooner Be Buying Than Selling 10-Year Yields

U.S. stocks shrugged off the government shutdown drama in Washington and rose to all-time highs following a report that regulators are close to further easing banking rules. Treasury yields reached the highest level in more than three years.

All major equity indexes gained, led by strength in apparel and durable goods makers. The dollar advanced but still posted a sixth straight weekly loss. And the yield on 10-year Treasuries climbed above 2.65 percent for the first time since June 2014.

“The outsized move (in Treasuries) continues to highlight market expectations of additional policy removal from the Fed -- and other central banks around the world -- coupled with a forecast of above-trend growth and inflation,” Lindsey Piegza, chief economist at Stifel Nicolaus & Co., wrote in an email. “While it’s difficult to push against the grain, we remain hesitant to drink the Kool-Aid just yet. Confidence will only support the market for so long in the absence of meaningful improvement in wage growth and top-line inflation.”

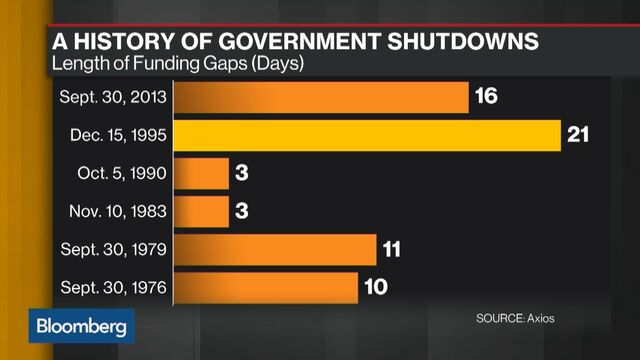

Meanwhile, traders seem didn’t seem to be taking the threat of a U.S. government shutdown too seriously.

“The market has been largely yawning at this,” Burns McKinney, chief investment officer for Allianz Global Investors based in Dallas, said on Bloomberg Television. “In the past year, they have disregarded all kinds of bad news. If you can shrug off geopolitical turmoil with North Korea, if you can shrug off Brexit, then really the government shutdown is by and large a softball. This is really something that’s not unprecedented. We’ve seen this before.”

BI’s Gina Martin Adams says markets have become "desensitized" to talk of a government shutdown.

(Source: Bloomberg)The dollar’s weakness rippled through the market, with the yen, gold and precious metals among the beneficiaries. The risk-on mood that helped drive up Treasury yields this week was still evident, with European stocks following Asian peers higher. Emerging-market equities climbed for a sixth day, and West Texas crude extended its retreat.

Optimism about global growth finally seems to be catching up with bond markets, as investors factor in the prospect of accelerating price increases in the world’s largest economy. Better-than-expected growth numbers from China this week added to a slew of recent data releases from around the world supporting the positive outlook, days before two of the big central banks rule on rates.

Terminal users can read more in our markets blog.

Here’s what to watch out for next week:

And these are the main moves in markets:

Stocks

Currencies

Bonds

Commodities

— With assistance by Adam Haigh, Natasha Doff, and Samuel Potter

Before it's here, it's on the Bloomberg Terminal.LEARN MOREHave a confidential news tip?Get in touch with our reporters.Most Read