Stocks Recoup Gains, Yields Hit Highs After Fed: Markets Wrap

Troy Gayeski, senior portfolio manager at Skybridge Capital, on the outlook for the dollar and impact from the Fed.

Troy Gayeski, senior portfolio manager at Skybridge Capital, on the outlook for the dollar and impact from the Fed.Treasury yields touched almost four-year highs and U.S. stocks managed to hold onto late gains after Federal Reserve officials set the stage for an rate increase in March by adding emphasis to their plan for more hikes while leaving borrowing costs unchanged.

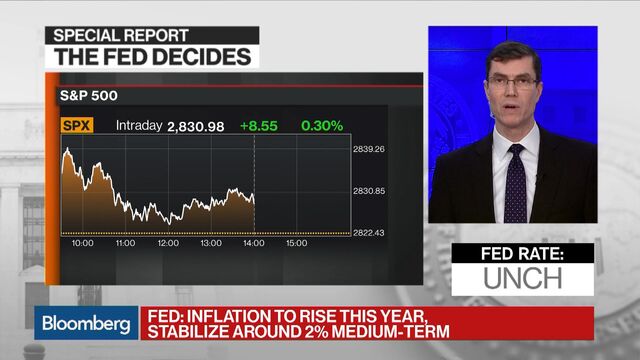

After being whipsawed by the Fed announcement, the S&P 500 Index closed higher for the first time in three days, rounding out the best start to the year for the U.S. benchmark since 1997. European and Asian equities continued to experience the pullback seen since the start of the week, with the Stoxx Europe 600 Index and the MSCI Asia Pacific Index both declining for a third day.

Bloomberg’s Chris Condon reports on the Federal Reserve’s policy-making meeting.

Source: (Bloomberg)The changes to the Fed statement, collectively acknowledging stronger growth and more confidence that inflation will rise to the 2 percent target. Officials also said inflation “is expected to move up this year and to stabilize” around the goal, in phrasing that marked an upgrade from December.

“Some people who were not as hawkish before are probably a bit more hawkish now,” said John Vail, chief global strategist at Nikko Asset Management. “So let’s say probably due to economic developments, including the tax cut, the board and all the Fed members are moderately more hawkish than they were at the last meeting.”

The yield on the 10-year U.S. note rose to as much as 2.75 percent, the highest since April 2014. It has climbed higher earlier the Treasury raised the amount of long-term bonds it will sell this quarter with the budget deficit worsening. The dollar briefly rallied before retracing losses.

While U.S. bonds are off to their worst start to a year since 2009, it’s been a big month for stock markets, with stellar gains across most major gauges that were followed this week by the MSCI All-Country World Index’s biggest two-day slide since September 2016.

Terminal users can read more in our markets blog.

Here are some important things to watch out for this week:

And these are the main moves in markets:

Stocks

Currencies

Bonds

Commodities

— With assistance by Lu Wang

Before it's here, it's on the Bloomberg Terminal.LEARN MOREHave a confidential news tip?Get in touch with our reporters.Most Read