Stocks Haven't Done This Since 2016

What it means when S&P stocks achieve a selling climax

What it means when S&P stocks achieve a selling climax

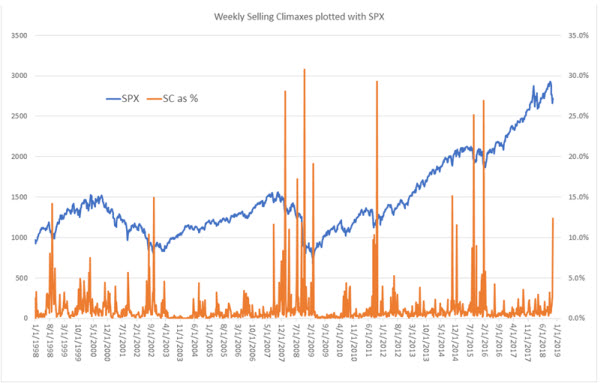

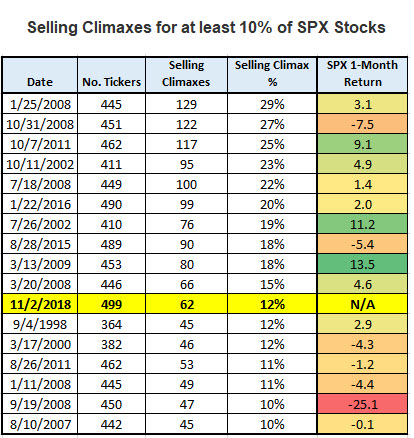

The stock market last week attempted to chip away at its steep October losses, with the S&P 500 Index (SPX) enjoying its best week since March. What's more, over 10% of SPX stocks achieved a "selling climax" -- something we haven't seen since January 2016. For the uninitiated, a selling climax occurs when a stock hits a 52-week low in intraweek trading, but eventually settles higher on the week. Below we discuss what this rare signal could mean for markets going forward.

Specifically, 62 equities made a selling climax last week, representing 12.4% of the index, per Schaeffer's Quantitative Analyst Chris Prybal. There have been just 16 times where at least 10% of the SPX achieved a selling climax, looking at data since 1998. The biggest signal occurred in January 2008, when 29% of the index ended the week higher after touching a new low.

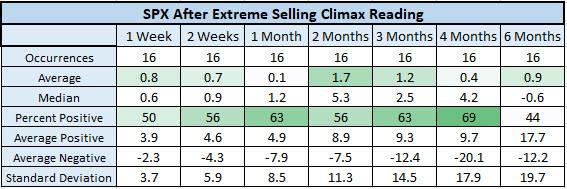

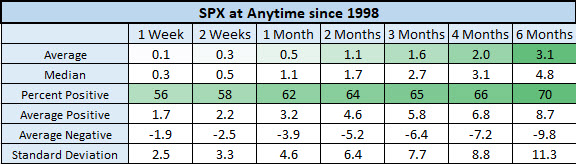

These signals have preceded stronger-than-usual price action for the S&P in the very short term, but weaker-than-usual momentum in the short-to-intermediate term. One and two weeks after signals, the SPX was up an average of 0.8% and 0.7%, respectively. That's compared to average anytime one- and two-week gains of 0.1% and 0.3%, looking at S&P data since 1998.

One month after signals, the SPX was up just 0.1%, on average, compared to 0.5% anytime. Four and six months later, the index averaged gains of just 0.4% and 0.9%, respectively, compared to 2% and 3.1% gains anytime. The broad-market barometer also tends to be more volatile than usual after signals, too, looking at the Standard Deviation rows in the charts below.