Stocks Pummeled on Trade Fears, Bond Yields

The 10-year Treasury yield spooked investors today

The 10-year Treasury yield spooked investors today

It was a bloodbath on Wall Street today, with the Dow closing nearly 800 points lower as trade tensions between the U.S. and China reared their ugly head again. Concerns remain that the two global superpowers are actually quite far from any concrete trade deal, despite a 90-day cease-fire, as President Donald Trump took to Twitter today to proclaim himself a "Tariff Man." The S&P 500 and Nasdaq finished deep in the red as well, with investors nervously eyeing the flattening yield curve, inversions of which have preceded recessions. Against this backdrop, bank stocks took a hit, while Apple (AAPL) and transports were also notable losers.

Looking ahead, the U.S. stock market will be closed tomorrow for a national day of mourning in observance of late President George H.W. Bush.

Continue reading for more on today's market, including:

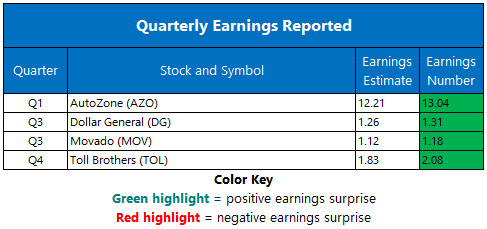

FAANG fears spell trouble for these 2 stocks. Analyst: Ditch this blue-chip chip stock.AutoZone stock raced to record highs today.Plus, a bank stock with ramped-up options volume; an analyst pumps the brakes on ATVI; and a beer stock for bears.

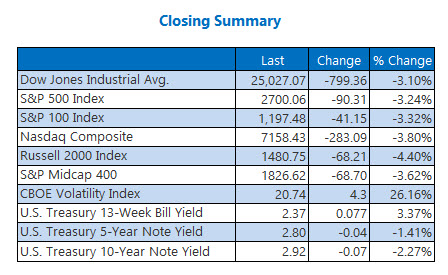

The Dow Jones Industrial Average (DJI - 25,027.07) dropped 799.4 points, or 3.1%. All 30 stocks ended lower, with Caterpillar (CAT) leading the race to the bottom with its 6.9% loss. Procter & Gamble (PG) fell the least with its 0.1% drop.

The S&P 500 Index (SPX - 2,700.06) shed 90.3 points, or 3.2%. The Nasdaq Composite (IXIC - 7,158.43) gave back 283.1 points, or 3.8%.

The Cboe Volatility Index (VIX - 20.74) added 4.3 points, or 26.2%.

5 Items on our Radar Today

Hundreds of U.S. officials gathered in Washington, D.C., today to pay respects to late U.S. President George H.W. Bush, who passed away at 94 last Friday. Among those in attendance included generals and former cabinet members from Bush's tenure as the 41st President of the United States. As alluded to above, markets will be closed tomorrow in observance. (Reuters)British Prime Minister Theresa May faced more obstacles to her Brexit plan today, as five days of debate begin over Britain's plans to leave the European Union (EU). Earlier today, a group of May's own members of parliament won a challenge to give more power to the House of Commons if her deal is voted down. The main vote will occur one week from today, on Dec. 11. (Reuters)This struggling bank stock had red-hot options volume today.The beer stock ripe for a bearish trade. One analyst is pressing pause on Activision Blizzard stock.

Data courtesy of Trade-Alert

Oil, Gold Continue to Rise

Oil finished a volatile session marginally higher, amid expectations for supply cuts from Russia and the Organization of the Petroleum Exporting Countries (OPEC), which is set to meet on Thursday. For the day, oil for January delivery added 30 cents, or 0.6%, ending at $53.25 per barrel.

Gold prices climbed today to a five-month high, as the dollar continued to get trampled. The falling 10-year Treasury yield in particular put pressure on the greenback today. February-dated gold futures gained $7, or 0.6%, settling at $1,246.60 per ounce.