Tech Talk for Friday March 28th 2025

U.S. equity index futures were lower this morning. S&P 500 futures were down 17 points at 8:30 AM EDT.

S&P 500 futures dropped 6 points following release of economic news at 8:30 AM EDT. February Core PCE Price Index was expected to increase 0.3% versus a 0.3% gain in January. Actual was a 0.4% gain. February U.S. Personal Income was expected to increase 0.4% versus 0.9% in January. Actual was a 0.8% increase. February Personal Spending was expected to increase 0.6%. Actual was a 0.4% increase

Lulu lemon dropped $19.53 to $322.00 after offering first quarter guidance below consensus.

US Steel advanced $2.27 to $45.25 on news that Nippon Steel's offer to purchase the company could go ahead.

Braze added $3.51 to $40.21 after reporting higher than consensus fourth quarter results. The company also offered positive guidance.

Oxford Industries dropped $8.70 to $53.84 after offering guidance below consensus.

EquityClock's Market Outlook for March 28th

The US Trade Deficit remains at an extreme as businesses seek to front-run the imposition of tariffs. See:

https://equityclock.com/2025/03/27/stock-market-outlook-for-march-28-2025/

Technical Notes for Friday

AT&T $T an S&P 100 stock moved above $27.97 to an all-time high extending an intermediate uptrend.

Broadcom $AVGO an S&P 100 stock moved below $177.07 extending an intermediate downtrend.

Dollar General $DG a NASDAQ 100 stock moved above $86.80 setting an intermediate uptrend.

Toronto Dominion Bank $TD.TO a TSX 60 stock moved above Cdn$87.57 to a 3 year high extending an intermediate uptrend.

Trader's Corner

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for March 27th 2025

Green: Increase from previous day

Red: Decrease from previous day

Source for all positive seasonality ratings: www.EquityClock.com

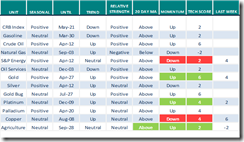

Commodities

Daily Seasonal/Technical Commodities Trends for March 27th 2025

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for March 27th 2025

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

S&P 500 Rolls Over, Look Out Below! Tom Bowley

S&P 500 Rolls Over, Look Out Below! - YouTube

Morgan Stanley’s Wilson Stands by His S&P 500 Call

Morgan Stanley’s Wilson Stands by His S&P 500 Call - YouTube

Tech "Death Cross" Forming, SPX Setting Up for Pullback

Tech "Death Cross" Forming, SPX Setting Up for Pullback - YouTube

CHART THIS with David Keller, CMT Thursday 3/27/25

https://www.youtube.com/watch?v=r-Q_FVVymBQ

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 2.60 to 40.80. It remains Neutral

The long term Barometer dropped 2.40 to 47.20. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer added 0.51 to 56.42. It remains Neutral.

The long term Barometer added 1.43 to 57.34. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

| More from the network: |

![clip_image001[4] clip_image001[4]](https://timingthemarket.ca/techtalk/wp-content/uploads/2025/03/clip_image0014_thumb-13.png)

![clip_image002[4] clip_image002[4]](https://timingthemarket.ca/techtalk/wp-content/uploads/2025/03/clip_image0024_thumb-14.png)

![clip_image003[4] clip_image003[4]](https://timingthemarket.ca/techtalk/wp-content/uploads/2025/03/clip_image0034_thumb-11.png)

![clip_image004[4] clip_image004[4]](https://timingthemarket.ca/techtalk/wp-content/uploads/2025/03/clip_image0044_thumb-11.png)