The Big-Cap Tech Stock With Cheap Options

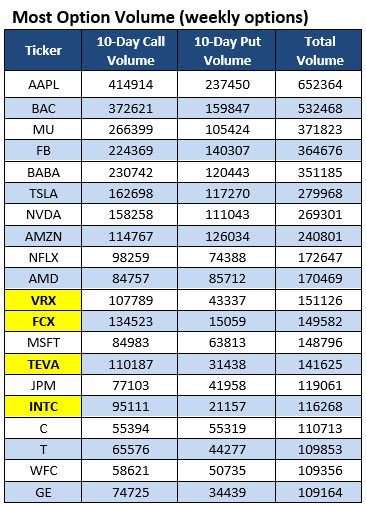

The 20 stocks listed in the table below have attracted the highest weekly options volume during the past 10 trading days. Stocks highlighted in yellow are new entries to the list. Data is courtesy of Schaeffer's Senior Quantitative Analyst Rocky White. Two names to note are streaming giant Netflix, Inc. (NASDAQ:NFLX) and semiconductor stock Intel Corporation (NASDAQ:INTC). Below, we'll break down recent options trading activity on NFLX and INTC.

Put Buying Picks Up On Netflix Stock

At last check, Netflix stock is down 0.4% to trade at $189.30, even after an analyst at Evercore noted that last week's asset deal between Walt Disney (DIS) and Twenty-First Century Fox (FOXA) would not necessarily spell doom for NFLX stock, because it "validates the [streaming] market." The equity has still added almost 53% in 2017, and found a firm foothold atop its 120-day moving average following a recent pullback from its Oct. 17 record high of $204.38.

Analysts remain split over NFLX stock, though. Of the 36 brokerages covering the streaming giant, 14 rate the shares a "hold" or "strong sell." Furthermore, NFLX's average 12-month price target of $215.03 represents a 13.7% premium from the stock's current perch.

Options traders, meanwhile, have been more skeptical than usual of late. During the past two weeks at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), Netflix has racked up a put/call volume ratio of 0.93, which ranks in the 77th percentile of its annual range -- meaning puts have been bought to open relative to calls at an unusual clip.

Digging deeper, the February 150 put has seen the largest increase in open interest during this time frame, with more than 30,000 contracts added. According to data from the major options exchanges, the bulk of this activity was of the buy-to-open kind. While shareholders may be using these out-of-the-money puts to guard against any unexpected risk, "vanilla" options traders expect the FAANG stock to sink to its lowest point since late July over the next two months.

INTC Options Traders Flock To Calls

Intel is currently up 2.9% to trade at $45.85 -- the best Dow stock so far -- and has benefited from a solid performance from big-cap tech stocks lately. The chip name has added 26% in 2017 and touched a 17-year high of $47.30 on Nov. 3. Since then, the stock pulled back to -- and bounced from -- its 50-day moving average, which also coincides with Intel's $200 billion market cap.

The security could be due for some analyst upgrades, as well. Of the 24 brokerages covering INTC, 9 still rate the stock a "hold" or worse.

Call buyers have been tremendously active on INTC, and perhaps some of that -- at least at out-of-the-money (OOTM) strikes -- is attributable to short sellers seeking an options hedge. The security has a 10-day call/put volume ratio of 4.11 at the ISE, CBOE, and PHLX. Not only does this indicate calls have outnumbered puts by a 4-to-1 ratio, but it also ranks 5 percentage points from a 52-week high.

The largest increase in front-month open interest during this time was at the January 2018 45-strike call, where roughly 14,000 positions were added. The majority of this activity seems to be at the hands of call buyers, which indicates options traders expect INTC stock to continue its uptrend in the coming weeks.

Those looking to bet on INTC's next leg higher with options are in luck. The stock's Schaeffer's Volatility Index (SVI) of 19% ranks in the 12th annual percentile, indicating low volatility expectations are being priced into short-term options -- a potential boon to premium buyers.