The Greatest Wealth-Building Opportunity in Two Generations

John Newell of John Newell & Associates reviews what he believes is the opportunity of a lifetime, and shares two stocks he thinks should be on your radar.

Every cycle leaves scars. After more than a decade of false starts, the instinct to sell early is understandable. But that instinct may be the single biggest risk investors face today. With gold trading north of $3,500, cash flows improving across the mining sector, and the tape signaling the early innings of a secular rerating, the opportunity is clear.

The real question is whether investors will hold through the inevitable shakeouts or trade themselves out of what could be the greatest wealth-building window in two generations.

Bull markets always try to buck investors off. That is why they call it a bull. The job now is to cinch in.

Why This Time is Different

For years, metal prices marched higher while equities lagged, starving mining companies of capital and leaving investors frustrated. That disconnect is now closing. Several forces make this cycle different:

Improved profit margins. Cost inflation from the Covid era has eased while metal prices surged. Producers are generating stronger cash flow, and weaker operators are being filtered out.

Capital rotation. Large caps moved first, then mid caps, and now attention is shifting to juniors. This progression is how durable bull markets breathe.

Stronger balance sheets. Major producers have paid down debt, bought back stock, and returned capital to shareholders. That discipline lowers the sector's cost of capital and supports higher valuations.

Limited supply. A decade of underinvestment means fewer new mines are coming online. Even if projects are sanctioned today, the supply response is years away. That scarcity boosts the value of existing assets.

Policy momentum. Canada and the U.S. are leaning back into mining, especially for critical minerals and gold. Permitting is still rigorous, but the policy backdrop is far more constructive than in years past.

The Technical Case: Long Bases Resolve in Long Trends

The Technical backdrop confirms the fundamental story.

Look at GDM (NYSE Gold Miners Index).

Broke out of a multi-year range, retested resistance, and accelerated. Targets at 1,300 and 1,560 have already been met. The next waypoint is 2,200, with a longer-term objective near 2,600. That is how secular turns unfold: breakout, confirm, continue higher.

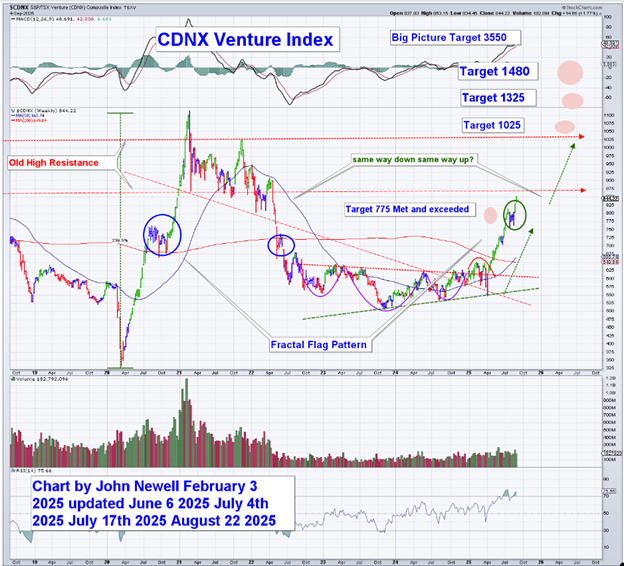

CDNX (TSX Venture Exchange): The lifeblood of junior exploration. It has lagged badly, but that is its power.

It took ~1.5 years for CDNX to claw back to its 2012-2013 breakdown area. It took GDM approximately eight years to do the same. We are now approximately 13 years from the highs, and CDNX remains deeply discounted to both gold and base metals.

After the first was met in the first half of 2025, the following near-term targets cluster at 1,025, 1,325, and 1,480, with a big-picture objective near 3,550 if the stair-step advance potentially completes.

Long bases build energy. The same way down, the same way up. GDM has already validated the move. CDNX's lag is not a flaw, it is fuel.

The Risk of Selling Too Soon

Indicators will flash "overbought."

Early in secular bull markets, that is normal. Strong trends live overbought. The real money is made by those who stay invested through the first scary pullbacks. Selling too early has cost investors dearly in every past secular escape, 1992, 2002, and 2009.

Who Actually finds the Great Mines

The greatest mines are almost always found by juniors. Not by committees, but by bug-bitten prospectors and geologists pitching tents in mosquito country and drilling a few more holes with their last financing because the rocks are talking.

Think of pioneers like Chester Millar of Glamis Gold. A prospector at heart, a pioneer of heap-leaching, and still out in the field in his 90s, convinced that the next ridge might hide what others had missed. That is the spirit that built this industry, and it is alive today in juniors across the Yukon, Nevada, Red Lake, and the Abitibi.

The public market exists so investors can back these builders before the majors step in. In a real bull market, that is where life-changing torque comes from.

The Yankees are Coming

History has a rhythm. When Roosevelt closed the gold window in 1933, Americans unable to hold gold turned to backing gold in the ground or at least the dream of finding it, when it was illegal to own physical gold until 1971. In the 1940s and 1950s, U.S. capital funded the great Canadian camps: Abitibi, Timmins, Red Lake, the Golden Triangle in British Columbia, and the Yukon Territories.

When Nixon closed the gold window in 1971, and inflation surged, American capital poured north again, fueling juniors that became household names.

That cycle is alive today. The last great frontier still open for juniors to re-rate from million-dollar shells to billion-dollar discoveries is the Tintina Gold Belt in the Yukon. It has already birthed companies like Sitka Gold and Snowline Gold. With the U.S. dollar buying 50% more Canadian shares thanks to exchange rates, the math is even more compelling. For American investors, Canadian juniors are not just speculative, they are a bargain.

Where the Next Gains Will Come From

Producers. Stronger cash flows fund growth and exploration.Developers. Clear paths to permits and funding become scarce and highly valued.Explorers. District-scale juniors with tight floats attract capital, often before the majors move.Silver. If growth and gold strength rhyme, silver's dual role tends to make it outrun gold mid-cycle, often when juniors go vertical.Two examples of the kinds of companies we are attracted to currently are shown below.

West Red Lake Gold

West Red Lake Gold Mines Ltd. (WRLG:TSX.V; WRLGF:OTCQB; FRA:UJO) is positioned in one of Canada's most prolific gold camps. The company has consolidated a dominant land package in Red Lake, Ontario a district that has produced more than 30 million ounces of gold.

After several years preparing for the Madsen Mine restart, WRLG is attracting renewed attention with its high-grade Madsen acquisition and exploration across the broader land position, which continues to generate encouraging results.

The stock has spent years building a long base, and rising volume now points to a potential breakout.

If the technical targets are met, shares could regain valuations not seen since the last cycle.

Triumph Gold Corp.

Triumph Gold Corp. (TIG:TSX.V; TIGCF:OTCMKTS) controls the Freegold Mountain Project in the Yukon's Tintina Belt, one of the most underexplored yet highly prospective gold districts in North America.

The project hosts multi-million-ounce gold-copper resources along a mineralized trend over 200 square kilometers, with both porphyry-style and high-grade vein potential.

Like many juniors, Triumph has endured a long bear market and dilution pressures, but the technical setup now points to a classic recovery pattern. A double bottom and emerging uptrend suggest the stock could regain significant lost ground as investor focus returns to the Yukon.

If M&A remains measured rather than manic, juniors will capture clean reratings before eventual takeouts. That is the sweet spot for wealth creation.

Risks to Respect

Cycles correct. Sentiment can overshoot. Macro shocks can hit silver and the base metals complex. Governments can still make missteps. And the cure for high prices is always high prices, as new supply eventually tempers rallies. None of this negates the current setup; it argues for sizing positions properly, keeping a shopping list for pullbacks, and above all, patience.

How to stay on the right side?

My process has not changed:

Respect the GDM breakout and the emerging stair-step on CDNX.Accumulate producers with improving margins and strong balance sheets. Let them finance your optionality.Add developers with genuine projects, then layer in explorers with district-scale geology.Avoid serial diluters and promotional teams. Bulls hide sins, but they still cost performance.If you trade, trade around a core, don't abandon itBottom Line

We just spent more than a decade building these bases. Seniors have broken out. The rotation is moving down the curve. Fundamentals are improving, technicals are aligned, and capital is waking up.

This is not a trade, it is a once-in-a-generation rerating. The biggest risk now is not being early. It is being shortsighted.

When the market feels overbought, remember: the greatest wins always go to those who back the tent-pitchers and ridge-walkers, then stay the course long enough to let the geology and the bull market do their work.

And just as in the 1940s and 1970s, the U.S. Investors are coming. U.S. capital has always participated and help fuel Canada's greatest cycles, and it may now again in the Yukon. The torque of this bull market will not be a trade. It will be the wealth-building opportunity of two generations.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

West Red Lake Gold Mines Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of West Red Lake Gold Mines Ltd.John Newell: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.