The Index Almost No One Is Watching . . . But Should Be

John Newell of John Newell & Associates explains why he thinks more people should be looking at the S&P/TSX Venture Composite Index (CDNX).

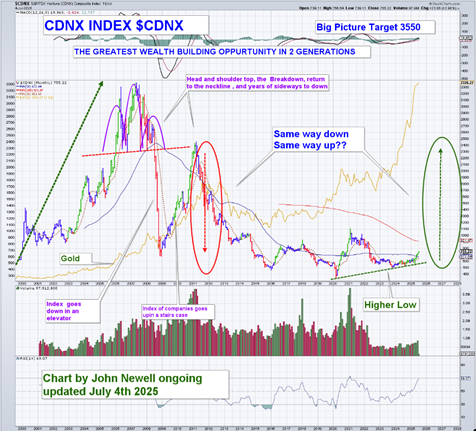

There's an old market adage: "Stocks go down in an elevator and up in a staircase."

That sums up the S&P/TSX Venture Composite Index (CDNX) over the last 15 years, except this time, it didn't just go down in an elevator. It got trapped in the basement, and every breakout attempt was met with rejection.

Now, it's not just climbing, it's breaking out. And hardly anyone's paying attention.

The CDNX, Canada's benchmark for early-stage resource and technology companies, has emerged from one of the longest and most painful sideways-to-down periods in its history. For over a decade, it's been ignored by the mainstream, starved of capital, and left for dead by speculators who moved on to crypto, cannabis, AI, or just gave up.

But that's changed. The long-term technicals are flashing green. Capital is rotating back into exploration. And the macro story, anchored by gold, copper, and the metals that power the global shift to electrification, is stronger than it's been in years.

The Setup: Same Way Down, Same Way Up?

Pull up the long-term CDNX chart and you'll see a dramatic elevator drop from the 2011 highs.

What followed was a decade-long churn that wore out all but the most patient investors. But the pattern that's forming now? It looks a lot like the mirror image of the move down.

Same way down, same way up?

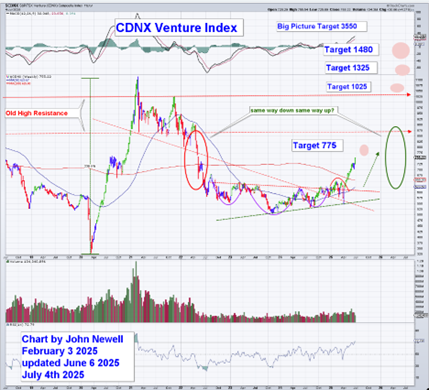

On the weekly chart, price has broken above long-term moving averages and resistance levels.

Technical targets are activating at 775, 1025, 1325, and 1480. And the long-term Big picture target?

3550, the level where everything started to unravel more than a decade ago.

This isn't guesswork. It's price memory. And markets never forget.

Amazon had 20% Corrections Too

Worried about volatility? Looking for the perfect entry? Consider Amazon.com Inc. (AMZN:NASDAQ).

Since the early 2000s, Amazon has gone through more than 15 corrections of 20% or more. Some were over 50%. That's the price of conviction. And most investors can't pay it.

If you want generational wealth, you don't sit in the stands waving pom-poms, you put the pads on and step onto the field.

We celebrate Amazon, Microsoft, and Home Depot as legendary compounders. But almost no one held them through all the turbulence.

Now compare that to junior mining.

You're not holding for 20 years, waiting on a trillion-dollar valuation. You're hunting for a discovery, a single drill hole, or deal, that re-rates a company's valuation in weeks. These aren't slow burns.

They're liftoff points.

This Isn't Just a Rebound. It's a Rotation.

The CDNX is heavily weighted toward the materials sector, about 40-50%, with gold and silver explorers doing most of the lifting. Base metals like copper and uranium are gaining momentum as investors wake up to the structural shortfalls in global supply.

This index doesn't move unless real capital is coming back into exploration. And it is.

With gold now holding above $3,300 and copper emerging from a massive base, this isn't just a bounce, it's a rotation back to real assets. And junior miners, most of which are still trading near historic lows, are still early in that rotation.

The Venture Exchange is where the rerates happen first.

The Opportunity in One Chart

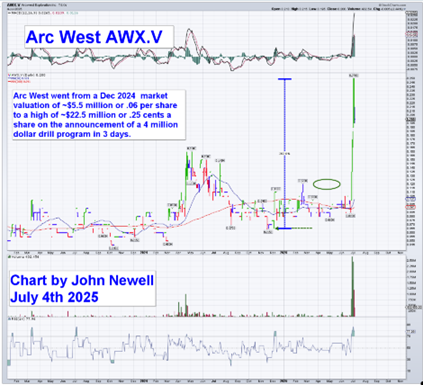

The index tells us capital is starting to flow. But if you want a more visceral example, take a look at what just happened with ArcWest Exploration Inc. (AWX:TSX.V).

In December 2024, the company was trading at $0.06 with a market cap of ~$5.5 million.

Then, in early July, they announced a $4 million drill program funded by a major.

The stock surged to $0.25 in three days, a revaluation to $22.5 million.

No results, no new resource, no discovery, just a funded drill commitment.

That's what this part of the market can do.

At the risk of cherry-picking, Arc West shows how fast capital can reprice a stock when sentiment flips. And we're starting to see more examples like this appear, quietly, for those paying attention.

Final Word

You hear it all the time: "If I'd just held Amazon, I'd be rich." Sure. But how many did?

Junior mining is different. You don't need to hold for decades. You just need to spot when a forgotten corner of the market is waking up and be early.

The TSX Venture Index is waking up. Few are watching. But for those willing to take a contrarian position, with eyes wide open, this may be the most explosive setup in the market today.

Like all great trades, it rewards action, not comfort.

| Want to be the first to know about interestingGold andCopper investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

John Newell: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.