The Quiet Recovery Of The Gold Miners

Gold stocks (XAU) have outperformed since December.

The impressive XAU rally has gone largely unnoticed, however.

Gold miners have excellent upside in the year ahead.

Lost amid the fanfare for the impressive upside run in the equity market, gold and silver mining stocks have been staging their own quiet comeback. The PHLX Gold/Silver Index (XAU), which measures the performance of the best known of the U.S.-listed precious metal (PM) producers, has risen over 20 percent since early December. Most retail investors are unaware of this impressive performance, though, since the mainstream financial media rarely highlights the PM mining sector. In this commentary we'll discuss the short- and intermediate-term outlook for the actively traded mining shares with a special emphasis on group momentum. We'll also see why the XAU turnaround which began in December is likely more than just a short-covering rally.

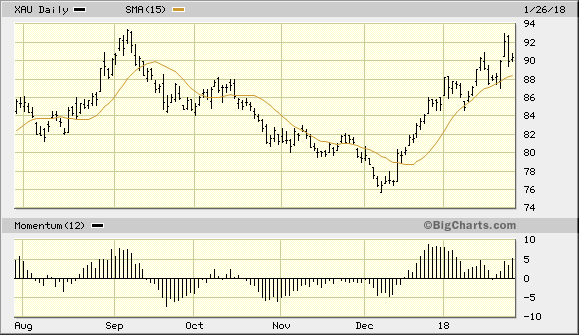

In recent commentaries I've repeatedly emphasized that the dominant immediate-term trend for the mining shares remains up as long as the PHLX Gold/Silver Index (XAU) stays above its 15-day moving average on a closing basis. Remarkably, this has been the case through January despite a brief dip under the 15-day MA on Jan. 23. There's no denying that the incremental demand for the shares of gold mining and exploration companies has been increasing since late last year, and for good reason as we'll discover here.

Meanwhile the XAU rallied sharply to its highest level since Sept. 7 on Jan. 24, closing at just over the 92.00 level (see chart below). The index pulled back sharply on Thursday, Jan. 25, shedding 2.36% for the day but remaining above the rising 15-day trend line. What's more, the 15-day MA remained unbroken on a closing basis on Friday, which means we have continued assurance that the dominant immediate-term (1-4 week) trend remains up for gold stocks as a group despite the recent volatility increase.

Source: www.BigCharts.com

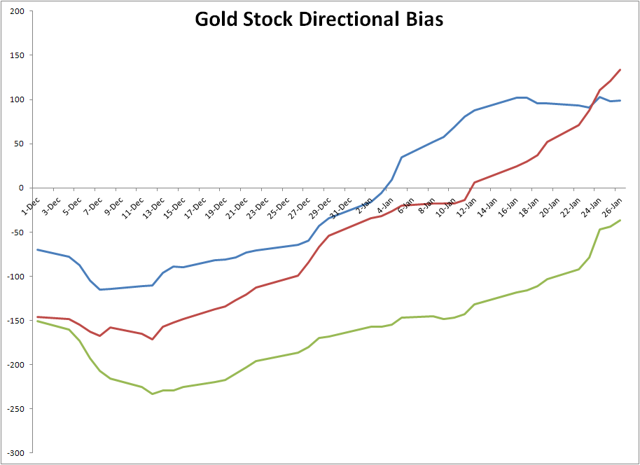

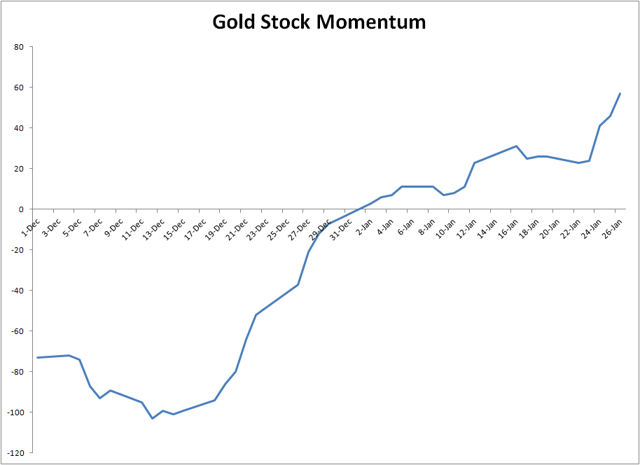

Also worth mentioning is the continued internal strength reflected in the following graph. This shows the three main directional components of the gold stock internal momentum indicator series known as GOLDMO. The three indicators shown below are the four-week (blue), six-week (red) and 12-week (green) rate of change of the 10-week new highs-new lows of the 50 most actively traded U.S.-listed gold stocks. The assumption behind this indicator is that since the new highs and new lows are the best reflection of incremental demand for equities, the momentum of the new highs and lows therefore shows the overall direction of that demand. As long as the indicators are in a rising trend, the path of least resistance for the mining shares as a group remains up.

Chart created by Clif Droke

Not only is the short-term directional bias of the actively traded gold stocks up, as shown above, but so is the intermediate-term bias. The chart below features the dominant intermediate-term (6-9 month) indicator for gold stocks. Investors should expect a positive interim bias for the "golds" while this indicator is trending higher.

Chart created by Clif Droke

Aside from technical considerations, there's also a very important fundamental aspect of the gold mining industry to consider. The simple fact is that gold production, exploration, M&A and other forms of expansion among the leading miners has been diminishing in the last few years. This underscores a disparity between a shrinking supply of the precious metal and an increasing demand for the perceived value both of the physical metal and the companies that produce it.

According to a Reuters report, production among the world's largest gold producers has declined by around 5 percent on average since 2015 as big producers have focused reducing debt and production costs, as well as selling off less profitable assets.

There alsp has been a decrease in the amount of new exploration projects and acquisitions among mining firms in recent years. As Goldcorp (NYSE:GG) CEO David Garofalo was recently quoted as saying, "Zero growth is the new growth in this industry." This dearth of activity in the face of an industry which is undervalued and under-appreciated means there is greater potential for expansion once mainstream investors finally warm up to the gold miners.

What, you may ask, will it take to increase the attraction of gold stocks in the eyes of retail investors? The simple answer is that rising prices are in themselves the best advertisement for attracting small investors. The internal momentum-driven continuation of the XAU's rebound off the December 2017 low in the coming months will eventually cause an increasing number of investors to take note and reevaluate the potential of gold miners. The year ahead has the potential to be the best one for gold mining stock investors since 2016. Investors should accordingly maintain a bullish bias toward gold stocks with a focus on the intermediate-term (6-9 month) outlook.

For disclosure purposes, I'm currently long the iShares Gold Trust (IAU) and have raised my stop loss to slightly under the $12.75 level on a closing basis. I'm also currently long the VanEck Vectors Gold ETF (GDX), which is my favorite proxy for actively traded gold mining stocks. I'm using the $23.50 level as the stop-loss for this trading position on a closing basis.

Disclosure: I am/we are long IAU, GDX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.