The Trump rally needs to see leadership switch from Amazon to value stocks

The best bet for the Trump rally to keep its legs is to see value stocks assume market leadership over growth. As I explain in my broadcast this week with Jim Goddard, if investors believe that strong second quarter growth is sustainable, they will see little need to pay premium valuations for stocks like Amazon (Mostly Sunny; AMZN). Instead, they will look for inexpensive stocks that can benefit from wide-spread growth in the economy.

This will certainly make for an interesting competition between growth and value this summer. You can keep an eye on the race right here on Canadian Insider by watching the real time performance of growth stocks as tracked by the iShares Russell 1000 Growth Index ETF (IWF) versus value stocks as tracked by the iShares Russell 1000 Value Index ETF (IWD). Get more colour on this growth-value match-up in my interview which you can find below.

Ted Dixon July 26th Interview with Jim Goddard

Unfortunately, one of the major headwinds facing a rotation from growth to value is the lack of low priced value stocks. Our US Insider Indicator has dropped back to the levels seen in late January when the market peaked. Insiders tend to be value-oriented investors, so when our indicators are depressed it suggests there are few value investing opportunities in relation to the risks.

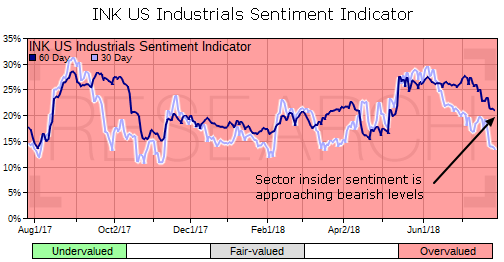

The 60-day INK US Industrials Indicator is approaching 20% which would be a danger sign

We are watching insider sentiment in the Industrials sector very closely. Since the end of QE, American stocks have tended to hit a rough patch when both our 30-day and 60-day US Industrials Indicators fall below 20%. When an indicator is below 20%, there are more than 5 stocks with key insider selling for every one stock with buying. Currently, the 30-day indicator is well below 20%, while the 60-day Indicator is at 21%. The trend for both is down. We will be providing an update on the Industrials indicators in our INK US market report next Wednesday.

INK Edge outlook ranking categories (Sunny, Mostly Sunny, Mixed, Cloudy, Rainy) are designed to identify groups of stocks that have the potential to out- or under-perform the market. However, any individual stock could surprise on the up or downside. As such, outlook categories are not meant to be stock-specific recommendations. For background on our INK Edge outlook, please visit our FAQ #5 at INKResearch.com.