The Worst Stocks and Sectors for November

While the November-to-April period is historically bullish for the stock market, there's one sector in particular that tends to sit out the November rally: real estate. Below, we'll discuss why short-term bulls may want to avoid the iShares U.S. Real Estate ETF (IYR), and take a look at the 25 worst stocks to own next month, including three real estate stocks -- two of which could move after earnings tonight.

Below are how 34 major exchange-traded funds (ETFs) tend to perform in the month of November. As you can see, the biotech sector tends to fare the best, with the SPDR S&P Biotech ETF (XBI) and SPDR S&P Pharmaceuticals (XPH) boasting average November gains of at least 3.5% over the past decade. However, the IYR has ended the month higher just 20% of the time in 10 years, according to Schaeffer's Senior Quantitative Analyst Rocky White, and averages a monthly loss of 3.39%.

As such, it's not surprising to find that three of the four worst S&P 500 Index (SPX) stocks in November fall under the Real Estate umbrella. Below is a list of the 25 worst stocks to own in November, if past is prologue. To make the list, stocks had to have at least eight returns.

Duke Realty Corp (NYSE:DRE) -- which reports earnings after the close today -- is typically the worst SPX stock in November, averaging a loss of 9.35%, and positive just once in the past decade. The shares have been in a channel of higher highs and lows since the 2009 bottom, but have struggled recently to top the round-number $30 level. At last check, Duke Realty stock was fractionally higher on the day, trading at $28.68. Another 9.35% drop next month would put DRE around $26 -- below most of its major moving averages, but still within the aforementioned channel.

Kimco Realty Corp (NYSE:KIM) also reports earnings tonight, and sports a November win rate of just 10%, averaging a monthly loss of 6.76%. Like DRE, KIM shares werein the midst of a long-term uptrend, but after peaking north of $32 in mid-2016, broke south of their channel. At last check, Kimco stock was 1.4% lower at $18.46. Another 6.75% loss in November would put the shares around $17.21 -- just cents from their four-year low of $17.02, touched in early June.

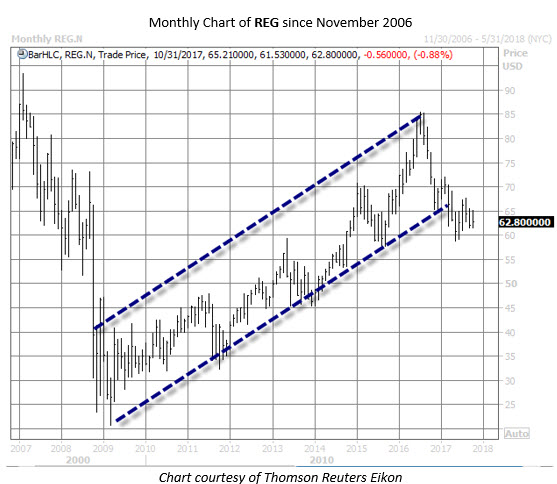

Regency Centers Corp (NYSE:REG) -- relatively new to the S&P 500-- will report earnings after the close on Wednesday, Nov. 1. REG stock has averaged a November loss of 4.84%, and has ended the month higher just once in the past 10 years. Since running into familiar resistance in the $85 neighborhood back in mid-2016, Regency Centers stock has broken south of its long-term channel of higher highs and lows, with recent rebound attempts capped at its 200-day moving average. At last check, the equity was down 0.9% at $62.80, and another 4.84% drop would place it around $59.74 -- in an area that contained pullbacks earlier this year.