This Apple Supplier Could Rally Through Black Friday

The S&P stock has averaged the best Thanksgiving week return over the last 10 years

The S&P stock has averaged the best Thanksgiving week return over the last 10 years

It was a dismal start to the week for semiconductor stocks as Apple (AAPL) suppliers sold off on concerns over iPhone demand. The sector is bouncing back today thanks in part to bullish brokerage attention for a pair of high-profile chipmakers, with Micron Technology, Inc. (NASDAQ:MU) up 2.4% to trade at $38.33. There could be more near-term upside in store for MU, too, considering it's one of the best stocks to own during Thanksgiving week.

According to data from Schaeffer's Senior Quantitative Analyst Rocky White, Micron stock has returned an average gain of 6.45% during the week of Thanksgiving over the past 10 years -- the most of any S&P 500 Index (SPX) component. Plus, the equity has been positive for the week 90% of the time at the abbreviated close on Black Friday.

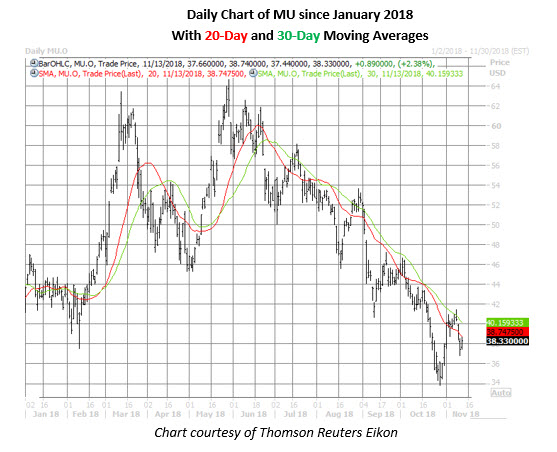

Taking a more broad look at Micron Technology's price action shows the tech stock has been in a channel of lower highs and lows for most of the past six months, down 40.7% since hitting a 17-year peak of $64.66 on May 30. And while the stock has come off its Oct. 29 annual low of $33.82, it's still staring up at its 20-day and 30-day moving averages -- two trendlines that have applied pressure during MU's recent downtrend.

Given Micron's longer-term technical troubles, there's plenty of skepticism priced into the shares. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock's 10-day put/call volume ratio of 0.77 ranks in the 100th annual percentile, meaning puts have been bought to open relative to calls at a quicker-than-usual clip.

Elsewhere, 10 of 25 analysts currently maintain a tepid "hold" recommendation on Micron Technology stock. Plus, short interest surged 10.9% in the most recent reporting period to 57.5 million shares, though this still represents just 5.3% of MU's available float.