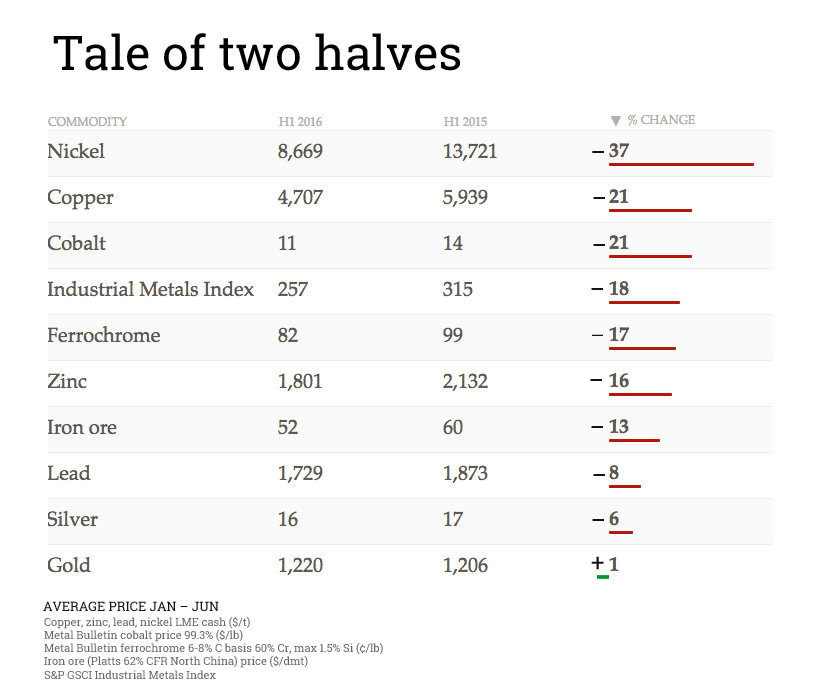

This chart shows how tough mining conditions still are

Gold has enjoyed its best first half of the year performance since 1908 and silver's 48% surge is a big swing even for such a volatile metal, but the 2016 rally in industrial metals has been just as remarkable.

Base metals are showing across the board gains year-to-date. Bellwether copper has been unable to break $5,000 decisively but is still ahead year-to-date while the likes of zinc (+41% at $2,280), tin (+27% at $18,440) and nickel (+24% at $10,770) have been stellar performers. Iron ore (+41% to $60) and coking coal (+34% ) have also come back strongly despite all predictions.

Glencore has been out in front when it comes to curtailing production to shore up pricesDesperate for better prospects after three years of declines maybe metals and mining watchers were too quick to declare the industry back to robust health.

A table tucked away in world number four miner and top commodities trader Glencore's production update, puts the year-to-date performance in a bit of perspective.

Despite the welcome recovery this year, miners are not out of the woods and major metals are still trading well below first half 2015 levels.

Glencore has been out in front when it comes to curtailing production to shore up prices.

It's not dominant enough to push copper very far in any direction, but its 31% zinc production decline in H1 2016 after idling mines in Peru and cutting back in Australia has been credited for a good portion of zinc's run up in price.

The fact that Swiss giant has decided not to return its zinc mines to full operation is another reminder that even after a 40% jump in price conditions remain tough.

Source: Glencore