This Weed Stock Buy Signal Has Never Been Wrong

Short-term options premiums are relatively rich at the moment, though

Short-term options premiums are relatively rich at the moment, though

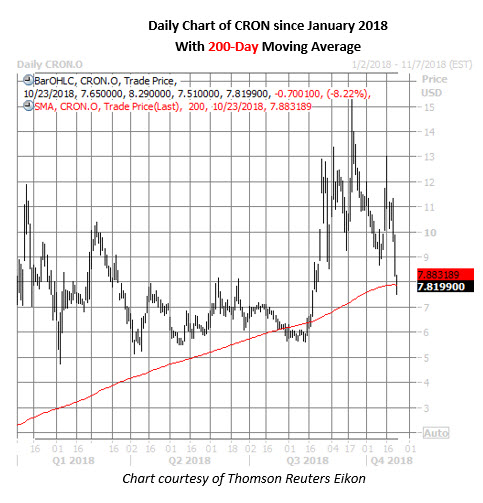

The shares of Cronos Group Inc (NASDAQ:CRON) topped out at a record high of $15.30 on Sept. 19, as the cannabis craze gripped Wall Street. The weed stock has since retreated from this milestone, and following a quick pop higher last week ahead of Canada's legalization of recreational marijuana, is down 8.2% today to trade at $7.82 -- on track for its fifth loss in six sessions -- after ratings agency DBRS expressed caution on large Canadian cannabis producers and placed a "non-investment grade" on the sector.

Not all news is bad news for the weed stock, with CRON shares now trading within one standard deviation of their 200-day moving average. There have been two other times the equity has pulled back to this trendline after a lengthy period of trading above it, and the shares went on to average a one-month gain 39.79%, according to data from Schaeffer's Senior Quantitative Analyst Rocky White. Another move of this magnitude would send Cronos stock back near $11, based on its current perch.

Options traders, meanwhile, have been positioning for a big bounce. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), speculative players have bought to open 2.45 calls for each put over the last two weeks.

Some of this heavy call buying -- particularly at out-of-the-money strikes -- could be at the hands of short sellers hedging against any upside risk. Short interest on CRON rose 9.3% in the two most recent reporting periods to a record high 22.51 million shares.

Whatever the reason, premium on the stock's short-term options is pricing in higher-than-usual volatility expectations at the moment, per CRON's 30-day at-the-money implied volatility of 136.3% -- in the 94th annual percentile. As such, those looking to bet on another potential bounce from the 200-day trendline may want to consider a long call spread, which lowers the cost of entry by combining a bought call with a sold one.