Trade War Cease-Fire Helps Stocks Start December Strong

Larry Kudlow and Steven Mnuchin waxed optimistic on the U.S.-China truce

Larry Kudlow and Steven Mnuchin waxed optimistic on the U.S.-China truce

The Dow kicked off December with a bang, finishing nearly 300 points higher thanks to optimism generated from the U.S.-China trade truce. The blue-chip index did, however, pare some of its initial gains, after being up 441 points at its early intraday peak. Treasury Secretary Steven Mnuchin also weighed in, expressing optimism about reaching a "real agreement" between the two global powers, while National Economic Council Director Larry Kudlow said he expects results from the 90-day pact to be felt "very quickly."

The S&P 500 and Nasdaq also finished confidently in the black, as sectors with heavy exposure to China rallied. Amidst global optimism, Wall Street's "fear gauge," the Cboe Volatility Index, fell to its lowest point in nearly four weeks.

Continue reading for more on today's market, including:

These 2 pot stocks made massive moves today. It could be time to short this blockchain stock. Options volume ran hot on these 2 Chinese stocks.Plus, options volume hot on a surging drug stock; 2 stocks to target now; and a Dow stock upgraded on the China trade truce.

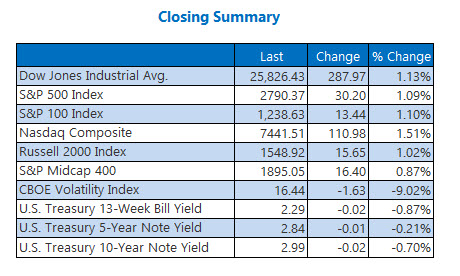

The Dow Jones Industrial Average (DJI - 25.826.43) added 287.9 points, or 1.1%. Twenty-two of the 30 stocks ended higher, with Boeing (BA) leading the charge with its 3.8% gain. Verizon (VZ) led the eight losers with its 3.5% drop.

The S&P 500 Index (SPX - 2,790.37) rallied 30.2 points, or 1.1%. The Nasdaq Composite (IXIC - 7,441.51) made gains, too, with its 110.9-point, or 1.5%, advance.

The Cboe Volatility Index (VIX - 16.44) dropped 1.6 points, or 9%.

5 Items on our Radar Today

Tencent Music Entertainment, a spin-off ofChinese tech giant Tencent Holdings, launched its initial public offering (IPO) earlier today, looking to raise up to $1.2 billion. This could be the second-largest IPO from a Chinese company in the U.S. in 2018, behind the $2.4 billion raised by streaming name iQIYI (IQ).(Reuters) Mercurial cryptocurrency bitcoinis continuing its freefall into December, falling as much as 8% today. The price of Bitcoin was valued at $20,000 around this time last year, and has shed roughly 70% since January. (CNBC)Options traders blasted this drug stock on FDA buzz.2 stocks to buy after the U.S.-China pact.Analysts upgraded this Dow stock after the China trade truce.There are no earnings to report today.

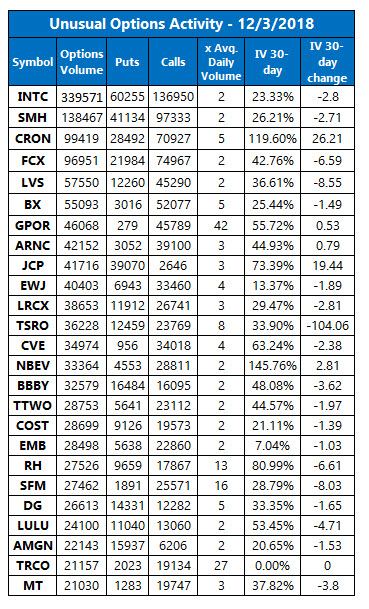

Data courtesy of Trade-Alert

Oil, Gold Join Global Rally

Oil also started December off strong, taking its cues from reports of expected production cuts at the Organization of the Petroleum Exporting Countries (OPEC) meeting on Dec. 6. Russia also agreed to extend production cuts, and Canada's Alberta surprised traders by announcing curbed output. For the day, oil for January delivery added $2.02, or 4%, ending at $52.95 per barrel.

Gold prices climbed today to a one-month high, thanks to a softening dollar. Amid easing tariff-related trade tensions with China, the dollar fell amid a basket of other currencies. February-dated gold futures gained $13.60, or 1.1%, settling at $1,239.60 per ounce.