Trump Throws Cold Water On The Gold Rally

Trump came out and tried to talk up the dollar.

While the "bounce" in the USD has been anemic, the precious metals and mining stocks have reacted very negatively.

I don't expect this bull market in gold will be derailed because of these statements, but it could remain under pressure for a bit longer.

Eventually, inflation and further increases in interest rates will crush the stock market. That's when gold will really shine.

Before President Trump's inauguration, his stance on the dollar was that it was too strong and U.S. companies couldn't compete as a result. In April of last year, months after taking office, he stated:

"Look, there's some very good things about a strong dollar, but usually speaking the best thing about it is that it sounds good. It's very, very hard to compete when you have a strong dollar and other countries are devaluing their currency."

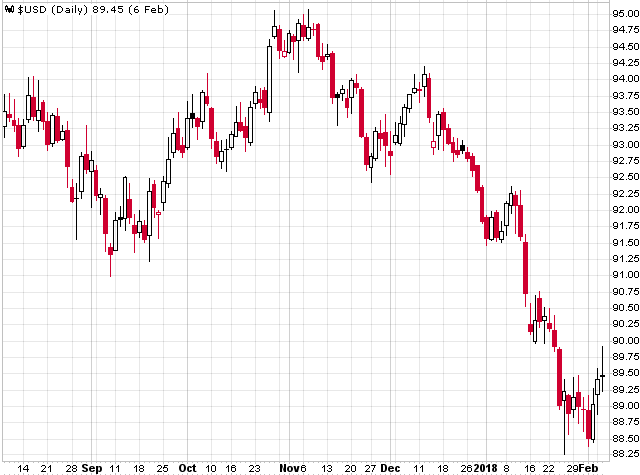

Over the last year, the USD has declined by hefty amount. A few weeks ago it had come under more pressure after US Treasury secretary Steven Mnuchin said that "obviously a weaker dollar is good for us as it relates to trade and opportunities" and that the currency's short-term value is "not a concern of ours at all." Those comments helped to sink the USD to lowest level since December 2014.

However, a few days later, Trump came out and tried to talk up the dollar and clarify Mnuchin's comments:

"I think they were taken out of context, cause I read his exact statement and I'll tell you where I stand, which ultimately is very important. No. 1 I don't like talking about it because frankly nobody should be talking about it. It should be what it is, it should also be based on the strength of the country - we are doing so well. Our country is becoming so economically strong again and strong in other ways too, by the way that the dollar is going to get stronger and stronger and ultimately I want to see a strong dollar."

For the record, I don't believe Trump wants a strong dollar, especially since he has been calling for a weak currency even before he took office. He has certainly been getting exactly what he's wanted given how much the dollar has fallen over the last year. His latest comments were just an attempt to temporarily prop up the USD in order to appease some on Wall Street and relieve tensions between the U.S. and other countries/central banks (who are saying that the weak greenback could upset currency markets and ignite a possible trade war).

The only way that the U.S. can reduce the debt and deficit is to burn the currency to the ground. Inflation is the solution to this mess, and pro-growth/inflation is the only way to get this economy going. Other nations are trying to do the same as this is a race to the bottom in the global currency game.

Curiously enough, the USD hasn't even received much of a bounce since Trump made these statements; it has just stopped moving lower. The market seems to be skeptical that the President actually wants to see the dollar appreciate in value.

(Source: StockCharts.com)

The lack of a major bounce in the USD doesn't surprise me, as I stated to subscribers of The Gold Edge after these comments by Trump were made:

The dollar might now find its footing, but I doubt it's about to see a major rally. Today it could barely close in the green despite this new show of support by the current administration. It's more likely that it just stops going down in the short-term and bounces around current levels for a while. It could increase a bit from here and put more pressure on gold, but I don't believe the dollar is going to increase 5-10%. That would put it at the same level it was last year when Trump said it was too strong.

Trump's comments, though, have thrown cold water on the gold rally as there is a short-term inverse correlation between gold and the USD. This can been seen in the performance chart below, as over the last year the SPDR Gold Trust ETF (GLD) has risen by just over 6% while the USD has fallen by almost 10%.

GLD data by YCharts

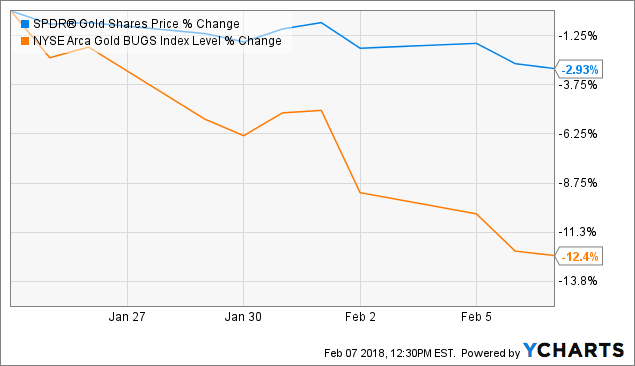

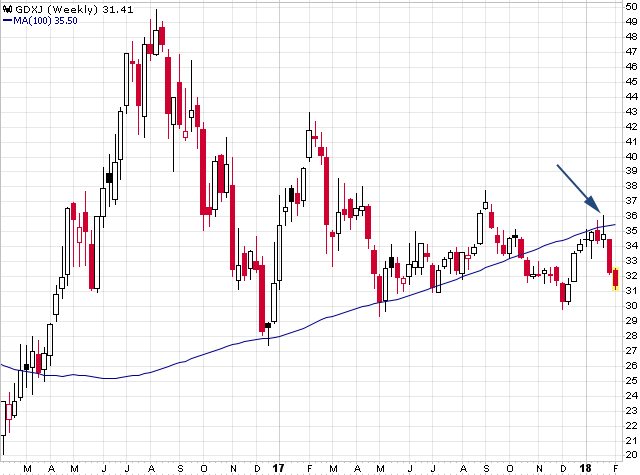

GLD data by YChartsWhile the "bounce" in the USD has been anemic, the precious metals and mining stocks have reacted very negatively. The selling pressure has been particularly intense in the miners, as GDXJ is down 12.4% over the last few weeks.

GLD data by YCharts

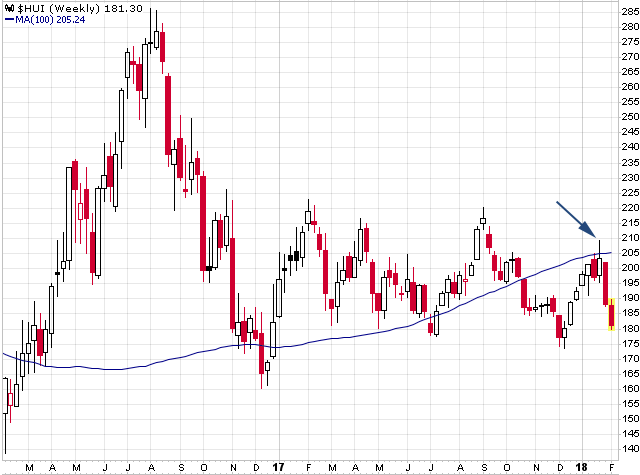

GLD data by YChartsThe timing of these comments were unfortunate (but I don't believe orchestrated) given that GDXJ and the HUI had just overcome major resistance levels in mid to late January - as both were back above their respective 100-week moving averages. GLD and SLV were also in near-term breakout positions at the time. The shorts have used this as an opportunity to pound away at the gold and silver miners as support has given way again.

(Source: StockCharts.com)

(Source: StockCharts.com)

(Source: StockCharts.com)

I don't expect this bull market in gold will be derailed because of these statements, but it could remain under pressure for a bit longer.

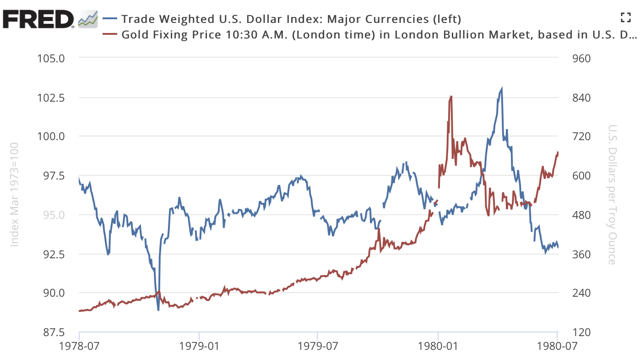

Gold also doesn't need a weakening USD for its rally to remain intact. As I have stated time and time again, there is no long-term correlation between gold and the USD. Eventually gold ignores movements in the dollar as it rises in response to inflation/increasing money supply. This 20+ year performance chart of gold and the dollar shows how there is ultimately zero correlation over the long-term.

I also want to highlight gold's performance in the late 1970's, as it quadrupled in value while the dollar was basically flat. If the USD finds some support in this region for the next few months and just manages to trade sideways (ultimately not making any progress to the upside), it's likely that gold will not be negatively impacted and could easily continue to move higher in price. The short-term inverse correlation between the USD and gold always eventually breaks at certain points and this could be one of those times. (Source: FRED)

(Source: FRED)

Gold's Rally Is Just Getting Started

While we aren't in a similar environment as we were in the 1970's, I believe we are headed in that direction as the focus turns to increasing inflationary pressures and rising interest rates.

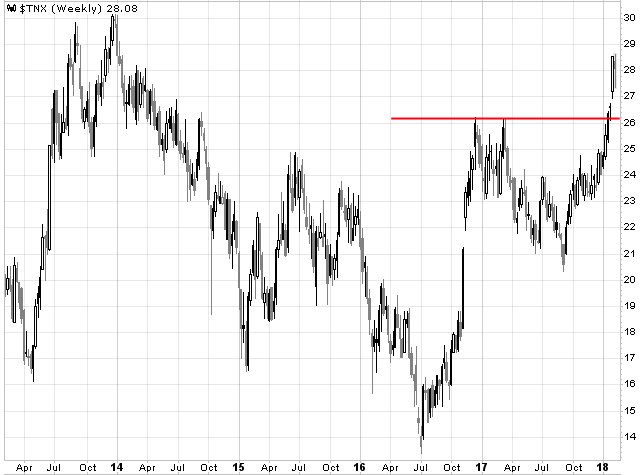

The yield on 10-year just broke out to new multi-year highs, and rising treasury yields are signaling that inflation is quickly becoming a major concern for investors.

(Source: StockCharts.com)

This is a multi-decade chart of the yield on the 10-year. That's a 30 year downtrend that's about to be broken. We haven't had a serious inflation problem since the 1970's, and these things run in cycles. How can a zero interest rate policy by global central banks and massive debt loads result in any other outcome? Once this line is breached, that's when the real "fun" begins because you are going to have surging interest rates going up against a surging stock market. There will be only one winner in that scenario.

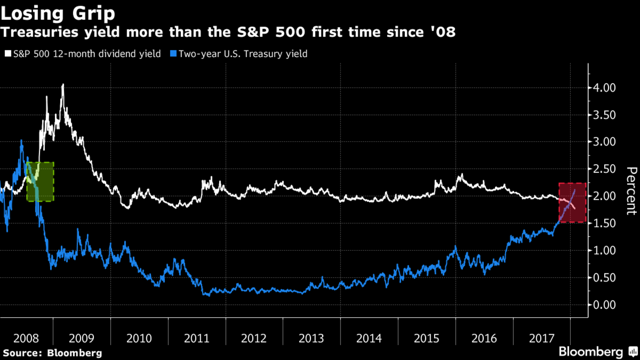

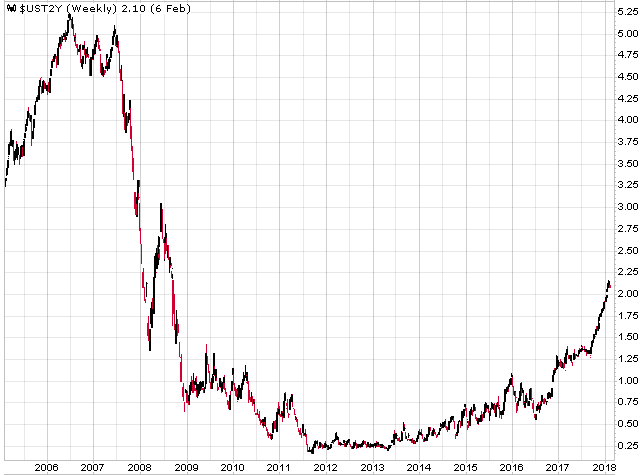

Just look at the sharp increase in the 2-year yield over the last 18 months. It's at levels not seen in almost 10 years and well above the average since 2009.

(Source: StockCharts.com)

The graph below shows the yield on the 2-year compared to the dividend yield for the S&P 500. The yield on the S&P 500 is now about 1.85 percent compared to 2.10 percent on 2-year Treasuries. This is the first time since 2008 that the 2-year has offered better income return than the S&P.

(Source: Bloomberg)

Stocks and rates have been rising in tandem, and it was only a matter of time until something broke. We are already seeing that to a degree given the recent mini-crash in the stock market.

I'm not convinced, though, that we are at that breaking point just yet. The stock market could extend its rally given that interest rates are still at historic lows, we have a pick-up in global economic growth, and considering the tax cuts hitting in the U.S.

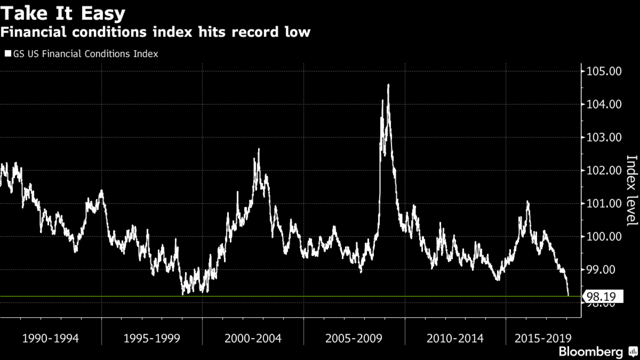

In fact, the Goldman Sachs index of financial conditions just hit a record low level, which is signaling the easiest conditions since 2000 and suggesting that further expansion lies ahead. Unless the Fed does something drastic to stop it like they did in 1999-2000 when the Fed Funds rate hit 6.5%. The current Fed Funds rate, though, is only at 1.25-1.50%, meaning there is a long way to go in this rate normalization process. As an interesting side note, the last time the index was at these levels, gold started a massive bull market.

(Source: Bloomberg)

It's ironic that New York Fed President William Dudley developed the GSFCI while at Goldman in the 1990s, as he and the rest of the Fed are now likely using this index as another data point to gauge whether to raise rates more aggressively.

According to Bloomberg, which highlighted recent comments from Dudley:

Faster economic growth from the tax cuts at a time when the labor market is already tight and financial conditions are already easy "suggests that the Federal Reserve may have to press harder on the brakes at some point over the next few years," Dudley said. "If the labor market tightens much further, it will be harder to slow the economy to a sustainable pace, avoiding overheating and an eventual economic downturn."

This statement is even more interesting:

Another risk Dudley cited was the country's long-term fiscal position. While the tax cuts stimulus may help boost consumer spending and business investment in the short run, "the current U.S. fiscal position is far worse than it was at the end of the last business cycle."

Over the last few years, we have seen a rising stock market, rising gold market, and rising treasury yields. There was always one scenario where everything goes up except for bonds, we are clearly in that environment and I believe it could persist for a while longer.

^SPX data by YCharts

^SPX data by YChartsEventually, inflation and further increases in interest rates will crush the stock market. That's when gold will really shine. We are entering a nightmare scenario for the Fed (higher inflation, higher interest on debt, etc.) and there is no possible way to engineer a soft landing.

I'm paying far more attention to interest rates (and where they are headed and what they are signaling) than I am to where the USD is trading.

The Gold Edge - Rating The Ramp Up Of New Projects

I just posted an in-depth article for subscribers of The Gold Edge that discussed many of the new gold and silver projects now coming online or that are about to in the next 6 months. These mines will have a significant impact on share price performance, and we are already starting to see that with some of these stocks already. Projects covered included Fekola (B2Gold), Rainy River (New Gold), San Agustin (Argonaut Gold), Brucejack (Pretium), Silvertip (Coeur), and several others.

Last month there was also a 3-part round-up series for subscribers that covered almost 50 gold and silver stocks, as well as Top Silver Stock article in which I ranked all of the major silver companies. Join my premium service on Seeking Alpha to find out which companies I'm bullish on and which ones that I'm avoiding.

I believe this strong surge in the gold market will continue for the foreseeable future. While we are in this surge, there will be lots of volatility, which means lots of opportunities. If you would like to read more of my thoughts, ideas, and research on the gold sector, including which companies I believe are best positioned for outsized returns in this bull market, you can subscribe here.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.