US Dollar Index Is Approaching a Top

Michael Ballanger of GGM Advisory Inc. shares his view on the current state of the market and specifically looks at the U.S. Dollar, gold, and silver.

Michael Ballanger of GGM Advisory Inc. shares his view on the current state of the market and specifically looks at the U.S. Dollar, gold, and silver.

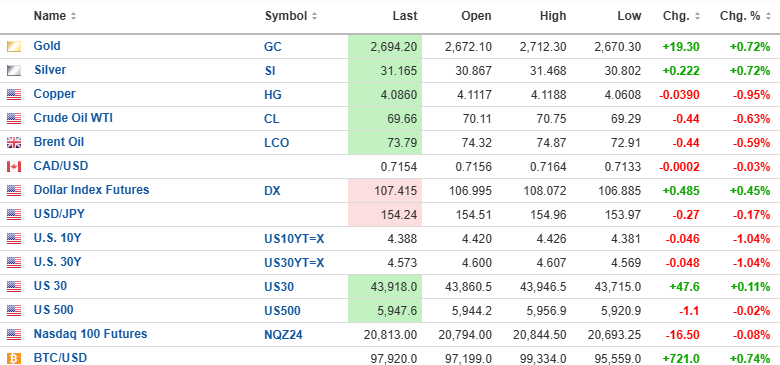

USD index futures are up 0.45% to 107.415 (a new high for the move and the highest print since late 2022). U.S. 10-year yield is down 1.04% to 4.388%, with the 30-year yield down 1.04% to 4.573%.

Gold (+0.72%) is up $19.30, with silver (+0.72%) up $0.22/ounce, but copper (- 0.95%) is down $0.04/lb. and oil (-0.63%) is down $0.44/bbl. to $69.66.

Stock index futures are mixed, with the DJIA (+0.11%) up, but the S&P 500 (-0.02%) and NASDAQ (-0.08%) both lower. Risk barometer Bitcoin is up $721 to $97,920.

Stocks

SPDR Dow Jones Industrial Average ETF (DIA:NYSE) November (29) option strangle worked out really well after the Nvidia Corp. (NVDA:NASDAQ) earnings blow-out on Wednesday, but it only worked because the DJIA completely ignored the weakness in not only NVDA but also the entire MAG Seven group of technology leaders.

The rally is broadening out, with the Dow Jones Transportation Average finally punching through to an all-time high a few sessions ago, which is a Dow Theory confirmation and "buy signal."

I am ahead 59.36% in after one trading session and intend to target 100% ROI today. If we see an aggregate of 8.12 points (being the sum of both put and call options on the DIA).

In the GGMA 2024 Trading Account:

Sell both the DIA (29) call and put contracts for a $8.12 credit

(e.g. If the call opens at $8.02 and the put is $.10 or better, sell them to net $8.12. If executed, it will be a 100% return (double) in under two trading sessions.)

It is the incredible strength of the U.S. dollar caused by massive inflows of foreign capital into the U.S. stock and bond markets since the November 6 election outcome that is causing dislocations around the globe.

However, it is also extremely overbought with RSI at levels (74.46) consistent with tradeable tops in October 2022, October 2023, and April 2024. U.S. bond yields have been positively correlated with the USD dating back to the September rate cut, so how a USD top affects yields remains an enigma. I do think that a declining dollar index will dampen enthusiasm from abroad, and that may spell the beginning of the much-needed correction.

Gold and Silver

The gold-and-silver ratio ("GSR") has been a fairly reliable tool for confirming advances in the precious metals complex, and as this chart reveals, the advancing GSR certainly does not provide me with a great deal of confidence in the gold rally.

December gold futures have rallied approximately $50/ounce off the early November lows, but silver is barely a dollar above its lows. This explains the rising GSR and is the sole reason I am avoiding the SPDR Gold Shares ETF (GLD:NYSE) or iShares Silver Trust (ETF) (SLV:NYSE) as short-term trading opportunities. I expect a re-test of the lows below $30 for December silver before I even think about a trade.

| Want to be the first to know about interestingCritical Metals,Silver,Gold andBase Metals investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.