US demand growth to push copper market into deficit

The surge in the copper price to near 18-month highs following Donald Trump's win in the US presidential election came as a surprise to an industry under pressure since 2011 over growing supply.

Bullishness about the impact of Trump's $500 billion infrastructure plans has cooled down considerably since then, but at $2.6430 per pound ($5,872 a tonne) in New York on Monday the bellwether metal is up by more than a third in value since hitting near-six year lows this time last year.

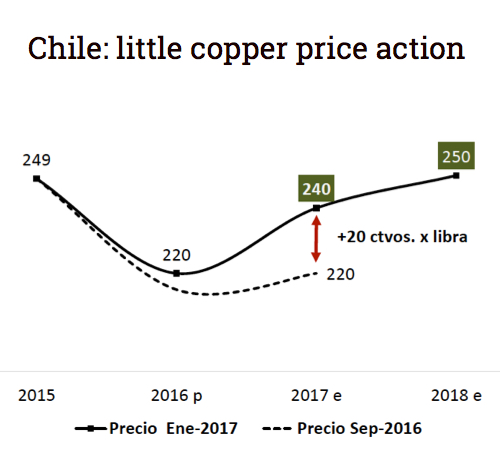

The Chilean Copper Commission upped its price estimates for this year and 2018 from its previous forecast in a report released on Monday, but the government forecaster for the world's top exporting country, still sees copper averaging below today's ruling price.

After contracting in 2016, US copper demand will grow 2.5% this year, offsetting slower growth in China

Source: Cochilco

Cochilco said it projected average copper prices of $2.40 per pound in 2017, up from its prior estimate of $2.20, citing expectations that proposed increased fiscal spending in the US will boost demand for the metal widely used in construction and manufacturing. Prices should improve further to average $2.50 per pound in 2018. The copper price averaged $2.21 in 2016.

Cochilco's prediction for global refined copper demand growth in 2017 is adjusted upward from 1.9% to 2.6% to a total of 24.3 million tonnes of refined copper globally. After contracting by an estimated 1.9% last year, US demand will grow 2.5% this year, offsetting slower growth in China which is still to expected to consumer 3% or 356kt more copper in 2017 compared to last year.

At the same time the government forecaster expects supply growth to moderate to 2.9% or 583kt this year to 20.76m tonnes as Chile which produces nearly 30% of the world's copper increases output by 4.3% or 306kt and Peruvian output continues to grow.

Last year the organization estimated growth in supply was a significant 4.7% or more than 900kt, mainly on the back of a 42% surge in production from Peru and huge jumps in Mexico and Iran which offset declines in the DRC and Chile.

Cochilco revised downwards its 2016 market surplus to 60,000 tonnes compared with the 128,000 tonnes it forecast in September. The organization now sees a market deficit in 2017 compared to a forecast oversupply of 114,000 tonnes it predicted previously. The market will stay in a slight deficit in 2018 of 34,000 tonnes.