Weak sterling boosts FTSE 100 after BoE keeps rates unchanged

Nov 4 (Reuters) - London's FTSE 100 rallied on Thursday as the pound plunged following the Bank of England's decision to defy markets by leaving rates unchanged, while heavyweight energy stocks tracked crude prices higher.

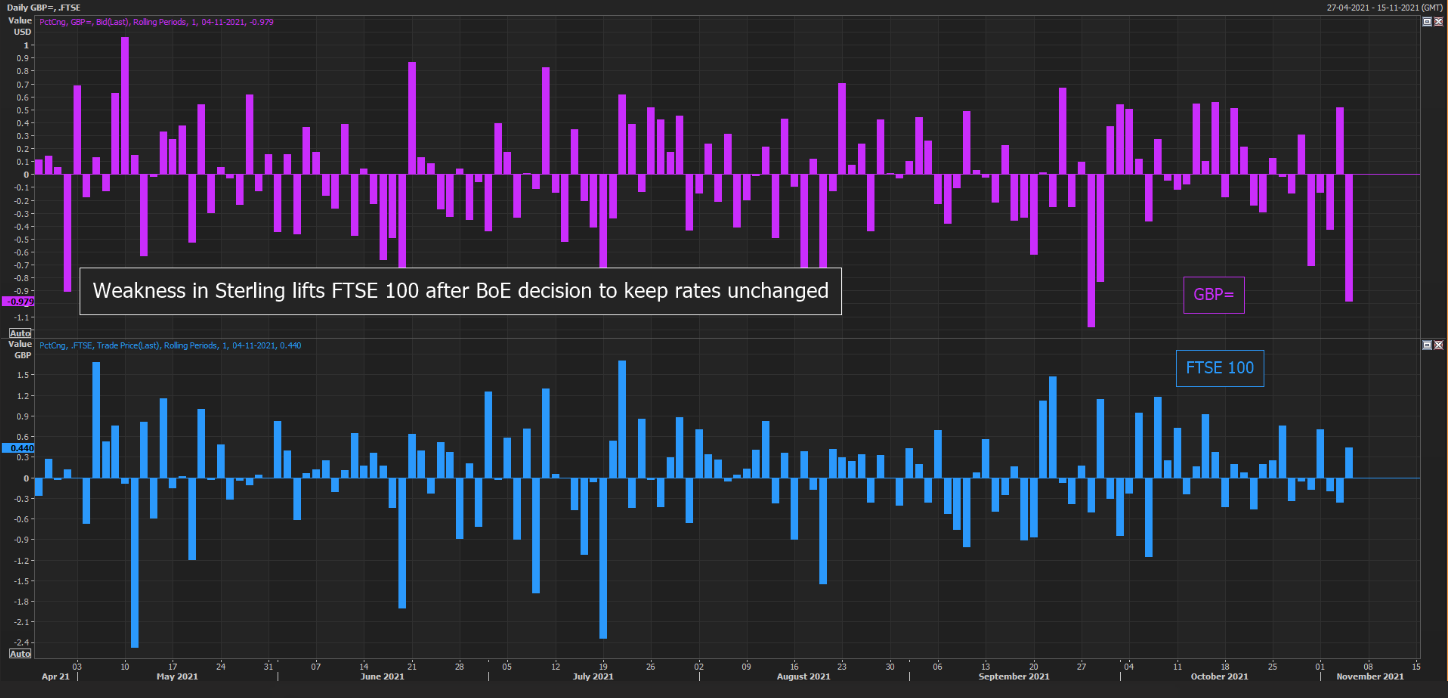

The pound weakened 1.33% after BoE's decision, boosting the FTSE 100 index and dollar earning companies. read more

The export-oriented FTSE 100 index (.FTSE), which was flat before the decision, ended 0.5% higher.

Oil majors BP (BP.L) and Royal Dutch Shell (RDSa.L) rose 1.2% and 1.7%, while telecommunications company BT Group (BT.L) added 11.0% after confirming its outlook for this year and the next. read more .

Limiting further advances were banks (.FTNMX301010), down 3.3%, hitting a three-week low following the central bank's decision.

"There is a realisation that the BoE is nowhere near to a rate hike than what the market initially thought," said David Madden, an analyst at Equiti Capital. "This is a big win for the U.S. dollar as they win the place to begin at least tightening and more money will be removed from the pound to the dollar."

The BoE has kept alive the prospect of a tighter monetary policy soon, saying it would probably have to raise Bank Rate from its all-time low of 0.1% "over coming months" if the economy performed as expected. read more

Supply-chain problems and rising inflationary pressures have led the FTSE 100 to underperform its European and U.S. peers that are trading near record levels after a dovish tapering stance by the European Central Bank and U.S. Federal Reserve on Wednesday.

"Underperformance of commodity-related stocks over the last few years versus tech, and the relative importance of banks in the UK versus U.S. have been the two things weighing FTSE down," said Edmund Shing, chief investment officer at BNP Paribas Wealth Management.

"Now is the time for commodities and banks to finally shine with a more value oriented environment."

The domestically focussed mid-cap index (.FTMC) advanced 1.6% to record its best session in over three months, led by positive earnings from engineering firm IMI (IMI.L) and electrical retailer Currys (CURY.L).

Britain's second largest supermarket grocer, Sainsbury's (SBRY.L), fell 2.4% to the bottom of the blue-chip index, as uncertainty around supply chains outweighed a 23% rise in first-half profit. read more

Rates at 0.1%Reporting by Bansari Mayur Kamdar, Shashank Nayar and Amal S in Bengaluru; Editing by Subhranshu Sahu, Shailesh Kuber, William Maclean

Rates at 0.1%Reporting by Bansari Mayur Kamdar, Shashank Nayar and Amal S in Bengaluru; Editing by Subhranshu Sahu, Shailesh Kuber, William Maclean