What's Holding Back Gold?

Gold is still stymied by dollar strength and other factors.

Gold mining stock weakness has been a major obstacle for gold.

Gold's relative strength (vs. equities) is encouraging, however.

In what has been a choppy week of trading, the gold price finally benefited from some safety buying on Thursday. April gold futures rose 0.3 percent to $1,322 on Feb. 8 as global equity markets continued to show weakness. In today's commentary we'll look at the factors which have held the gold price back recently. We'll also try and discern its prospects for finally breaking free of its immediate-term downward slope in view of the latest financial market developments.

U.S. stocks tumbled on Thursday, creating some renewed buying interest for precious metals. This also was helped along by serious weakness in the Asian equity markets overnight, as investors continue to worry about rising bond yields and what impact it might have on the U.S. economy and global trade.

Also weighing on gold lately is continued weakness in the crude oil market. The oil price has dropped to its lowest level in seven years as supply continues to glue the market along with diminished demand from industrial powerhouses such as China. Traders are worried that any additional weakness in the oil market may kick off a bout of deflation in the global market.

While a strengthening U.S. dollar has put downward pressure on gold during the recent equity market sell-off, investors turned bullish on the metal Thursday in light of the 4% drop in the S&P 500 Index (SPX) on Feb. 8. The turnaround came as the gold price approached the widely watched 50-day moving average on Thursday. An intraday move to the $1,307 level in spot gold was the reversal point for the Feb. 8 session, which saw a strong rebound in the gold price at the close.

Source: www.Barchart.com

As can be seen in the above graph, the gold price remains above this important intermediate-term trend line and which shows the yellow metal remains in decent shape on an interim basis. Its short-term status, however, is still in question as we'll review here.

With all the worries which have been assailing investors lately, gold should be showing decisive strength from the increased safe haven demand. So what's holding the gold price back from rallying in a sustained fashion? One thing that has kept the gold price in check lately has been an obvious culprit, namely the dollar. As we've seen in previous commentaries, the U.S. dollar index (DXY) has been strengthening after a three-month declining trend.

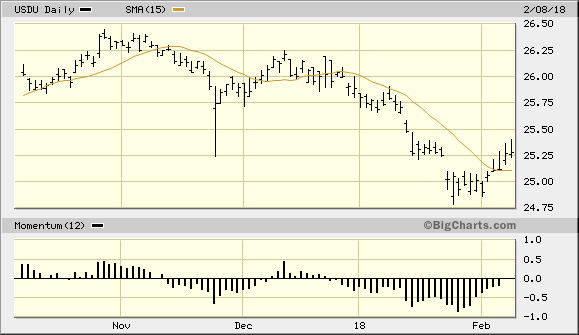

The WisdomTree Bloomberg US Dollar Bullish Fund (USDU), my preferred dollar tracking vehicle, has technically confirmed an immediate-term (1-4 week) bottom per the rules of my trading discipline as of Thursday. It has closed two days higher above its 15-day moving average, as can be seen in the following graph. Although it's possible that both gold and the dollar can rise together during periods of turbulence in the financial market, the recent dollar strength has nonetheless created a headwind against the gold price in recent days.

Source: www.BigCharts.com

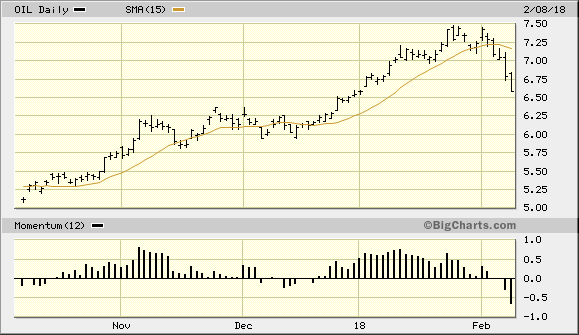

Another factor weighing against gold in the immediate term has been the crude oil price. Pictured below is the iPath S&P GSCI Crude Oil Total Return Index (OIL). This oil-tracking fund confirmed an immediate-term top on Monday when it closed under its 15-day moving average for the first time since December.

Source: www.BigCharts.com

Crude oil price strength is one of my five "pillars" of a strong gold price (the other four being the dollar, silver, the XAU, and gold's relative strength vs. equities). As long as the oil price remains weak, gold also will likely experience some resistance due to the close correlation between the two in the investment world. Keep in mind that fund managers consider a strengthening crude oil price as an incentive to buying other inflation-sensitive commodities like gold. For that reason the oil price should ideally move in synch with the gold price during rallies.

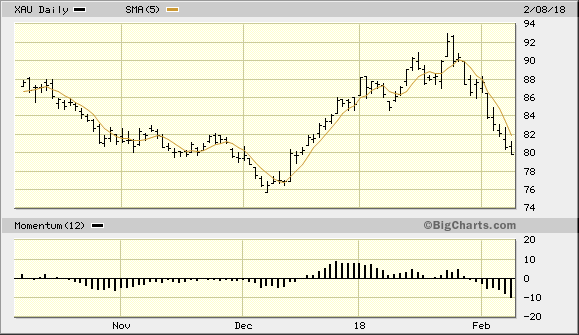

Gold mining shares also have come under heavy selling pressure since late January, which is another thing holding back the gold price from rallying. The progression of the PHLX Gold/Silver Index (XAU) is shown here and needs no further commentary. The immediate trend is still down and the XAU has been unable to close above even its five-day moving average. This has likely resulted in at least some spillover weakness in the physical gold market as traders especially have been somewhat put off by the XAU's poor performance.

Source: www.BigCharts.com

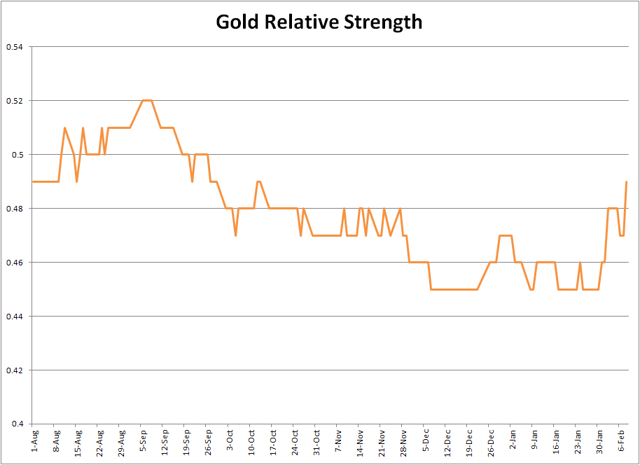

Not all is bad news, though, and there are some encouraging signs of improvement for the gold price in the near term. Consider for example the following graph which shows the relative price strength of gold compared with the S&P 500 Index (SPX). As emphasized in previous reports, a steady and sustained improvement in gold's relative strength vs. equities is another major incentive for market-moving investment funds to accumulate gold. When they see gold's prospects increase vis-? -vis the stock market, they're almost forced to give serious consideration for purchasing gold. In the latest graph shown here you can see that gold's relative strength rating vs. the SPX rose to 0.49 on Thursday. This was its best showing since October. If gold's relative strength continues to increase from here we should soon have another confirmed entry point for new gold purchases.

Chart created by Clif Droke

Indeed, recent stock market selling pressure has been the primary reason for gold's increasing relative price strength. If the global equity markets continue to show weakness, it's more likely than not as individual investors and fund managers will turn en masse to gold once again. Long-term investors should therefore maintain core long-term bullish positions in gold as the previously longer-term fundamentals underlying the two-year recovery of the gold price remain intact despite the latest volatility.

I'm not recommending any new short-term trading positions in gold, however, until the above mentioned technical improvements become apparent. For disclosure purposes, I don't plan on initiating a new trading position in the iShares Gold Trust (IAU), my preferring gold tracking vehicle, until IAU is first able to close above its 15-day moving average. In consequence of Tuesday's sell-off in IAU, I've honored my previously mentioned loss limit of $12.75 as this level was broken on a closing basis.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.