What Could Propel A Continued Gold Recovery?

Gold's short-term prospects have diminished, but all is not lost.

Even as the dollar strengthens, gold's 2-year recovery remains intact.

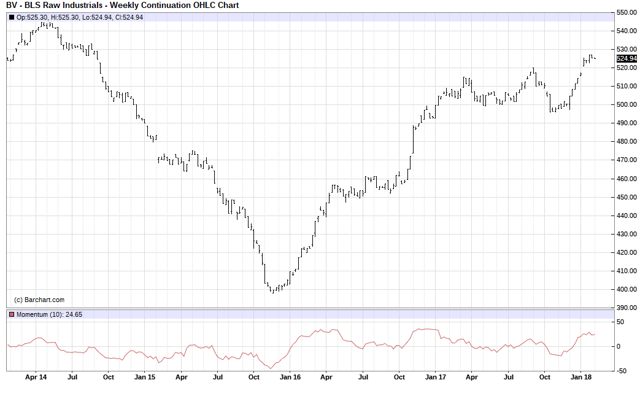

CRB raw industrials index holds the key to gold's longer-term future.

After an impressive upside run over the last several weeks, the price of gold is showing weakness once again. This has caused participants to wonder how much lower the gold price must sink before equilibrium is restored to the market and also what could drive gold prices higher in the near term now that the dollar is strengthening. I'll attempt to answer these questions, as well as discuss gold's longer-term recovery, in this commentary.

Let's start by considering that the rally in the gold price in December through January was mainly the result of short covering along with weakness in the U.S. dollar index. Both factors are no longer supportive of gold's immediate-term (1-4 week) trend, however.

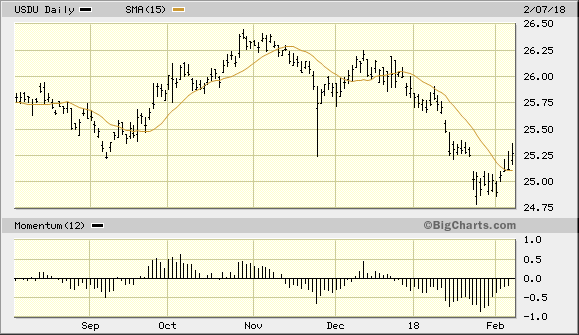

Let's start with gold's currency component. I've been using the WisdomTree Bloomberg US Dollar Bullish Fund (USDU) as my preferred dollar proxy. USDU has confirmed a preliminary immediate-term bottom per the rules of my technical trading discipline as of Feb. 7, as can be seen here. The following graph shows that the USDU price closed two days higher above its 15-day moving average on Wednesday to signal a bottom. As long as USDU doesn't close below the $25.12 level on Thursday, the signal will be confirmed.

Source: www.BigCharts.com

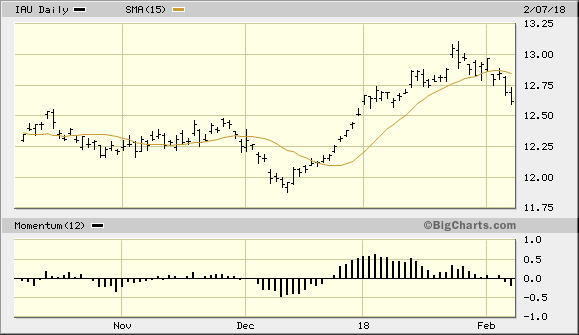

My favorite gold proxy is the iShares Gold Trust ETF (IAU), which is shown here. On Feb. 6 I was stopped out of the long position which I initiated in IAU in December when the $12.75 level was violated. IAU is also below its 15-day moving average, which suggests that sellers control the immediate-term trend for IAU. Accordingly, as long as IAU remains under this technically important trend line, no new trading positions are recommended in this ETF.

Source: www.BigCharts.com

Yet despite the immediate-term weakness in the gold market, not all is bad news. Investor sentiment is another factor to consider in the short term. From a contrarian standpoint, we should be seeing individual investors becoming less bullish on the gold outlook as the price of the asset declines. This lets us know that the market is doing its job of shaking out the weaker investors from holding gold so that stronger hands can continue accumulating longer-term positions of the metal during pullbacks as the 2-year recovery continues.

As it turns out, not only has retail investors' ardor toward gold cooled recently but so has that of large speculators. Large speculators lowered their net long position in COMEX gold contracts last week, according to the latest U.S. Commodity Futures Trading Commission (CFTC) data. This marked the first time in seven weeks that gold speculators reduced their gold bullish positions, according to COT analyst Zachary Storella.

According to Commitments of Traders (NYSE:COT) data, the non-commercial futures gold contracts traded by large speculators and hedge funds totaled 207,262 net contracts through January 30 - a weekly decline of 7,422 contracts from the previous week's total of 214, 684 net contracts. Speculative gold positions had risen conspicuously in the previous six weeks by 107,616 net contracts before the latest reduction. This latest reduction in bullish sentiment is a welcome sign that the latest gold price pullback is thus far taking on the appearance of a normal, healthy "correction" within the ongoing 2-year recovery.

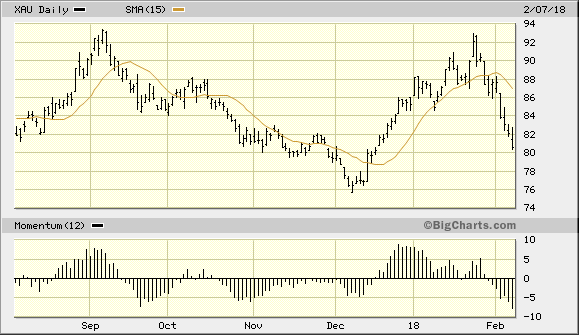

Unfortunately for gold's immediate-term outlook, gold mining stocks are showing relative weakness which suggests that the gold price may have further to decline before bottoming. Shown here is the PHLX Gold/Silver Index (XAU), which often serves as a leading indicator for physical gold. Consider for instance that the XAU preceded the decline in the gold ETF (IAU) by several days, closing under its 15-day moving average on Jan. 26, four days before IAU did the same. Internally, weakness in the major gold mining shares means that the gold price will remain vulnerable to selling pressure in the days ahead. Ideally, the XAU index should reverse its decline before the gold price does to let us know that the immediate-term danger has abated.

Source: www.BigCharts.com

Turning our attention to the bigger picture, many analysts have pointed out that "fear factor" over the possibility of a global recession which gripped the minds of many investors in the past two years is diminishing. This fear was a major inducement for many smaller investors to accumulate a safe-haven position in gold. With such fears no longer a driving factor, what could possibly serve to propel gold prices higher in the intermediate-to-longer term?

My answer would be that the very recovery in the global economy itself will provide the increasing demand for gold, silver, copper, and other industrial commodities in the years ahead.

To that end, it should be noted that the CRB/BLS raw industrials spot price index continues its V-shaped recovery since bottoming on November 23, 2015 after falling 27% from April 14, 2014's high. It's now back to the highest reading since August 2014 and only slightly below 2014's high. Additional strength in the industrial metals from here would also likely bode well for gold, especially since gold often follows the lead of the industrial metals in the early-to-intermediate-term stages of a broad economic recovery.

Source: www.Barchart.com

The bottom line is that it's too early to write off gold's intermediate-term prospects based simply on rising interest rates and returning economic strength. Indeed, gold like many other commodities should benefit from the return of global demand. Investors should therefore maintain a core long-term bullish positions in gold as the steady recovery of the gold price should continue in the years to come. I'm not recommending any new short-term trading positions in gold, however, until the above mentioned technical improvements become apparent. For disclosure purposes, I'm no longer in my long position in the iShares Gold Trust (IAU) which was established in December. In consequence of Tuesday's sell-off in IAU, I've honored my previously mentioned loss limit of $12.75 as this level was broken on a closing basis. No new trading positions in IAU are currently recommended.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.