What Gold Investors Should Expect Heading Into The Chinese New Year

Last week, speculative gold positions declined for the second straight week as both longs and shorts cut positions.

Despite the drop, speculative gold positions remain relatively high on a 10-year historic basis.

Silver speculators cut silver positions once again to a net-short position, which is a bullish contrarian signal.

The 2018 Chinese New Year started on Friday and we expect volatility in the gold price next week and speculative longs to be tested.

At this point we are more bullish on silver than on gold based on the speculative positioning.

We are back after a hiatus of few months, we had to get a few personal things in order, but we hope to be regular once again with our COT reports. So, let us get back into analyzing what short-term precious metals traders are doing with their COT positions!

The latest Commitment of Traders (COT) report showed a second straight weekly decline as speculative longs continued to trim positions, though after a seven-week stretch of consecutive speculative positional gains this isn't particularly surprising. Speculative shorts also closed out positions, so we really had little in the way of conviction from shorts on the decline in gold through the COT week. Though we would remind investors that gold rose after the report's Tuesday close, which suggests that the current speculative gold position understates how long the market truly is.

The major calendar event that gold investors need to focus on next week is the Chinese New Year, which started on Friday (2/16/2018). The big takeaway here is that there will be much less activity from China as the country celebrates its new year, which in our experience makes for much more volatile trading as less money is needed to move the gold market up or down.

We will get more into some of these details but before that let us give investors a quick overview into the COT report for those who are not familiar with it.

About the COT Report

The COT report is issued by the CFTC every Friday, to provide market participants a breakdown of each Tuesday's open interest for markets in which 20 or more traders hold positions equal to or above the reporting levels established by the CFTC. In plain English, this is a report that shows what positions major traders are taking in a number of financial and commodity markets.

Though there is never one report or tool that can give you certainty about where prices are headed in the future, the COT report does allow the small investors a way to see what larger traders are doing and to possibly position their positions accordingly. For example, if there is a large managed money short interest in gold, that is often an indicator that a rally may be coming because the market is overly pessimistic and saturated with shorts - so you may want to take a long position.

The big disadvantage to the COT report is that it is issued on Friday but only contains Tuesday's data - so there is a three-day lag between the report and the actual positioning of traders. This is an eternity by short-term investing standards, and by the time the new report is issued it has already missed a large amount of trading activity.

There are many ways to read the COT report, and there are many analysts that focus specifically on this report; we are not one of them, so we won't claim to be the experts on it. What we focus on in this report is the "Managed Money" positions and total open interest as it gives us an idea of how much interest there is in the gold market and how the short-term players are positioned.

This Week's Gold COT Report

*Gold price data reflects the COT week (Tues-Tues) not a standard week (Mon-Fri)

For the week, speculative longs decreased their positions by a sizable 19,660 contracts for the second straight weekly decline. Despite the drop in the net long speculative position, gold only dropped by .45% for the week, which was primarily due to short speculators also closing their own positions.

Moving on, the net position of all gold traders can be seen below:

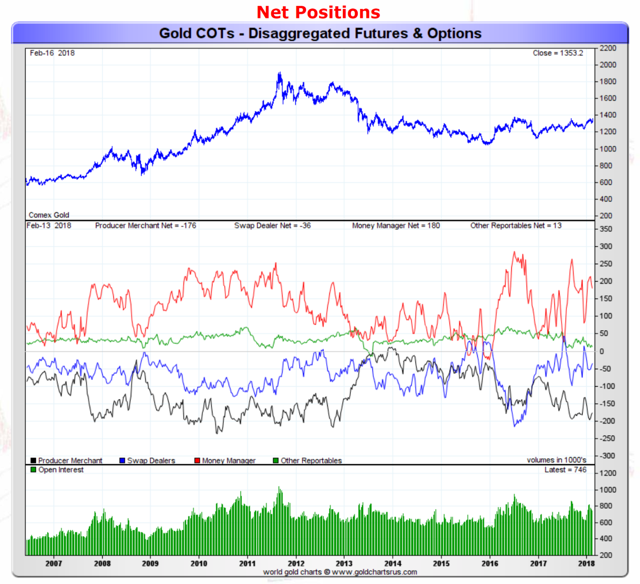

Source: GoldChartsRUS

The red-line represents the net speculative gold positions of money managers (the biggest category of speculative trader), and as investors can see, we saw the net position of speculative traders decrease by a little under 12,000 contracts to 180,000 net speculative long contracts. In terms of the historical range, the speculative positions are currently on the higher end of their 10-year chart, so we would caution investors to be careful here.

As for silver, the week's action looked like the following:

Source: GoldChartsRUS

The red line, which represents the net speculative positions of money managers, showed the speculative position declining by around 11,000 contracts in silver as speculative longs slightly cut their position while speculative shorts jumped in to increase their own positions by 10,300 contracts.

Taking a look deeper at the silver position we see the following COT data:

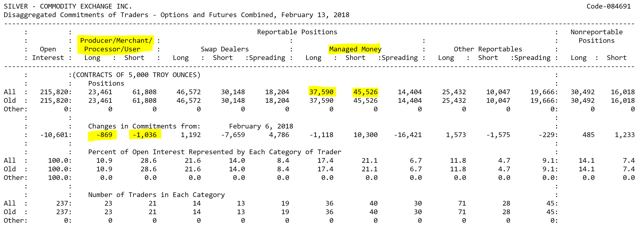

Source: CFTC

The two important things for investors to take away here are that (1) speculators are now net-short silver and (2) Producers/Commercials are not picking up the slack significantly.

In regards to the first point, historically when we hit a net-short position in silver we have seen a bounce-back in the silver price and thus have made it a good time for investors to buy - a bullish signal.

As for the second point, Producers/Commercials are not picking up the slack in terms of their positioning in silver, which suggests to us they are not as optimistic on the demand side for silver as they have been in the past. That is not surprising for us as we still have our concerns about bullion investors cutting back their silver purchases over the past year to much lower levels. We do not think the industrial side can make up for this cut in demand, so this is a bearish sign.

Thus, our view on silver is a bit muddled as the clear bearishness of speculators is a contrarian-positive, but the lack of buying by Commercials is bearish. It might be a good time to initiate silver positions, but not yet to really go all-in with silver.

The Chinese New Year

This Friday begins China's New Year celebration where the Shanghai Gold Exchange will be closed for a week as Chinese traders and investors travel and celebrate their new year. While gold doesn't tend to have a clear direction during the week, it does tend to be more volatile than usual in our experience - which makes a lot of sense as there's less trading volume in Asia.

Practically speaking, it is an ideal time for short-term traders to push markets in the direction they wish as it takes less money to make larger moves in these quieter markets. Thus, we are a bit concerned specifically about the gold price since it is toward the higher end of its historical range in terms of the speculative net-long position - it would be an ideal time for the speculative longs to be tested.

Our Take and What This Means for Investors

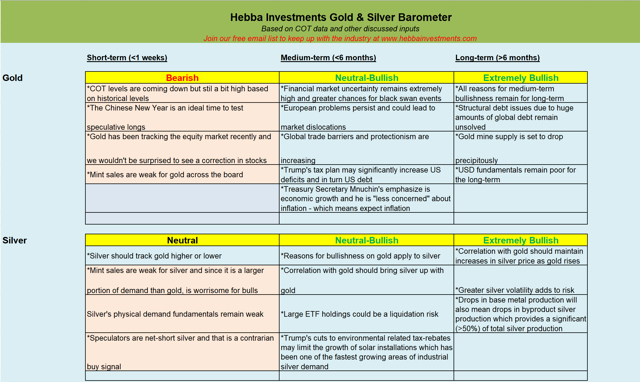

Despite the strong run in gold over the past few weeks, we are extremely cautious on the gold price and wouldn't be surprised to see a correction in the gold price as the speculative position is a bit high right now. The Chinese New Year may be the ideal time for it to begin.

As for silver, we are more bullish on it than in gold because it is a much more contrarian play in terms of the speculative position with traders being net-short silver. That has historically been a good time to buy, and despite some of demand-side weakness, we would be interested in buying if there is a drop next week.

Thus, we have a Bearish short-term outlook on gold but a Neutral outlook on silver as we expect silver to outperform gold on a relative basis simply due to speculative positioning.

We would hold off on gold purchases in ETFs SPDR Gold Trust ETF (NYSEARCA:GLD) and equities. But we would be very interested in silver ETF purchases in the iShares Silver Trust (SLV), Sprott Physical Silver Trust (PSLV), and ETFS Physical Silver Trust ETF (SIVR) as we expect silver to outperform gold on a relative basis and the risk-reward in silver seems to be better than in gold at this time.

Disclosure: I am/we are long SIVR.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.