What on Earth Was THAT Selloff About?

We'll be trusting Santa rallies a tad less as a result of Tuesday's take-no-prisoners selloff. Mainly, it'll be a matter of keeping the word "DISTRIBUTION!!!" well in mind every time shares take even a few mincing steps higher. That goes for AAPL as well, my one-size-fits-all bellwether. The stock had switched on the charm Monday, all but shouting "Buy me!" from the rooftop as the session ended. This was before AAPL tripped an outright 'mechanical' buy signal midway into Tuesday session one that met our criteria for jumping on that type of trade. Lo, the stock thwacked our bid, then continued relentlessly lower for the remainder of the day. This eventually stopped out the trade, but the thing to notice was that AAPL barely bounced after the last bull had been cast off.

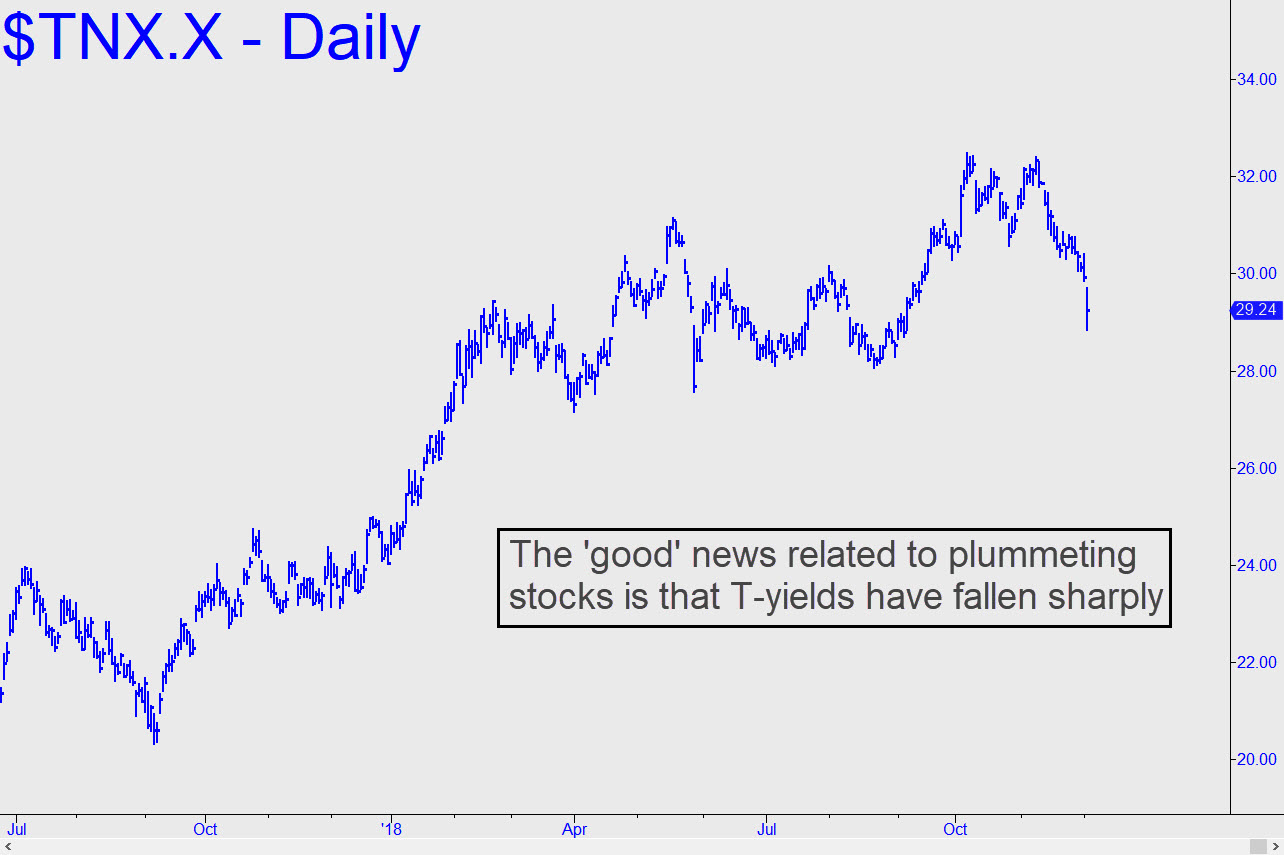

Nomura bank's man-in-the-trenches said the selloff was, um, technical, and that the firm's 'CTA Trend Model' here's a mouthful of jargon "is again deleveraging massive notional in long US Equities expressions across SPX, RTY and NDX live." Phew! For a moment there, we'd though it was just run-of-the-mill fear that brought sellers out in droves. He also noted that the selling occurred in the context of a well entrenched global shift by investors out of stocks and credit and into government bonds all due, apparently, to a sharp turn in the economic cycle. Now they tell us! Think what it could have meant to us pishers if we'd known a day earlier what was on the tiny, fevered brains of algo traders and their Olympian Masters as the week began. The Masters' unaccustomomed lust for Treasury paper has reversed the upward spiral in rates, a development that some will see as beneficial. But a fat lot of good it will do us if the U.S. economy is already headed into a recession that dulls housing appetites, even with mortgages 75 to 100 basis points lower. If you don't subscribe but want a peak behind the headlines, click here for a free two-week trial to Rick's Picks. It will give you instant access to all features and services, including a 24/7 chat room where great traders from around the world share ideas that can help you make money.