Why Gold Failed As A Hedge Against This Stock Correction

Gold and silver prices failed as a hedge against the recent stock market correction, in my opinion, because of U.S. dollar appreciation.

The U.S. dollar appreciated because of a robust U.S. economy and an intensifying expectation for a worthy tightening of Fed monetary policy as a result.

Precious metals investors should be aware of scenarios through which the tide might turn for their fortunes; those are also discussed herein.

Many precious metals investors buy and own the alternative asset class or its relative securities for the diversification it offers from stock market exposure. Gold and silver are seen by many as a hedging mechanism against stocks and currencies, and in many instances they can act as such. So why did gold fail as a hedge against stocks through last week's stock market correction?

Gold & Silver Prices through the Stock Market Correction

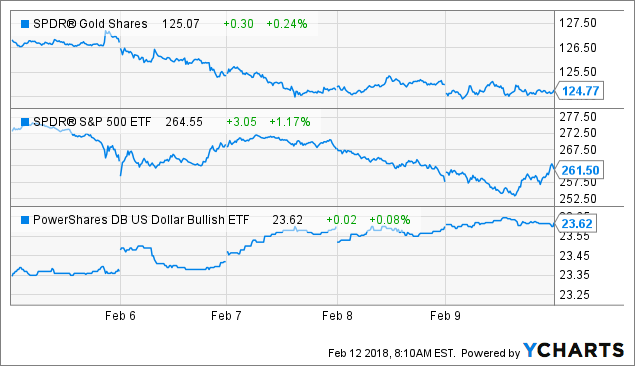

While stocks entered correction territory, down more than 10% in their darkest hour last week, gold and silver hardly provided any light. Shares of the SPDR S&P 500 (NYSE: SPY) were down 7.1% from Thursday February 1 through Friday February 9, while the shares of the SPDR Gold Trust (NYSE: GLD) also declined, by 2.6%, and while shares of the iShares Silver Trust (NYSE: SLV) moved lower by 5.3%.

Why the Gold Hedge Failed this Time

Clearly the price action of precious metals proved useless as a hedge through the latest stock market correction. To help us to understand why, let's look at two examples, each domestic in nature.

If stocks had dropped last week on concern about the U.S. economy entering recession or depression, the U.S. dollar would have depreciated in value and precious metals prices would have appreciated in dollar terms to U.S. based investors. The reason for this is because of a decreased value in the macro factor, the U.S. economy, which detrimentally affects all U.S. based assets; and potentially demand for U.S. treasuries, U.S. based investment securities and the U.S. currency, the dollar.

But, last week, U.S. stocks dropped because of concern that the Federal Reserve might raise its trajectory for the Fed funds rate to meet warming inflation on a robust economic outlook. The U.S. dollar appreciated in value as a result of fear of the Fed putting on the brakes via a steeper Fed funds rate trajectory and more hawkish monetary policy. The PowerShares DB US Dollar Bullish ETF (NYSE: UUP) appreciated by 2.1% through the same span measured for the SPY, GLD and SLV above.

In this case, the cost of capital to Americans and American firms increases and the threshold to the creation of economic value addition is raised (so stock prices took an initial hit), but these same firms are in a position to meet that challenge due to economic robustness. Economic health raises demand for goods and services and also provides companies with a better pricing environment for their goods and services. In this instance, the catalyst is economic robustness, a positive for America and its currency. The Fed's tightening of monetary policy thereby raises the value of its currency, which is in demand. Gold and silver priced in dollar terms decrease in value against a stronger dollar.

It's important to note that inflation is really not a serious threat just yet, or at least it is not perceived as such. In the case of surprising and abruptly presenting hyperinflation, well then, the U.S. dollar would see its value eroded dramatically (not what happened last week). In this instance, Fed action, though it would be the same (tightening), would be seen as late in coming and, in my opinion, it would not serve the dollar fast enough (until it eventually did down the road). In this case, gold and silver would do extremely well.

Gold is Currency and Commodity

Gold is, in my often expressed opinion, both commodity and alternative currency. As currency, its price should fluctuate with the currency it is priced against. For U.S. investors, that means a stronger dollar prices down gold and silver. As a commodity, gold and silver likewise price against the currency used to buy them. For American investors, an appreciating U.S. dollar means the gold commodity is priced lower.

How Things Could Change for Gold Relative to the Stock Correction

If a stock market crash is deep enough and lasts long enough it can feedback into the economy. The "wealth effect," often described in terms of real estate values, serves investor and consumer confidence and consumer spending when those assets increase in value. The wealth effect, because of the pervasiveness of securities investing in America via pension plans and individual retirement plans, probably also exists in relation to fluctuations in stock market prices. Thus, the last few years' stock market gains have probably served consumer spending and investor confidence. However, the theory holds that a deep enough and long enough stock market decline would have the opposite impact.

If, therefore, this correction was to worsen or to lengthen, which is not my expectation (see my guide to this correction), then the direction of the dollar might change and gold and silver prices might draw capital and see price appreciation. That would be because the outlook for the U.S. economy would deteriorate; again this is not my expectation.

In conclusion, we see that despite the stock market correction, gold and silver prices failed as a hedge for investors. The reason is very likely because of U.S. dollar strength on U.S. economic robustness.

For more of my work on markets and securities, readers are welcome to follow me here at Seeking Alpha.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.