Why New Gold Is A Buy, Although The Rainy River Guidance Is Disappointing?

Rainy River's AISC is expected at $875/toz over the first 9 years of production, which is notably higher than originally projected.

New Gold is working on an update of the Rainy River mine plan. It estimates that the average annual production could be 275,000-375,000 toz gold over the first 9 years.

Despite the higher than expected Rainy River AISC, if New Gold hits the 2018 guidance, the share price should climb to the $4.3 level.

On Tuesday, New Gold (NGD) reported the Q4 2017 and FY 2017 production volumes as well as the 2018 guidance. The most attention was paid to information related to the Rainy River mine, New Gold's newest and most important asset that got into production only several months ago. And it was the Rainy River-related news that disappointed the investors and pushed New Gold's share price lower.

After closing at $3.44 the day before the news release, the stock price quickly tanked back to the $3.1 level. It is quite possible that the decline will continue in the near future, especially if the gold price keeps on declining as well. On the other hand, despite the negative news, New Gold is still undervalued and the share price should start to recover sooner or later.

The first slightly negative news was related to Rainy River's Q4 production. Although New Gold's total 2017 gold production has beaten the guidance by 864 toz gold, this positive news was a little overshadowed by the fact that only 45,654 toz gold was produced by the Rainy River mine in Q4, which is less than the expected volume of 50-60,000 toz. According to New Gold, the guidance was missed because the nameplate throughput was reached later than originally expected.

Although the missed guidance is unpleasant, the most disappointing part of the news release is related to the estimated AISC. It seems like the AISC will be much higher than projected by the feasibility study. According to New Gold:

Based on current input cost estimates, silver prices and foreign exchange rates, all-in sustaining costs over Rainy River's first nine years of operation (including 2018) are expected to average approximately $875 per ounce. Costs are expected to be higher than this average in the next three years as a result of sustaining capital expenditures associated with completion of the full tailings dam footprint in 2018 as well as the construction of the first tailings lift later in 2018 into 2019.

This is a big problem that weighs on the value of the whole project. It was originally estimated, that the AISC should equal $710/toz over the first 9 years of production. Only a couple of months after the production at Rainy River started, the AISC estimate was increased by $165/toz, or by 23.24%, which is really disappointing. Another bad news is that over the next three years, the AISC should be even higher than this. In 2018, it should be $990-1,090, due to the sustaining CAPEX expenditures of almost $200 million, that should be expended especially on the construction of a tailings dam.

However, it is hard to say how accurate the new AISC estimate will be, as according to the recent news release, New Gold doesn't seem to be too confident when talking about the average gold production over the next 9 years:

As the mine is now fully operational, the Company is currently completing an update of the life-of-mine plan for Rainy River. The update will incorporate the insights and refinements in expectation gained from both the successful commissioning and production experience over the first few months of operation. Based on the Company's current estimates, annual gold production for the first nine years of the mine life (including 2018) should average between 275,000 to 375,000 ounces.

The provided interval is pretty wide. At an average annual production of 375,000 toz gold, 3.375 million toz gold should be produced between 2018 and 2026. On the other hand, at an average annual production of 275,000 toz gold, only 2.475 million toz gold should be produced over the same time period. According to the feasibility study, 325,000 toz gold per year should be produced over the first 9 years. It means that the actual number could be +/- 15% from the original estimate.

If the actual average annual production will be closer to the upper boundary of the estimate, it should have a positive impact on the AISC that should be probably lower than the new estimate of $875/toz. On the other hand, if for any reason the average annual production approaches the lower boundary of the estimate, it is reasonable to expect that the average AISC will be higher than $875/toz. The answer to this rebus will be perhaps known after the updated mine plan is released.

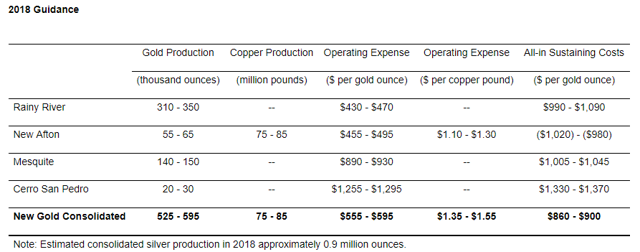

In 2018, Rainy River should produce 310-350,000 toz gold, at an AISC of $990-1,090. Although the high AISC is a negative surprise, Rainy River is still a valuable asset. New Gold's total 2018 production should equal 525-595,000 toz gold and 75-85 million lb copper. The AISC should belong to the interval from $860 to $900/toz gold. Using the middle of the intervals, it is possible to expect production of 560,000 toz gold at an AISC of $880/toz.

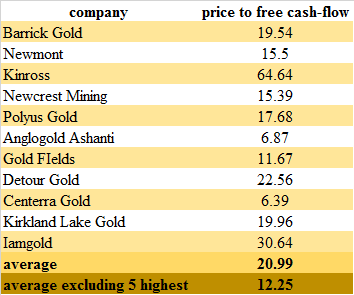

These numbers should lead to a free cash flow of around $250 million, at the current gold price of $1,325/toz. In one of my previous articles about New Gold, I used a price to free cash flow ratio of 10, to come to a share price estimate. I used the ratio of 10, in order to be conservative. As shown in the table below, for the gold mining industry, this value can still be considered to be conservative.

Source: own processing, using data of gurufocus.com

Using the price to free cash flow ratio of 10 and the above-mentioned expected 2018 free cash flow of $250 million, it is possible to come to a market value of $2.5 billion. It equals to $4.32 at the current share count of 578,185,179. This price target is notably lower compared to my previous estimate, that used the original production and AISC estimates for the Rainy River mine. Although the new price target is almost lower by $2 compared to the old one, it shows that New Gold still offers a substantial upside potential at the current share price of $3.1.

Conclusion

Although the Rainy River guidance is disappointing and it seems like the AISC will be notably higher compared to the original projections, New Gold remains undervalued. If the 2018 targets are hit, New Gold should be valued around $4.32, which is almost 40% above today's closing price of $3.1. However, it is important to note that New Gold is preparing an updated mine plan and it announced that over the first 9 years, the average annual production could be from 275,000 toz to 375,000 toz gold.

This interval is pretty wide and the actual production volumes may have a notable impact also on the projected AISC. If the actual average annual production is closer to the upper limit of the provided interval, the $4.32 price target will turn out to be too conservative. As the current share price seems to be reflecting the more negative outcome, it is possible to conclude that the downside is limited and far outweighed by the upside potential.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.