Why the Market for Large Diamonds Is in Freefall

RAPAPORT... As the who's who in the glitzy world of high-valuediamond auctions gathered in Geneva in May, there was an understated tone tothis year's pilgrimage to the Swiss city. While Sotheby's and Christie's playedup their offerings of magnificent jewels, which usually boost market sentimentwith the records they set, dealers approached the sales with some trepidation.The big-stone market, they noted, has seen better days.The major auction houses are setting lower reserve pricesthan before in response to the weakness, explained Johnny Kneller, CEO ofbig-stone manufacturer Safdico.A 12.50-carat, D-color, VVS1-clarity, potentially internallyflawless rectangular diamond sold at Christie's for "just" $68,000 per carat. While the stone had non-idealproportions, the price reflected a serious slowdown in the big-stone sector, stressedThomas Faerber, a jewelry dealer and co-founder of the GemGen??ve trade show. The final price was 27.5% off the Rapaport Price List, according to Faerber's calculations. "Apart from the 77% depth, it was a beautiful stone, andI would have expected it to fetch around list price in a better market," Faerberadded.

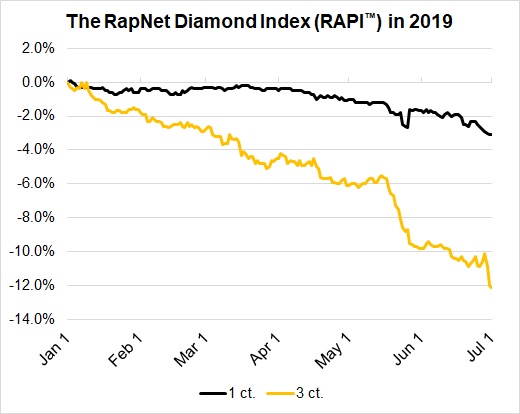

RAPAPORT... As the who's who in the glitzy world of high-valuediamond auctions gathered in Geneva in May, there was an understated tone tothis year's pilgrimage to the Swiss city. While Sotheby's and Christie's playedup their offerings of magnificent jewels, which usually boost market sentimentwith the records they set, dealers approached the sales with some trepidation.The big-stone market, they noted, has seen better days.The major auction houses are setting lower reserve pricesthan before in response to the weakness, explained Johnny Kneller, CEO ofbig-stone manufacturer Safdico.A 12.50-carat, D-color, VVS1-clarity, potentially internallyflawless rectangular diamond sold at Christie's for "just" $68,000 per carat. While the stone had non-idealproportions, the price reflected a serious slowdown in the big-stone sector, stressedThomas Faerber, a jewelry dealer and co-founder of the GemGen??ve trade show. The final price was 27.5% off the Rapaport Price List, according to Faerber's calculations. "Apart from the 77% depth, it was a beautiful stone, andI would have expected it to fetch around list price in a better market," Faerberadded.  The sale was not an exception. Prices of large stoneshave been plummeting for six months as an array of challenges have dentedsentiment, with each discounted sale setting off alarm bells in the trade,knocking confidence further. The RapNet Diamond Index (RAPI?,,?) for 3-carat stonesdropped 12% in the first half of 2019, compared with a 3.1% decline for the1-carat category. "It's a vicious circle," a rough broker said on conditionof anonymity. "Some people are expecting prices to come down further, so aredelaying their purchases. The one leads to the other." Dealers identified four main factors contributing to thedownward spiral. 1. Tight liquidityIn the past six months, larger Indian companies have beenoffloading polished diamonds above 3 carats to raise capital, the anonymousbroker observed. That has weakened sentiment in the market, and createdexpectations that prices will fall further. Retailers don't want to makepurchases when they expect prices to continue their descent, he observed. "They had to raise cash rather quickly, and to raise thatcash in pointer [sizes] doesn't make any sense, as it takes you way too long," thebroker explained. "There have been quite a few players offering these [large] goodsat serious discounts on the market, and as a consequence, people have lostconfidence in that product." A few low-price transactions can have a wide, negativeimpact on trading, explained Safdico's Kneller, who echoed the rough broker'sexplanation of the slowdown. The large-stone market is relatively small, soknowledge of a new price benchmark spreads fast. "The prices were pushed up by speculators with easycredit, and have now dropped as the speculators face liquidity problems,"Kneller said. 2. Stricter complianceWhile improved transparency is helping clean up thetrade, it has contributed to the high-end slowdown, dealers acknowledged. Individualswho previously stored illicitly obtained wealth in diamonds are no longer ableto do so with such ease, a director of an Antwerp-based diamond company noted. Governmentsare cracking down on the black market, and banks are asking for moredocumentation to prove the legitimate origin of goods and funds.In particular, it's become more difficult to trade withHong Kong, as the municipality has stepped up its compliance rules in an effortto improve its global reputation, traders reported. Companies with longstandingbanking relationships find their lenders are questioning income and asking forproof of transactions."The strictregulation of money is not having a positive effect on [the industry]," saidEphraim Zion, founder of Hong Kong-based high-end jeweler Dehres. "It's [anissue] all over the world, but it's more pronounced here in Hong Kong." There'sa direct connection between the compliance challenges and the price of largediamonds, he insisted.Meanwhile, US sanctions against certain individuals whopreviously bought diamonds have taken some important clients out of the market,another diamantaire said. 3. Reduced rarityOne ironic influence is mining companies' success recoveringrough. Improvements in technology have helped producers keep large stonesintact when extracting them, affecting the rarity of those valuable diamonds,traders told Rapaport News. That's the case both for 10-carat-plus rough,and for the extraordinary pieces above 100 carats. "When you've got dozens - and I mean dozens - of diamondsthat are coming out of the mines right now,...they're not so rare anymore," saidAlan Bronstein, owner of New York-based Aurora Gems and president of theNatural Color Diamond Association.

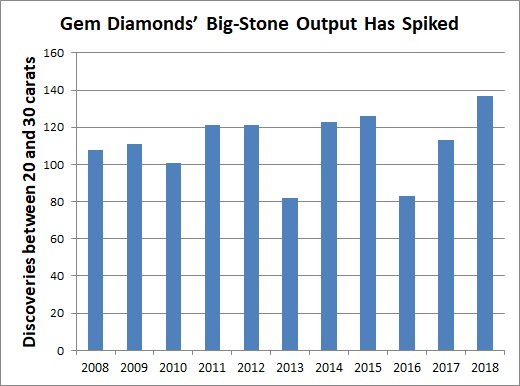

The sale was not an exception. Prices of large stoneshave been plummeting for six months as an array of challenges have dentedsentiment, with each discounted sale setting off alarm bells in the trade,knocking confidence further. The RapNet Diamond Index (RAPI?,,?) for 3-carat stonesdropped 12% in the first half of 2019, compared with a 3.1% decline for the1-carat category. "It's a vicious circle," a rough broker said on conditionof anonymity. "Some people are expecting prices to come down further, so aredelaying their purchases. The one leads to the other." Dealers identified four main factors contributing to thedownward spiral. 1. Tight liquidityIn the past six months, larger Indian companies have beenoffloading polished diamonds above 3 carats to raise capital, the anonymousbroker observed. That has weakened sentiment in the market, and createdexpectations that prices will fall further. Retailers don't want to makepurchases when they expect prices to continue their descent, he observed. "They had to raise cash rather quickly, and to raise thatcash in pointer [sizes] doesn't make any sense, as it takes you way too long," thebroker explained. "There have been quite a few players offering these [large] goodsat serious discounts on the market, and as a consequence, people have lostconfidence in that product." A few low-price transactions can have a wide, negativeimpact on trading, explained Safdico's Kneller, who echoed the rough broker'sexplanation of the slowdown. The large-stone market is relatively small, soknowledge of a new price benchmark spreads fast. "The prices were pushed up by speculators with easycredit, and have now dropped as the speculators face liquidity problems,"Kneller said. 2. Stricter complianceWhile improved transparency is helping clean up thetrade, it has contributed to the high-end slowdown, dealers acknowledged. Individualswho previously stored illicitly obtained wealth in diamonds are no longer ableto do so with such ease, a director of an Antwerp-based diamond company noted. Governmentsare cracking down on the black market, and banks are asking for moredocumentation to prove the legitimate origin of goods and funds.In particular, it's become more difficult to trade withHong Kong, as the municipality has stepped up its compliance rules in an effortto improve its global reputation, traders reported. Companies with longstandingbanking relationships find their lenders are questioning income and asking forproof of transactions."The strictregulation of money is not having a positive effect on [the industry]," saidEphraim Zion, founder of Hong Kong-based high-end jeweler Dehres. "It's [anissue] all over the world, but it's more pronounced here in Hong Kong." There'sa direct connection between the compliance challenges and the price of largediamonds, he insisted.Meanwhile, US sanctions against certain individuals whopreviously bought diamonds have taken some important clients out of the market,another diamantaire said. 3. Reduced rarityOne ironic influence is mining companies' success recoveringrough. Improvements in technology have helped producers keep large stonesintact when extracting them, affecting the rarity of those valuable diamonds,traders told Rapaport News. That's the case both for 10-carat-plus rough,and for the extraordinary pieces above 100 carats. "When you've got dozens - and I mean dozens - of diamondsthat are coming out of the mines right now,...they're not so rare anymore," saidAlan Bronstein, owner of New York-based Aurora Gems and president of theNatural Color Diamond Association.  Source: Gem Diamonds company reportsGem Diamonds found 15 stones over 100 carats at itsLet??eng mine in Lesotho last year, beating its previous record of 11 in 2015.It also recovered 137 diamonds between 20 and 30 carats, compared with 113 in2017. Lucara Diamond Corp., another big-stone specialist, has unearthed 12diamonds above 300 carats since commissioning new X-ray-transmission (XRT)technology at its Karowe mine in Botswana in 2015, it reported in April. Lucarasold a total of 153 diamonds above 10.8 carats in 2018, compared with 115 inthe previous year. "We've heard fromcompetent people that there are more large, D-flawless diamonds on the market,"said Faerber, who noted slower sales by some GemGen??veexhibitors due to the situation. "The way toextract these stones has become more sophisticated." One anonymous dealer said he personally knew of seven oreight 20-carat, D-flawless polished diamonds. In the past, the number of suchstones available would have been significantly smaller. That has made wealthyindividuals perceive the product as a less exclusive option than before. "Prices of diamonds have been falling so steadily overthe last few years that people don't view it as an asset class anymore," hesaid. 4. Economic uncertaintyThe tariff dispute between the US and China hasaggravated the decline in the past six to 12 months, according to the sameanonymous diamantaire. "One of the main reasons [for the big-stone slump] isthat people want to conserve their wealth," he said. "The trade wars aren'thelping."High-end consumer demand in the US - on which thelarge-stone market partly relies - has also been shaky. The public is now moreaware of price "bubbles" after seeing what happened during the 2008 financialcrisis, according to Elisabeth Austin, founder of Diamond Runway, which helpsconnect jewelry and gem sellers with collectors. At the same time, the wealthyare no longer comfortable being seen wearing super-expensive items, sheobserved. "The only people in the US who are displaying things ofhigh value are seemingly the rapper and reality-TV community, which thehigh-end people do not want to emulate," Austin said. "So we're still strugglingto successfully represent high end to the high-net-worth individuals in theUS." The uncertainty has forced diamond suppliers to carry more large-stoneinventory than they would normally want, she added. Big stones, little optimismThe trade can expect key buyers to sit out for the timebeing as they see little hope for improvement in the short term. For instance,consortiums that previously bought supersized rough through profit-sharingarrangements are likely to restrict their spending, predicted Bronstein atAurora Gems. "The syndicates are overextended, because they're sittingon hundreds of millions or billions of dollars of rare gems that have nowhereto go," he said. "They're also going to be quiet unless they can get a bargain."With so many things affecting the market, a lot will haveto change if confidence is to return. Last week's agreement by the US and Chinato resume trade talks could boost overall sentiment, but the other factors willremain. And dealers will need to find a way around those challenges.Better marketing is one partial solution, as consumerdemand is currently out of kilter with the huge quantities of large diamondscoming out of mines, Dehres's Zion argued."As long as there is an imbalance between supply anddemand, things will not improve dramatically," he concluded. Image: An exhibitor displays jewelry at the 2019 GemGen??ve show. (David Fraga/GemGen??ve)

Source: Gem Diamonds company reportsGem Diamonds found 15 stones over 100 carats at itsLet??eng mine in Lesotho last year, beating its previous record of 11 in 2015.It also recovered 137 diamonds between 20 and 30 carats, compared with 113 in2017. Lucara Diamond Corp., another big-stone specialist, has unearthed 12diamonds above 300 carats since commissioning new X-ray-transmission (XRT)technology at its Karowe mine in Botswana in 2015, it reported in April. Lucarasold a total of 153 diamonds above 10.8 carats in 2018, compared with 115 inthe previous year. "We've heard fromcompetent people that there are more large, D-flawless diamonds on the market,"said Faerber, who noted slower sales by some GemGen??veexhibitors due to the situation. "The way toextract these stones has become more sophisticated." One anonymous dealer said he personally knew of seven oreight 20-carat, D-flawless polished diamonds. In the past, the number of suchstones available would have been significantly smaller. That has made wealthyindividuals perceive the product as a less exclusive option than before. "Prices of diamonds have been falling so steadily overthe last few years that people don't view it as an asset class anymore," hesaid. 4. Economic uncertaintyThe tariff dispute between the US and China hasaggravated the decline in the past six to 12 months, according to the sameanonymous diamantaire. "One of the main reasons [for the big-stone slump] isthat people want to conserve their wealth," he said. "The trade wars aren'thelping."High-end consumer demand in the US - on which thelarge-stone market partly relies - has also been shaky. The public is now moreaware of price "bubbles" after seeing what happened during the 2008 financialcrisis, according to Elisabeth Austin, founder of Diamond Runway, which helpsconnect jewelry and gem sellers with collectors. At the same time, the wealthyare no longer comfortable being seen wearing super-expensive items, sheobserved. "The only people in the US who are displaying things ofhigh value are seemingly the rapper and reality-TV community, which thehigh-end people do not want to emulate," Austin said. "So we're still strugglingto successfully represent high end to the high-net-worth individuals in theUS." The uncertainty has forced diamond suppliers to carry more large-stoneinventory than they would normally want, she added. Big stones, little optimismThe trade can expect key buyers to sit out for the timebeing as they see little hope for improvement in the short term. For instance,consortiums that previously bought supersized rough through profit-sharingarrangements are likely to restrict their spending, predicted Bronstein atAurora Gems. "The syndicates are overextended, because they're sittingon hundreds of millions or billions of dollars of rare gems that have nowhereto go," he said. "They're also going to be quiet unless they can get a bargain."With so many things affecting the market, a lot will haveto change if confidence is to return. Last week's agreement by the US and Chinato resume trade talks could boost overall sentiment, but the other factors willremain. And dealers will need to find a way around those challenges.Better marketing is one partial solution, as consumerdemand is currently out of kilter with the huge quantities of large diamondscoming out of mines, Dehres's Zion argued."As long as there is an imbalance between supply anddemand, things will not improve dramatically," he concluded. Image: An exhibitor displays jewelry at the 2019 GemGen??ve show. (David Fraga/GemGen??ve)