Will Gold's Safety Bid Remain Intact?

Only three of gold's Five Factors support its near-term trend.

Silver price also hasn't confirmed latest gold rally.

Gold's important safety bid is still apparent, however.

Gold remains stuck in a 4-week lateral trading range as it seeks to consolidate the gains it achieved in the run-up to late January. As we'll discuss in this commentary, gold's immediate-term technical underpinning isn't as strong as it was last month, yet it does still enjoy a measure of safety-related support in the wake of the heightened volatility in the equity market. This safety bid is coming under attack, however, and we'll look at whether gold has enough strength to maintain its intermediate-term upward trend.

Gold prices were lower on Tuesday as the U.S. dollar index strengthened and despite a 1 percent decline in the Dow Jones Industrial Average. The yellow metal rose 2.4 percent last week in its best weekly performance in more than five months. Investor uncertainty concerning rising inflation in the U.S. and the near-term outlook for global equities, as well as uncertainties over this week's huge U.S. Treasury bond auctions, contributed to gold's strong performance. However, the immediate-term resolve of the gold bulls is now being tested.

Despite the psychological support of lingering fears over the global equity market outlook, there are other concerns for gold's short-term trend. It should be noted that gold's latest rally is technically unsupported by most of the Five Factors which should ideally confirm a bullish gold price. The factors which tend to support an extended gold rally are:

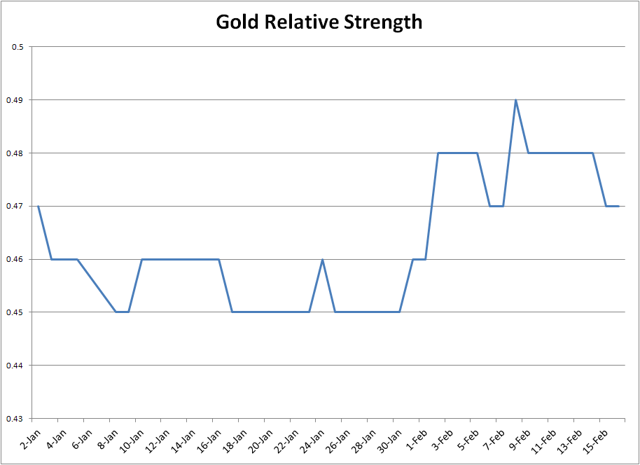

Gold being above its rising 15-day moving average. Silver confirming gold by doing the same. Gold showing relative strength vs. the S&P 500 Index. A strengthening crude oil price. A weak U.S. dollar index.Currently only three of those factors are confirming gold's upward trend: Factors #1, #3, and #5. Consider for example the silver price, which hasn't yet confirmed last week's gold rally. While the gold price recovered decisively back above its 15-day moving average and came very close to its January high, the silver price never managed to close two days higher above its 15-day MA. The May silver futures graph shown below illustrates this failure to confirm gold's recent rally.

Source: www.BigCharts.com

Normally this would be a less-than-ideal occurrence since it would mean gold is somewhat vulnerable with two of its key supports missing. It's a definite concern for the immediate-term outlook when silver isn't confirming, though it need not be a deal-killer for gold if the "fear factor" in the financial market is high enough. As it now stands, with broad market volatility and investor uncertainty over the equity market outlook still high, gold still enjoys an unusual degree of safe-haven interest. This safety-related support could prove strong enough to keep gold's latest immediate-term buy signal intact. Money management is paramount to successful trading and investing, however, which means we can't automatically assume that investors' concerns over the financial market outlook will see gold safely through the latest turmoil. It's for that reason that I always recommend using protective stops on all trading positions as discussed below.

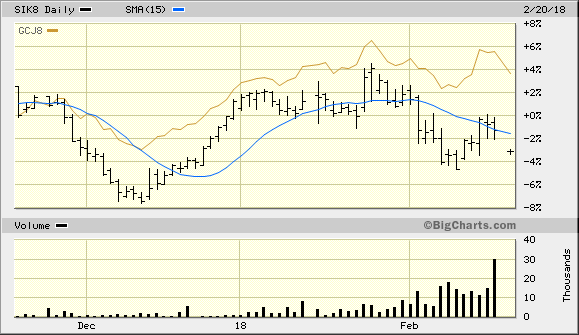

After closing two days above its 15-day moving average last week to confirm another immediate-term (1-4 week) buy signal, the iShares Gold Trust (IAU) - my favorite trading vehicle for gold - came close last week to hitting its Jan. 24 peak at the $13.05 level. Closing above this key level would turbo-charge IAU's immediate trend as it would serve as fuel for a short-covering rally. IAU came under some selling pressure on Tuesday, Feb. 20, however, as the dollar index rallied. IAU is very close to a price level which I consider to be critical for maintaining its short-term upward trend, namely the $12.62 level. This is the Feb. 7 closing low and serves as the nearest pivotal support for IAU based on technical factors. If IAU violates this level on an intraday basis I would consider the gold ETF's short-term uptrend to have been violated and I would return to a cash position as it would trigger my stop loss.

Source: www.BigCharts.com

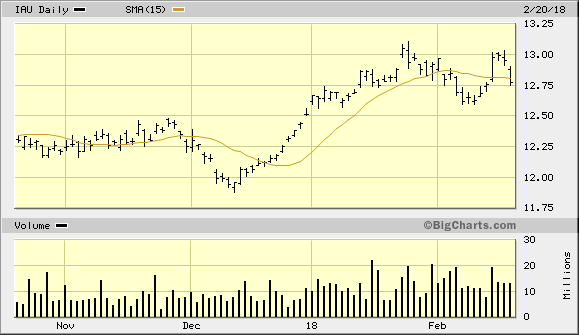

Meanwhile gold's relative price strength measured against the U.S. equity market has been constructive in recent weeks but is still in need of additional improvement. Gold's relative strength ratio (RS) versus the S&P 500 Index (SPX) should be above the 0.48 level, although it's currently at 0.47 (see chart below). An improvement in gold's RS in the coming days would also greatly augment the near-term upside potential for the metal's price.

Chart created by Clif Droke

On a strategic note, I currently have a long position in the iShares Gold Trust (IAU) as of Feb. 14. I recommend using the $12.62 level (the Feb. 7 closing low) as the initial stop loss for this position on an intraday basis. Longer-term investment positions in gold can also be retained as the fundamentals underscoring gold's 2-year recovery effort are still favorable.

Disclosure: I am/we are long IAU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.