Will Gold And The Dollar Rally Together?

In light of stock market panic, would a dollar rally hinder gold?

History shows that both gold and dollar can rally together.

Gold's relative strength (vs. equities) is the key variable, however.

For the first time in several months, gold is showing an increase in its relative strength versus the equity market. For reasons that have become abundantly clear, the metal's attraction as a financial safe haven has risen during the stock market's recent plunge. Here we'll look at how much gold's near-term prospects have improved and how this in turn has given further impetus to its longer-term recovery.

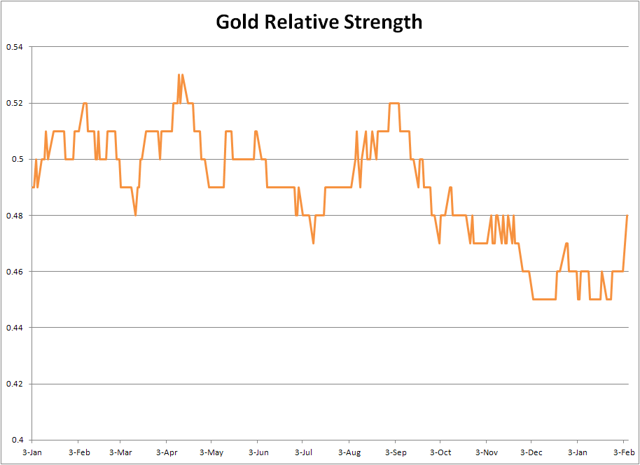

Gold's latest strong performance on Monday was a breath of fresh air for precious metals investors, many of whom had worried about the rising dollar of late. I, too, have shared this concern although my recommended trading position in the iShares Gold Trust ETF (IAU) has remained intact throughout gold's latest volatility period. Yet Monday's rally in the gold price, while not particularly impressive in percentage terms (+0.31% in the April contract), did manage to spike gold's relative strength indicator versus the S&P 500 Index. The latest relative strength reading is shown in the following graph.

Chart created by Clif Droke

Gold's relative strength against the stock market is an important indicator since it is one of the things which institutional money managers look at before deciding whether or not to commit funds to gold. An improvement in gold's relative strength has historically served to attract major money flows into gold, thereby increasing its longer-term forward momentum.

I've longed to see a major improvement in gold's relative strength profile for several months now, and it finally appears to be happening. Ideally, the relative strength indicator should rise above the 0.48 level (which was reached on Feb. 5) in order to confirm that gold's relative strength versus equities is truly on the mend. By pushing above the 0.48 level, the established pattern of lower highs and lower lows will be formally broken which in turn will give another major advantage to the buyers in their attempt at consolidating control over the longer-term trend. More importantly, an increase in the gold relative strength reading from here would greatly increase the chances of the gold price continuing to rally alongside the dollar in the near term, even if the latter is increasing in value.

In the previous report we looked at how gold's negative reaction on Friday (down 1.2%) to the latest U.S. employment report was actually a harbinger of better things to come for the intermediate-term (6-9 month) outlook. This was because of the revelation that hourly earnings had increased last month to almost 3% year over year - the highest growth rate since May 2009. Rising wages are one indication that inflation, which has been seriously lacking in recent years, is finally picking up. The return of inflation is welcome news to gold investors who view the yellow metal as a hedge against inflationary pressures.

It was also revealed that bullish sentiment among the big players in the precious metals market has been increasing. Hedge funds and money managers raised their net long position in COMEX gold contracts as of Jan. 30 to their highest level since late September, according to data from the Commodity Futures Trading Commission (CFTC). From a contrarian sentiment standpoint I don't normally like to see traders become more bullish, but right now gold needs all the help it can get in the immediate term.

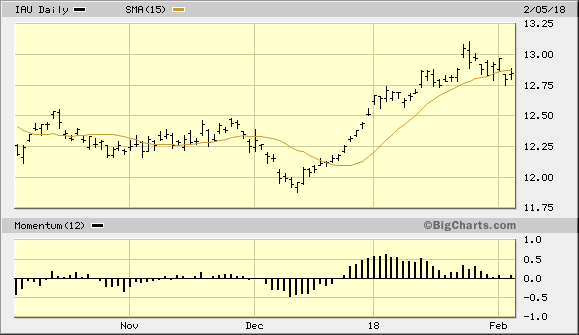

As can be seen in the following graph of the IAU, my favorite gold ETF remains above the $12.75 level - which I have recommended as a stop-loss on open long positions - but it still remains below the important 15-day moving average. To let us know that the recent selling pressure has completely lifted from gold and that the buyers have regained control over the immediate-term (1-4 week) trend, we need to see IAU recover back above its 15-day MA on a two-day closing basis. As long as IAU remains under the 15-day MA, additional caution is still advised despite the relative strength shown by gold on Monday.

Source: www.BigCharts.com

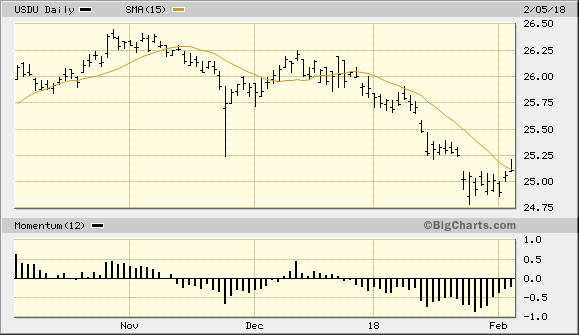

Meanwhile the dollar index is still showing signs of trying to reverse its recent decline. This isn't unusual given that the latest selling panic in the stock market has increased the demand for cash. Consequently, the WisdomTree Bloomberg US Dollar Bullish Fund (USDU) is very close to confirming an immediate-term bottom per the rules of my technical trading discipline. For this to happen, a 2-day higher close above the 15-day moving average is needed. As can be seen in the following graph, USDU closed just below the 15-day MA on Monday after pushing above the trend line on an intraday basis.

Source: www.BigCharts.com

Many investors are asking whether it's possible for gold and the dollar to rally simultaneously. In times of great uncertainty in the financial market it's certainly possible for both to move in concert, at least temporarily. However, a sustained dollar rally would sooner or later put downward pressure on the gold price. It's important then that we keep a close watch on USDU (my favorite dollar proxy and tracking fund) from here. As mentioned previously, if USDU breaks out above the 15-day moving average gold bulls will definitely have their work cut out for them since the pressure will be against them.

For disclosure purposes, I'm still long the iShares Gold Trust (IAU) as long as the $12.75 level holds on a closing basis. I consider $12.75 to be the proverbial "line in the sand" for the IAU trading positions which was recommended in December. A close under this level in IAU would violate my stop-loss and thus confirm an exit signal on the remainder of our trading position in this ETF. (I recommended on Jan. 5 taking some profit after IAU's 5% rally from the December entry point). For now I recommend remaining long IAU since the immediate-term uptrend is still intact, but stay close to the market.

Disclosure: I am/we are long IAU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.