Will The Digital Currency Market Cause Central Banks To Buy More Gold?

Bitcoin and its cousins threaten money, banking, and government control.

The attack on fiat currencies.

A decade of liquidity and accommodation gave birth to a baby crypto that is growing into a force.

Central banks are the world's largest gold holders.

Comfort for naked currencies as a weapon.

I have been thinking a lot about the digital currency revolution over recent months as I continue to kick myself for not realizing that what I thought was nothing more than a video game is a disruptive revolutionary technology.

Last week, even Jamie Dimon, the CEO of JP Morgan Chase, admitted he was wrong when he called the digital currencies a "fraud" a few short months ago. However, Warren Buffett chimed in to add his name to the list of detractors. Buffett said that if there were a five-year put option on all the digital instruments available he would buy that option. However, he did not disclose a bid price for that option and Buffett has gotten many trends wrong over the course of his mega-successful career. Buffett has never been a fan of technology, and Silicon Valley and his most notable connection to innovation has been his close personal relationship with Bill Gates.

Aside from the massive and fast inflow of capital into digital currencies that had taken the market capitalization of over 1450 cryptos from around $300 billion in October to almost $800 billion, there is a rising acceptance that the disruptive technology will change money and banking forever. In a sign of the extreme volatility in the sector the cap dropped to $574.3 billion on Friday, January 19. Just like the ATM and online banking, these currency instruments and the blockchain that underlies them are bringing dramatic change to finance. However, the difference is that the current innovation comes from outside of the world of public and private finance which upsets the status quo.

I believe that the next significant shoe to drop in the world of digital currencies will come from a government, and not Venezuela, that brings a token and change or refinement to market. Meanwhile, I have been scratching my bald head trying to understand what the role of the oldest and most widely held central bank asset will be in this new world. After all, gold has been around for longer than any currency that central banks hold as foreign exchange assets today, and they all still hold the yellow metal as well.

Bitcoin and its cousins threaten money, banking, and government control

While I am sold on both the concept and utility of blockchain technology and the future of digital currencies, in some form, I expect a continuation of wild volatility in the sector in 2018. We have witnessed a high degree of price variance in the digital currency asset class when it comes to total market cap.

The biggest risk that I see for the burgeoning asset class is that it poses a threat to both the private and public sectors. When it comes to the private sector, credit card fees and high rates of interest could be challenged by the digital currencies in the future which is why we have seen lots of pushback from banks like JP Morgan and others. However, disruptive technologies often threaten fees and profits for status quo businesses and are likely to cause an adjustment to pricing. Think of how much a scientific calculator cost in the 1980s. Today, that technology is free on the internet and comes gratis with a smartphone. Meanwhile, it is the public sector of central banks, monetary authorities, and regulators who are most likely to impose their collective will on the digital currencies. After all, controlling the money supply and short-term interest rates through monetary policy is a core tool of central bankers. The rise of digital currencies threatens their ability to conduct operations and influence market. The ultimate conflict comes down to control and powerful nations around the world are not likely to surrender their dominant role in the world of money and banking. Last week, U.S. Treasury Secretary Steve Mnuchin said that he will work with the Group of 20 to make sure that the cryptos do not become "Swiss numbered bank accounts."

The attack on fiat currencies

Bitcoin and its digital cousins are merely a symptom of the declining faith in fiat currencies like the dollar, euro, yen, and other foreign exchange instruments. The global financial crisis of 2008 was a watershed event in that the response was to flood markets with liquidity. Central banks, led by the U.S. Fed slashed interest rates to historical lows to encourage borrowing and spending and inhibit savings to stimulate economic conditions. While central banks only have a direct influence on the short-term rates, policies of quantitative easing to buy government debt securities in the U.S. and even corporate issues in Europe, caused rates to decline precipitously further out on the yield curve. Economies around the world have improved and economic growth has returned, but it is too soon for the central banks to take a victory lap because the long-term effects of digging deep into the monetary policy toolbox have not yet played out. There is a price for creating unprecedented amounts of liquidity, and that could turn out to be inflationary pressures that eat away at the value of fiat currencies. These instruments rely on the full faith and credit of the governments that print money and the digital currency revolution was born after the 2008 crisis. Therefore, cryptocurrencies have been a symptom rather than a cause of the decline in value of fiat money.

A decade of liquidity and accommodation gave birth to a baby crypto that is growing into a force

2018 marks the ten-year mark since the meltdown of the U.S. housing market and European debt crisis. Bitcoin was born in 2010, and the other digital currencies followed. While the sector remains small compared to the size of currency markets, the growth trend has been exponential which is what has attracted many to speculate on the value of the individual tokens. Today, at over 1450, there are many more tokens out there trading in the market than currencies in the world.

Central banks have yet to hold digital instruments as part of their foreign currency reserves, but a report by the International Monetary Fund at the end of 2017 indicated that could be changing in the coming months and years. The supranational financial institution projected that governments would soon introduce digital instruments and embraced the concept of blockchain technology. I view the IMF's report as significant in that they hold the position as the world's central banker to monetary authorities around the globe. Governments around the world hold currency instruments as part of their foreign exchange reserves. They also hold gold. The IMF is the world's third largest official sector gold holder with 2,814 metric tons of the yellow metal in their coffers. While the dollar is the reserve currency of the world, gold remains a significant asset which central bankers rarely highlight. In fact; the IMF spoke more about digital currencies than gold in 2017 even though they hold substantial reserves.

Central banks are the world's largest gold holders

The latest estimate of all of the gold ever mined in the history of the world is around 165,000 metric tons or about 5.82 billion ounces. At $1335 per ounce, that represents a total market cap of roughly $7.77 trillion or over thirteen and one-half times the level of the 1450 digital currencies. Gold has been around longer than every currency instrument in circulation today, and the yellow metal holds a special place in the history of humans. While dollars, euros, yen, Bitcoin, and other means of exchange today are not referenced in the Bible, gold, and silver are. Gold (and silver) are hard money because people throughout history have ascribed value to the metals.

As of the end of December 2017, central banks around the world held a total of 33,604.1 metric tons of gold or over 20% of all of the gold ever extracted from the earth. The U.S. government is the world's leading holder with 8,133.5 tons followed by Germany with 3,363.6 tons of the metal. The top ten holders in the world own 25,270.3 tons or over 75% of all central bank gold. Meanwhile, China is the world's second-largest economy and is closing in on the United States for first place. China holds 1,842.6 tons of the metal, but both China and Russia have been increasing their holding over recent years. China is also the world's leading gold producer as they surpassed South Africa around a decade ago. China has been collecting a large percentage of its annual production of around 455 tons to increase their governmental holdings.

Comfort for naked currencies as a weapon

While the gold standard that gave comfort for currencies around the world disappeared years ago, the fact that governments continue to hold the yellow metal offers some degree of validation to their foreign exchange instruments. The United States, Germany, Italy, France, and the Netherlands, all members of the top ten have more than 64.9% of their foreign exchange holdings in gold bullion. China has 2.3% of their reserves in the precious metal while Russian holdings only account for 17.3% of their foreign exchange reserves as the of the end of 2017. It is possible that both countries view their holdings as a state secret, but even if they have more gold in their coffers, they still have a lot less than the U.S. and European nations.

Given the ascent of digital currencies, the exchange rate of Bitcoin and many others against all major currency instruments display a trend of declining values for status quo fiat money. The trend has also occurred when it comes to the gold market since the turn of the century.  Source: CQG

Source: CQG

As the quarterly chart of COMEX gold futures highlights, gold closed the end of the last century at $289.60 per ounce. On Friday, January 19 the yellow metal was trading around $1335.00, 4.61 times higher than it was just over eighteen years ago. The increase in the value of gold is another sign and perhaps a symptom of the decline in faith and credit of the governments that issue fiat currency instruments.

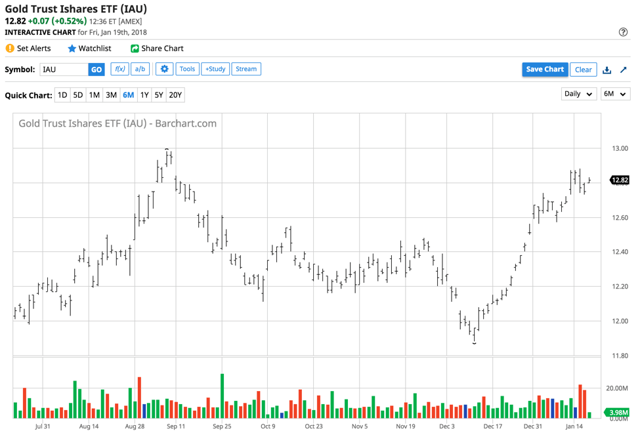

The top ten governmental gold holders own around 812.5 million ounces worth over one trillion dollars at $1335 per ounce. I have been thinking about what it could mean if the market cap of the digital currency asset class were to rise above this level. Additionally, the world of cryptos transcends borders, as does the international gold market in many ways. I have been writing for the past two years that while it is probable that Bitcoin and its cousins have taken away some of the speculative interest from precious metals, the appreciation could be highly bullish for the price of gold. After all, gold has a lot in common when it comes to a comparison with the world of cryptos. The big difference is that while cryptos exist in the world of cyberspace, gold is a hard asset that has survived thousands of years and will continue to be around as a means of exchange and symbol of wealth long after all of us are gone. I am bullish on gold, and the ascent of the cryptocurrencies has only strengthened my conviction. I believe that the yellow metal will continue to make higher lows and higher highs. One of the problems with precious metals over recent months is that silver has been unable to break to the upside above the $17.50 per ounce level. It is beginning to look like cryptos have drained speculative demand for silver more than gold which has caused volatility in gold's little brother to decline. It is possible that digital currencies have contributed to a decoupling of the price relationship between gold and silver because central banks continue to hold gold while silver's path of least resistance is a function of speculative interest. I am a buyer of gold, and these days my favorite ETF instrument is the iShares Gold Trust (IAU). IAU is one-tenth the size of GLD, but it has net assets of $10.15 billion and trades an average of around 9.5 million shares each day. GLD's net assets stood at $34.9 billion on January 16. The IAU ETF is one-tenth the size, but GLD, with net assets of $34.9 billion, is only 3.44 times bigger when it comes to net assets.

As the long-term chart illustrates, like gold, IAU has been making higher since December 2015 and was trading at the $12.81 per share level on January 19. Technical resistance is at the July 2016 high at $13.25, and the current trend appears to be on course for a challenge of that level at some point in 2018.

I believe that central banks are watching the incredible volatility in the digital currency asset class with keen interest. I wonder whether their vast gold holdings could eventually serve as a weapon against losing control of money supply and other status quo functions of the monetary authorities. Moreover, central banks have been net buyers of the yellow metal over the past decade which is a sign that they are also realistic when it comes to the value of the fiat currencies they issue. However, the latest round of crypto-carnage last week could slow down the pressure on governments to bring the hammer down on the currencies that have brought the most innovative financial technology of our lifetime.

To profit from commodities, you have to stay ahead of the trade. As a veteran commodities market watcher, I'm uniquely qualified to help you do that. My Marketplace service, the Hecht Commodity Report, offers a comprehensive weekly outlook on over 30 individual commodities markets, including U.S. futures. One of the most detailed commodities reports available, The Hecht Commodity Report provides weekly up, down or neutral calls on each market and highlights technical and fundamental trends. I also make timely recommendations for risk positions in ETF and ETN markets and commodity equities and related options. The Hecht Commodity Report is a must-read if you want to profit in commodities, so subscribe today. And, there is an active chat section in the service where I reply quickly to answer all questions.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.