A Big Week For Gold Ahead

The European Central Bank meeting next week will shed more light on their expectations for the current quantitative easing program.

The UK election could create additional volatility and if there is an upset, the pound could depreciate heavily.

The May jobs report showed a wide miss versus expectations, however a rate hike is still on for the June FOMC.

Investors should continue to retain their hedge in gold with GLD.

There are many key events next week and gold investors are going to be on the edge of their seats trying to capitalize on every available opportunity. There is a major ECB meeting where Mario Draghi will likely provide the 2018 outlook for the current quantitative easing program, where the ECB is now purchasing 60 billion EUR worth of bonds each month. On the same day, there's the UK election, where current Prime Minister Theresa May will square off against Labour Party candidate Jeremy Corbyn, which comes just under a year after Brexit. Finally, gold traders have to balance a weak jobs report for the month of May and a weakening dollar ahead of the June FOMC in a few weeks. These two European events and the weak U.S. jobs report lend continued support to investors being long the SPDR Gold ETF (NYSEARCA:GLD).

Source: The Telegraph

Europe Will Move The Needle

Next week, there are two key events in Europe that could move the needle on gold and potentially create a wave of volatility in the global markets. First, the European Central Bank will have a meeting where this upcoming Thursday, they will determine whether or not to will raise rates. The consensus is that the ECB will leave rates unchanged at 0%, but that's hardly what's on the minds of traders. Rather, recall the bond buying program that has been in place the last couple of years. Until the announcement at the December 2016 meeting and subsequent implementation this past April, the ECB was purchasing 80 billion EUR worth of bonds per month. That was reduced to 60 billion EUR per month and will continue to be in this amount until December 2017.

What Mario Draghi and the ECB are trying to do is keep stimulus on the table, while creating quality jobs and boosting inflation to near 2% for the EU that won't subside immediately after quantitative easing is complete and expansionary policies become center stage. Thus, this meeting becomes heavily important not only for Draghi's outlook on the current bond buying program, but the market may get insights into the timeline to the next reduction in buying and the potential timeline for the end of QE. Draghi has been moderately dovish in recent speaking appearances, so I think the risk, here, is to the downside of gold.

Another critical event will be the UK Election, where current Prime Minister Theresa May will face off against Labour Party candidate Jeremy Corbyn. This is also taking place on Thursday, June 8, which really means there's potential for volatility to grow. This is a noteworthy occasion because it's been just over eleven months since Brexit occurred and the current polling data may as well not be present at all given the large upset that occurred last year. Still, taking a look at the polling data, May has a 6.3 point lead over Corbyn, which is too narrow to definitively call May the early winner. Additionally, this lead has been declining rapidly over the last month. Rather, we'll have to wait until Thursday to see what the outcome is and if Corbyn pulls off a victory, I'd expect gold to surge.

One of the key currencies helping to drive down the dollar these past couple months has been the British Pound. Below you can see the pair GBP/USD, which has appreciated to 1.288 after hitting lows near 1.20 to begin the year. The initial Brexit slide was from 1.45 to 1.325 (at its lowest intraday point), so clearly there's a lot at stake with the upcoming election given that the last one had such a material impact on the nation's currency, let alone their future. Should May win, we'll continue to see the pound gain strength against the dollar, however we'd witness potentially a sharp depreciation if Corbyn pulls off the upset.

Source: StockCharts

Let's Talk Jobs And FOMC

The May jobs report showed the addition of 138,000 jobs, widely missing estimates of 185,000. The unemployment rate did decline, however, from 4.4% to 4.3%. This is the second notably weak jobs report this year and we're clearly seeing that displayed in the dollar index, which has ticked down to its current level at 96.67. This level is well below both its 50 and 200 DMA, but more importantly, it's at the same level that it was the night before the election. That's why you've seen a bit of consolidation in the dollar index over the last week.

Investors are deciding whether or not to take a step back and determine if the United States' political instability is too much of a wild card to continue justifying equity inflows relative to G7 counterparts. The weak dollar has supported gold's rise, but its momentum is so low that it seems like such a fantastic contrarian opportunity for the next couple months to be bullish on the dollar. However, current instability blocks that thesis from becoming viable and being long gold, here, remains the smart choice.

Source: StockCharts

How does this weak jobs number play into the upcoming FOMC meeting? Certainly, Fed Chairwoman Janet Yellen will speak on the matter, but at this point, the market continues to price in a second rate hike and in the interest of not scaring the markets, it's likely that the Federal Reserve will proceed with a second hike. Additionally, the report has to be taken with a grain of salt, given that unemployment is so low and the potential for large jobs numbers every month is inherently lower.

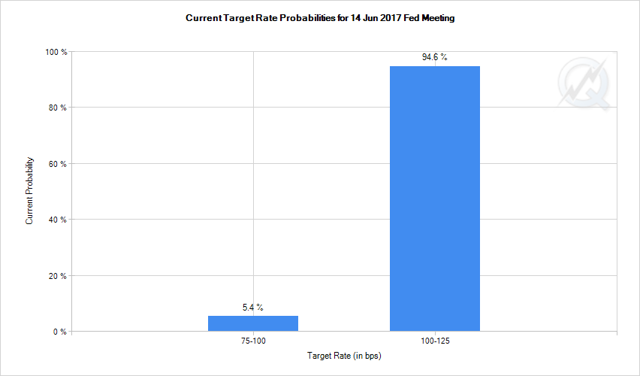

This can actually only be a win for gold, in my opinion, because the market expects the hike to happen and if, on some off chance, it doesn't, investors will flood into safe haven assets like gold and safe haven ETFs like GLD. The current chance of a rate hike is 94.6%, up from 87.7% a week ago, seen below. The risk to gold is already priced in, thus investors will be focusing on Yellen's guidance rather than the hike itself on June 14.

Source: CME Group

Is Gold The Right Bet?

In my opinion, investors need to continue to have a hedge in place. The chart for gold continues to tick up and we're looking at $1,300/oz as the next stop. The 50 DMA has picked up steam and while the trend for the 200 DMA is still down, we could begin to see this slope shift positive over the next couple of months if gold can surpass $1,300/oz and retain ground above that level. The consolidation mid-May around $1,250/oz was leading me to believe that the post-election uptrend could be broken, but gold broke higher on a variety of global macro risks. If $1,300/oz, investors should reevaluate their hedge in GLD, taking a firm look at the global risks present, but the major factors developing this week support being bullish on this precious metal.

Source: StockCharts

For GLD in particular, my preferred investment choice for tracking gold, the same fundamental factors support being long gold for another week. Momentum has ticked up week over week and is actually nearing overbought, even though it's not quite there yet. I see upside being $124 if gold takes out $1,300/oz. Again, a small return, but a hedge nonetheless to help take pressure off of a large allocation to U.S. equities or even global equities. If the ECB says that the bond buying program will end after December 2017, then that's hawkish and we could see GLD take a small hit. On the same day, if Jeremy Corbyn upsets Theresa May, then we can see a large bid higher for GLD and it could allow the ETF to hit $124 faster than expected. I expect the downtrend for the dollar to continue in the short-term, even with momentum so low, so there is passive support for GLD here.

Source: StockCharts

Conclusion

Many factors are on the table this week for gold investors to be keen on and any one of them could move the needle for gold. Taking a more holistic approach and recognizing that with equities at all-time highs and multiple core risks on the table, a continued hedge in a gold-tracking ETF like GLD is more than warranted. The ECB meeting and the UK election will really be the key focus of the week ahead, but investors will also be managing expectations for the dollar ahead of the June FOMC in a few weeks' time.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in GLD over the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.