A Brand-New Silver Company Looks to Consolidate a Silver-Rich Region in Mexico

Sierra Madre Gold and Silver is fast out of the blocks with reconnaissance sampling silver values up to 648 grams per ton, and gold values up to 7.43 grams per ton.

Sierra Madre Gold and Silver (SM:TSX.V) is a five-week-old public company it began trading on the TSX Venture Exchange on April 19 developing the silver-rich Tepic Project located in the mining-friendly state of Nayarit, Mexico.

Fifteen kilometers from a regional airport and 120 km from the Puerto Vallarta Airport, Sierra Madre holds five mining concessions covering a total of 2,612.5 hectares.

Streetwise Reports spoke with the President and CEO of Sierra Madre, Alex Langer, who started his career at Canaccord Genuity where he helped fund over 100 private and publicly listed companies including IPOs for Endeavour Silver, Fortuna Silver and Great Panther.

"During my time at Canaccord, we were focused on junior companies, including a list of silver companies in Mexico," stated Langer. "I got comfortable with Mexico as a mining jurisdiction."

"There's a lot of production in the Nayarit area, but it's on a small scale. Small mines, small processing facilities," added Langer. "Part of our plan is to consolidate the area in and around Nayarit."

Langer envisions production from two or three mines, to reach 50-100 million ounces and build a junior mid-tier silver-gold company.

Previous operators have invested $20 million exploring the Tepic property.

"We inherited 31,000 meters of drilling data," explained Langer. "There is a historical resource of just over 10 million ounces of silver, which is an excellent start for us."

Langer's geological team is lead by Gregory Liller (B.SC), who has been operating in Mexico since 1993, playing a key role in the discovery and development of more than 11 million ounces of gold and 600 million ounces of silver.

Liller was an officer or director of Prime Mining, Genco Resources, Gammon Gold, Mexgold Resources and Oracle Mining.

Langer considers Liller a key asset to Sierra Madre.

"Making one metal discovery could be good luck," commented Langer. "Making six or seven is not."

"I've a list of things I look at when I am acquiring a project," stated Liller. "One of them is the infrastructure. I've done projects in the middle of nowhere. It's a different set of economics to make something work if you have to travel 12 hours on dirt roads just to get to the project."

"The national electric grid is throughout the area. And we have a load out siding on the main Pacific Coast rail line, about 3.5 kilometers from our project. The historical resource totals about 10 million ounces.

"Before we acquired the Tepic project, I looked very closely at the maps, the data and the metallurgy," stated Liller. "I could see that there was room for improvement in the structural model used in the historical resource estimates. I also found that the historical drilling programs had low recoveries and perhaps had underestimated the actual in-situ grades."

"I have a very disciplined, traditional approach to exploration," explained Liller. "This is the way I was mentored. I prefer to be methodical. You map, sample, trench and drill. It's one of the reasons my hit ratios are higher than a lot of folks. If you just start drilling on a hunch, you can waste a lot of shareholders' money."

Numerous times in the conversation with Streetwise Reports, Liller stated vehemently, "I don't like wasting shareholders' money."

Not used to hearing geos fret about exploration budgets, we circled back to the SM Management Link, and realized that Liller is also the chief operations officer (COO) of Sierra Madre, responsible for managing day-to-day operations.

Typically, the integration of financial and geological teams is beneficial to medium- and long-term shareholders.

On May 3, 2021, Sierra Madre provided an update on the field activities at the Tepic Silver Gold project.

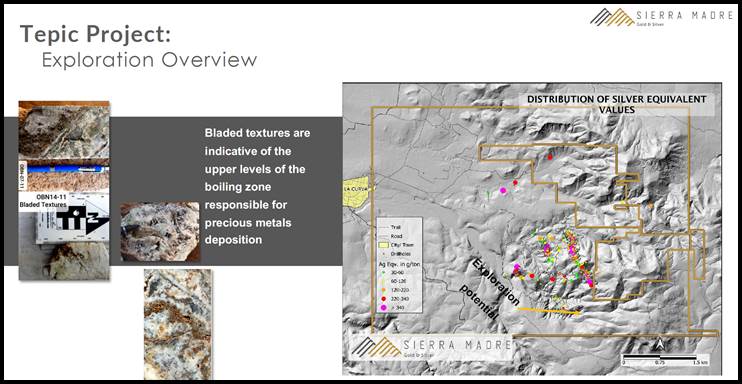

Work for the last six months has focused on geologic mapping and reconnaissance sampling with approximately 50% of the project covered at a 1:5000 scale level of detail or better.

This has resulted in the recognition of more than 10 kilometers of hydrothermally altered and mineralized structures compared to the 3.5 kilometers known at the time the company optioned the project.

The reconnaissance sampling has returned silver values ranging from