A Drill-Ready Copper Opportunity in One of the World's Best Copper Belts

John Newell of John Newell & Associates explains why he thinks Nobel Resources Corp. (NBLC:TSX) is a Speculative Buy.

Nobel Resources Corp. (NBLC:TSX) is a TSX Venture Exchange-listed, Canadian-headquartered exploration company focused on copper exploration in northern Chile. The company has assembled a portfolio of four copper projects totaling approximately 6,050 hectares, all located within well-established metallogenic belts and all showing copper mineralization at surface.

The strategy is straightforward and disciplined. Nobel is targeting projects with historical work, clear geological merit, and reasonable acquisition terms, then advancing the best opportunities toward drilling. Chile remains one of the world's most important copper jurisdictions, offering strong infrastructure, experienced labor, and a long history of mining investment. Nobel's projects benefit from low to moderate elevation, year-round access, and proximity to existing mines and infrastructure.

Among the portfolio, the Cuprita Project Flagship project clearly stands out as the near-term value driver.

The Cuprita Project: The Catalyst Asset

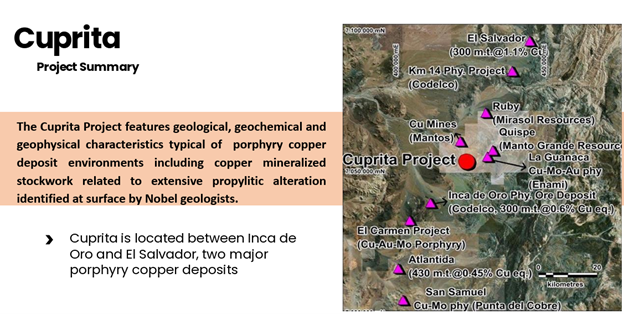

The Cuprita Project is Nobel's flagship property and the asset most likely to move the shares. The project covers approximately 1,000 hectares in the Atacama Region of northern Chile, within the prolific Paleocene Porphyry Copper Belt. This belt hosts several world-class porphyry copper deposits, including El Salvador, Spence, Cerro Colorado, and Sierra Gorda.

Cuprita is strategically positioned between the Inca de Oro and El Salvador copper districts, an address that immediately commands attention from a geological perspective. The project exhibits many of the classic hallmarks of a porphyry copper system. These include widespread surface copper oxide mineralization, hydrothermal breccias, quartz stockwork veining, and alteration assemblages consistent with low-pyrite porphyry systems common in the region.

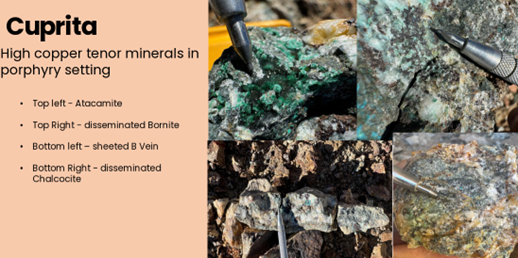

Surface sampling and trenching have confirmed copper mineralization, with rock chip values ranging from approximately 0.25% to over 3% copper. Copper oxide minerals such as atacamite, chrysocolla, and brochantite are present at surface, along with chalcocite and bornite, pointing to a fertile mineralizing system.

Geophysics strengthens the case. Induced polarization surveys have identified chargeability and resistivity anomalies at depth, roughly 200 meters below surface, a depth range typical for porphyry copper targets in northern Chile. These anomalies remain open along strike, suggesting scale potential rather than a closed or isolated system.

Importantly, Cuprita is drill-ready. Drill permits were received in October, allowing the company to move directly into testing priority targets. Nobel holds an option to earn 100% ownership of the project, giving it full exposure to exploration success.

Management with Deep Technical and Capital Markets Experience

Nobel's management team combines capital markets expertise with decades of hands-on exploration experience in South America.

Lawrence Guy serves as Interim CEO and Chairman. He brings a strong background in portfolio management and capital markets, having held senior roles at several investment firms. His experience is particularly relevant for a junior explorer at this stage, where financing strategy, market positioning, and disciplined capital allocation matter.

Vernon Arseneau, Chief Operating Officer and Director, provides the technical backbone of the company. He has more than forty years of exploration and project development experience, including extensive work throughout Chile, Peru, and Argentina. His background includes senior roles with Noranda and involvement in major porphyry copper systems, giving Nobel the technical credibility needed to advance Cuprita efficiently.

Greg Duras, Chief Financial Officer, has over twenty years of experience in financial management within the resource sector and has served as CFO for several publicly traded mining companies. Damian Lopez, Corporate Secretary, is a corporate securities lawyer with extensive experience advising TSX and TSX Venture listed companies.

Share Capitalization

Nobel has approximately 157.4 million basic shares outstanding. Including options and warrants, the fully diluted share count is approximately 206.7 million. Management and insiders own roughly 10.85% of the company, with the remainder held by retail and high-net-worth investors. The structure is typical for a TSX Venture copper explorer with multiple assets and active exploration plans, and it provides leverage to exploration success without being excessively tight.

Technical Analysis

From a technical standpoint, the stock appears to be emerging from a prolonged basing phase. After a multi-year correction, the chart shows a series of higher lows developing through late 2024 and into 2025, suggesting that selling pressure has largely been absorbed.

The shares have been consolidating in the roughly CA$0.03 to CA$0.05 range, with improving volume on up-weeks. This type of compression often precedes a directional move, particularly when paired with a clear fundamental catalyst such as drilling.

A sustained move above the CA$0.05 level would be constructive and could open the door to a test of higher resistance zones near CA$0.07 and CA$0.08. Meaningful drill results from Cuprita would likely act as the trigger for a re-rating, given how little speculative premium is currently reflected in the chart. We have penciled in an initial working technical target of CA$0.15.

Conclusion: A Speculative Buy with Discovery Ambition

Nobel Resources Corp. is positioning itself to become a copper discovery company at a time when new discoveries in tier-one jurisdictions are increasingly rare. The company's vision is clear. Identify underexplored ground with district-scale potential and apply modern exploration tools to unlock value that earlier programs may have missed. Cuprita is the embodiment of that approach.

The project sits in the heart of Chile's most prolific copper belt, between two major deposits, El Salvador and Inca de Oro. That location alone matters. Add to that widespread surface copper mineralization, encouraging trench results, and geophysical signatures consistent with a large, low-pyrite porphyry system at depth, and Cuprita begins to look like the kind of asset that can change a company's trajectory if drilling is successful.

What strengthens the story further is the team. Nobel is led by a group with decades of experience in copper exploration, project development, and capital markets, including deep operational experience in South America. This is not a first-time technical group learning on the job. It is a team that understands how porphyry systems are built, tested, and advanced.

With drill permits in hand, 100% option rights on Cuprita, and a phased exploration strategy, the company has a clear path forward. The current valuation reflects modest expectations, which is often where the best speculative opportunities begin. If drilling confirms the geological model, the upside could be meaningful.

At the current price of CA$0.04, I view Noble Resources as a Speculative Buy for investors who understand exploration risk and are looking for leverage to copper discovery in a world-class jurisdiction.

Investors who want to follow upcoming exploration plans and corporate updates can find more information at the company's website here: www.nobel-resources.com.

| Want to be the first to know about interestingCopper andBase Metals investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, between US$2,500.As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Nobel Resources Corp. Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.