A Gold Exploration Stock With Big Upside and Very Little Downside

Technical Analyst Clive Maund explains why he thinks it is now an excellent point to buy or add to positions in StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB).

StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB) is viewed as being a most attractive stock at this juncture because the downside is almost nil whilst the upside is relatively unlimited after its long bear market from its early 2021 highs when it was 20 times the current price. Whilst the continued drop in the stock price recently has doubtless been due to a succession of financings, the company has nevertheless been advancing towards its goals with this year seeing the acquisition of 152 claims at the Cuprite property in Nevada and the acquisition of the Hercules Gold Project also in Nevada at a very good price.

The company has four properties two on the prolific Walker Lane trend and two lesser properties in British Columbia.

The map on the following slide from the company's October investor deck shows the locations of the two Walker Lane properties in Nevada and also the relative proximity of big finds along the trend by other companies, which, of course, increases the chances that Strikepoint's properties will harbor significant reserves.

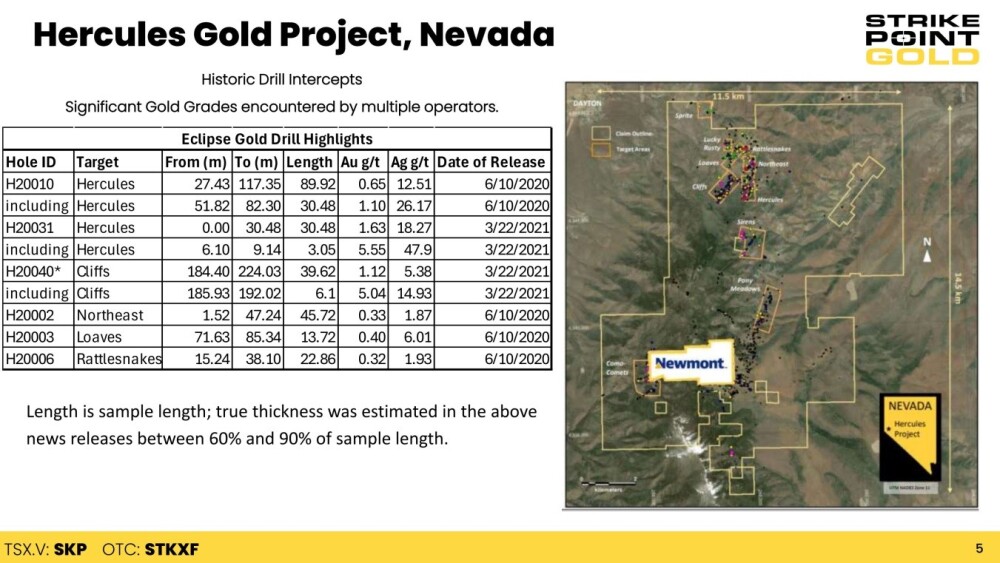

The following slide gives some details of the recently acquired Hercules Property. An important advantage that the company has with this property is that it has been explored in the past with significant quantities of gold having already been found some 300 drill holes were made, and the company has the data from these.

Below is a table showing historic drill intercepts at Hercules, which show significant gold grades being encountered.

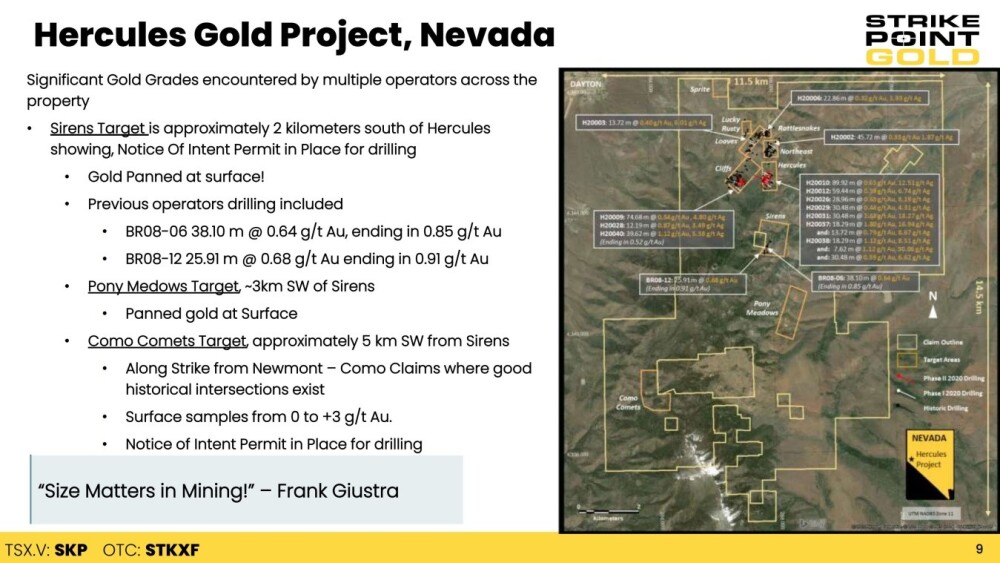

The following slide shows the locations and extent of the various targets across the Hercules property and details of what has already been discovered at some of the targets.

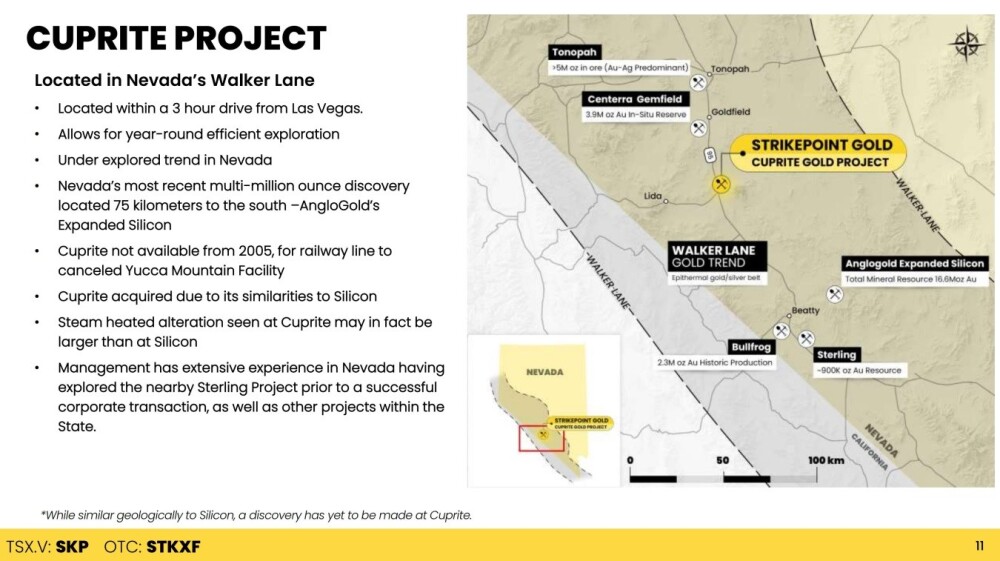

This slide below gives details of the company's other main gold exploration property on the Walker Lane trend, Cuprite.

There are two especially important points made on this slide. The first is that Cuprite was originally acquired by the company because of its similarities with Anglogold's expanded Silicon Project, which was only 75 kilometers to the south, where a multi-million-ounce discovery was made. The other point is that Cuprite was off-limits for exploitation up until relatively recently, and so by Walker Lane standards, it is relatively "virgin" territory with big discovery potential.

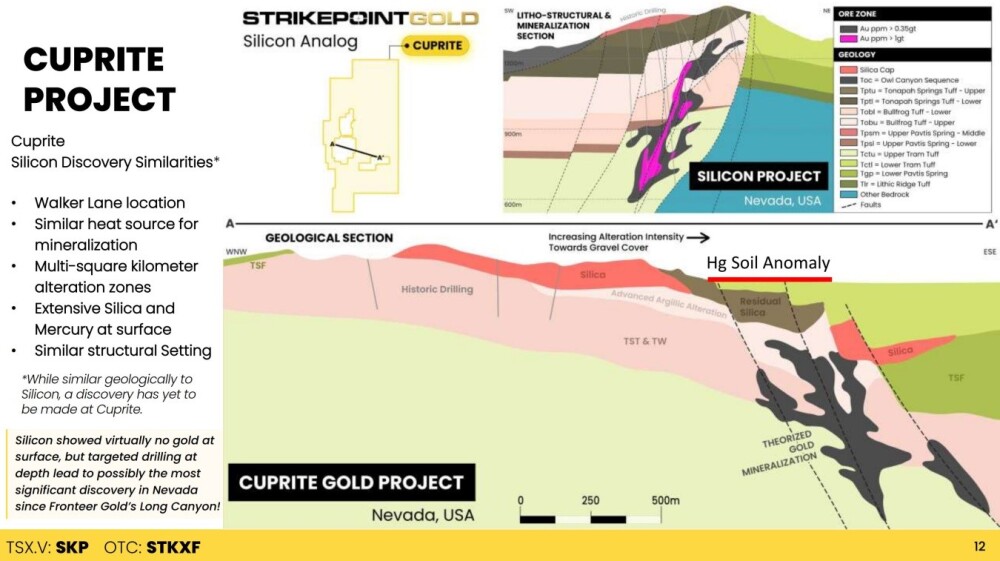

This next slide is interesting as it highlights the similarities between Cuprite and Anglogold's Silicon big discovery.

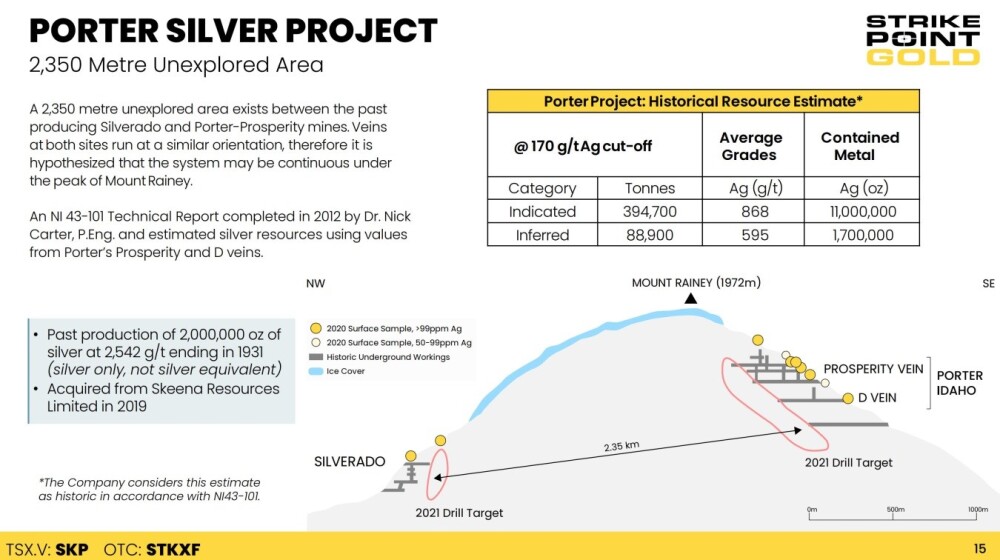

Although the company's Nevada properties should probably be considered to be its "flagship" properties because of their outstanding discovery potential, it is worth keeping in mind that it has two other significant properties in BC's Golden Triangle that also have significant discovery potential. They are the Porter and Willoughby gold-silver projects.

Some details of the Porter Silver project are here:

Some details of the Willoughby gold-silver Project are here:

This last slide shows the share structure. The company still has a relatively modest number of shares in issue, at 26.4 million, of which Eric Sprott holds 11.3% and Pathfinder Asset Management 7.6%.

Now, we will proceed to examine the company's latest stock charts. Strikepoint Gold has been in a long and severe bear market since the start of 2021, but now, having erased 95% of the stock's value, it has run its course.

On the 5-year chart, we can see this bear market in its entirety and how it has been moderating in stages defined by a 3-arc Fan pattern with a more moderate downtrend becoming established from mid-2022 onwards, which is bringing the price closer and closer to the third fan line. Normally, a breakout above the third fan line ushers in a new bull market, and this is made more likely by the overall positive divergence of the Accumulation line, which is shown at the top of the chart.

The increased volume from the middle of this year also makes a new bull market more likely because it indicates that a correspondingly greater quantity of stock has been rotating from weaker to stronger hands, which is obvious since most of the sellers are selling at a significant loss while the buyers will be less inclined to sell until they have turned a profit. It is thus interesting for potential buyers here to observe that the price is currently at the lower boundary of the large downtrend channel from mid-2022, which makes it more attractive here even though it has yet to break out above the third fan line.

Having established by means of the long-term chart that Strikepoint Gold is very good value here and is likely to start higher soon, we will now proceed to look at recent action in more detail on shorter-term charts, starting with the 1-year chart.

On this chart, we can see that, following the nasty sharp drop at the start of June, it ground lower into early August when it arrived at support at the downtrend channel line shown, which is the bottom rail of the downtrend that we looked at on the 5-year chart. Even though it continued to drift lower, making new lows until late last month, it continued to find support at this channel line with downside momentum (MACD) showing overall moderation.

The 6-month chart opens out recent action still further and enables us to see that even though it made a new intraday low late last month, on a closing basis, that low looks like it made a Double Bottom with the October low and further than that, the modest rally off the second low has been followed by the price dropping back again over the past several days to make what looks like the second low of a much smaller Double Bottom.

Whilst this may seem like abstract theorizing, it has very practical implications because if this line of reasoning is correct, we could scarcely have a better entry point for Strikepoint Gold, which has the potential to make huge percentage gains from the current price.

This is, therefore, considered to be an excellent point to buy or add to positions in Strikepoint Gold.

Strikepoint Gold's website.

StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB) closed for trading at CA$0.165, US$0.1049 on December 12, 2024.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

StrikePoint Gold Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of StrikePoint Gold Inc. Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts' Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.