A mea culpa for not recognizing the 2011 resource bubble

There was no commodity paradigm shift and there was no "peak everything" in 2011, says Jeremy Grantham in his recent letter to investors.

The storied investor, writing in this spring's GMO Quarterly Letter, runs an autopsy on his own bullish outlook on commodities in 2011 and dissects how it all went wrong.

Boston-based Grantham, Mayo, & van Otterloo has more than US$118 billion in assets under management as of March 2015.

Grantham said it started with oil and extrapolating out the price spike in 1979 when a barrel of oil hit $100 in today's money, a 1 in 1 billion event against the previous 100-year trend. Before then oil was trading at $16.

If we were running out of low-cost oil, I asked myself in 2011, why should we not run out of other finite resources? That everything finite runs out is known by everyone except madmen and economists (said Kenneth Boulding). Also, China uses a much larger fraction of total global minerals than it does of oil.

So, predisposed to see signs of finite resources running out, I saw in 2011 a set of remarkable resource statistics. The most extreme among them, iron ore, was measured as a 1 in 2.2 million possibility. This data made me believe that China's growth together with increases in world population was causing us to be facing "peak everything."

But, alas, I was fooled - along with all of the CEOs of the miners - by China. The four sigma event in mineral prices did not occur because those resources were running out. Not yet. Although there are suggestions in the data that we are running low on some low-cost resources: Even in the current truly sensational glut, the 34 equal-weighted index is only two-thirds of the way back to the old trend. I would guess, though, that in explaining the price behavior of commodities for the last 15 years I would only allocate a weighting of 20% or so to elements of paradigm shift.

Go read the full report. Grantham's summation starts on page 12.

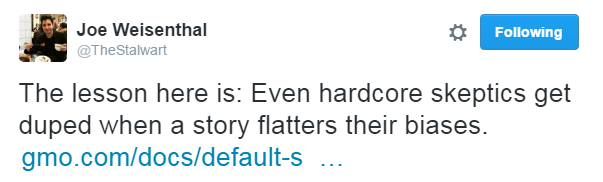

Hat tip, @thestalwart