A Message from Dr. Copper; Copper Use Is Everywhere

Sector expert Michael Ballanger examines the rise of copper and what that rise means and portends for other markets, including the precious metals.

Sector expert Michael Ballanger examines the rise of copper and what that rise means and portends for other markets, including the precious metals.

"The bloody uproar of the war is over: let's enjoy the carnival of the inflation. It's loads of fun and paper, printed paper, flimsy stuff do they still call it money? For five billion of it, you can get one dollar. What a joke! The Yankees are coming but as peaceful tourists this time. They purchase a Rembrandt for a sandwich and our souls for a glass of whisky. Krupp and Stinnes get rid of their debts, we of our savings. The profiteers dance in the palace hotels." Klaus Mann, 1923; Weimar, Germany

To begin, I recognize the alarmist tilt contained in this introductory quote, but subscribers are cautioned to remember the famous quote penned eighteen years earlier, in 1905, by George Santanyana in his brilliant piece, "The Life of Reason," in which he states, "Those who cannot remember the past are condemned to repeat it."

As a student of markets and history since the 1970s, I have paid a rigid and unyielding amount of time to "the past," particularly the behavior of the human race when it comes to tendencies for self-extinction and suffering. Both are at the opposite ends of a spectrum of extremes that includes gluttony and greed and five other well-known "sins," which dominate the "up" cycle for a fraction of the global populace that invests money.

I chose this topic because there was a period not long ago when the greed, ambition and nationalistic pride of an entire nation of pseudo-communists run by a committee drove copper prices into the ionosphere, as vacant cities and destination-less superhighways consumed every available tonne, pound and gram of cement, lumber, iron ore and metal available to man. The Commodity Supercycle of 2001-2011 was a classic exercise in "demand pull" inflation. It was Asian growth that propelled demand, as over a billion Chinese citizens discovered the wonderment of deficit financing and the wealth that fiscal largesse can bestow upon a once-agrarian society.

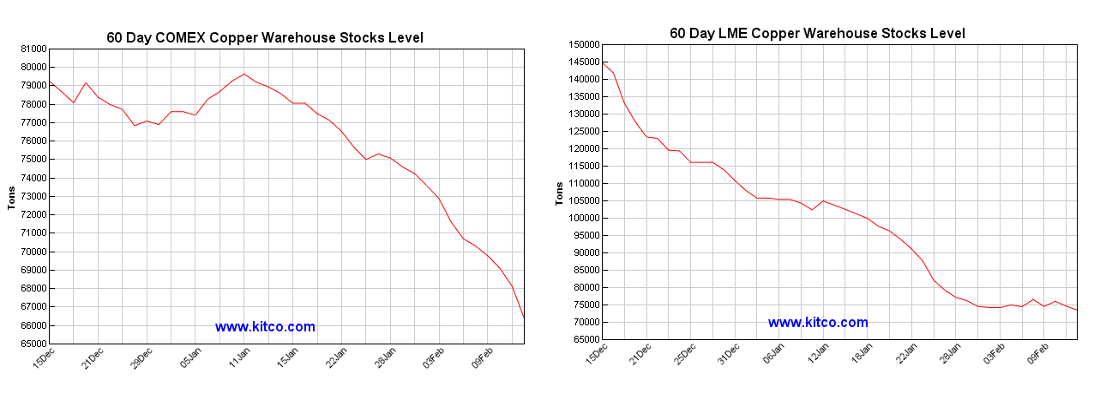

The first phase of the 2001-2011 bull run in copper prices was interrupted by the Great Financial Bailout Crisis of 2008, but quickly resumed its ascent. The second phase was propelled by the massive money-printing fiasco from 2009-2011. After peaking in the $4.60/lb range in Q1/2011, record prices met with increased supply, and as the Chinese infrastructure build-out frenzy abated, prices entered a bear market, with bottoms just under US$2.00/lb in January 2016 and in March 2020, during the Flu-bug Covid Crash. Conditions in 2021 are decidedly different than in 2011; the drivers behind the copper advance are today more related to supply issues, with inventories at historically low levels and the specter of depleted mines and pandemic supply shocks creating the perfect storm.

However, I believe there is a far greater impetus at work today. For the past six months, the financial world has witnessed the arrival of a new generation of market participants that have been raised as environmental activists. They invest not only with their heads but also more with their hearts than predecessor generations, giving rise to massive investment flows into alternative currencies (crypto) and alternative leisure products (cannabis), and now the metals, with emphasis on battery-related metals such as nickel, lithium, manganese and cobalt, rather than the traditional metals.

As I have discussed before, this new wave of youthful exuberance, whether irrational or not, make statements as a voting bloc rather than by a singular icon or representative. Fueled and shepherded by social media, they move en masse, and as the short-selling hedge funds learned the hard way back in January with GameStop, when these kids move, they do so with a vengeance.

Now, during this entire orgy of "green metal" investing, which includes an embarrassingly lame effort by the silver bugs to lure them in with the #silversqueeze propaganda campaign, seldom has there been any concentrated discussion of the role of the #1 metal used in the electronics industry copper. I believe the world is transitioning to copper, and while not denying silver's role as the best conductor of electricity in nature (with copper second), as the global lockdown eases and the flight from urban to rural living boosts housing construction, more and more copper is going to be consumed.

So, while there is certainly "demand pull" inflation coming to bear on copper, "cost push" inflation is also weighing in, as global currency debasement resulting in reduced purchasing power is causing input costs for copper mining to accelerate. It is this trend that is going to create the setup for copper as both a currency hedge and a green metal. Once this becomes a topic for the Reddit and WSB crowd, cell phones and tablets around the globe will be inundated with stories about junior copper explorers and developers, and volumes in this space are going to go even more vertical than they obviously already have.

The message being conveyed by copper is one that should be followed closely, and do not think for a moment that the central bankers led by Chairman Powell & Co. are oblivious to it. The danger in Dr. Copper's ominous behavior is that copper usage is everywhere, and if we are seeing new highs in copper, virtually everything in the CPI universe is going to be impacted.

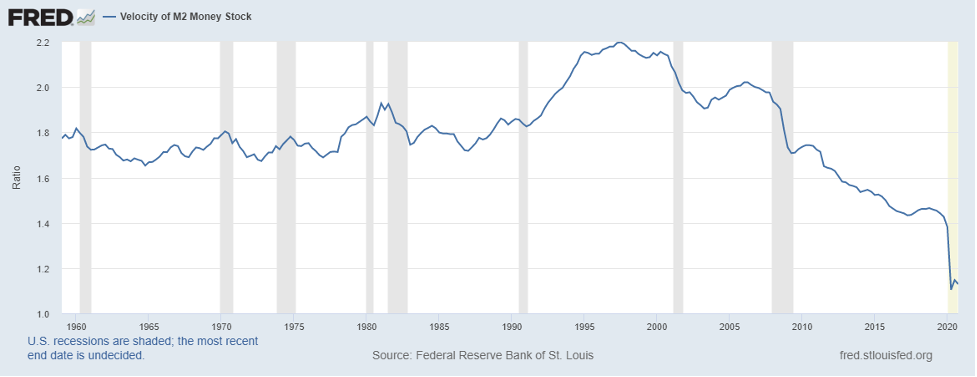

My last point on the topic reverts back to Weimar, Germany. I want you all to look at the chart below, courtesy of the Federal Reserve Bank of Saint Louis: the "Velocity of M2 Money Stock," which is approaching sixty-year lows.

Now read this quote from Julius Wolf, German economics professor, in 1922: "In proportion to the need, less money circulates in Germany now than before the war. This statement may cause surprise, but it is correct. The circulation is now 15-20 times that of pre-war days while prices have risen 40 to 50 times."

One of the telltale characteristics of a hyperinflationary spiral is the plunge in money velocity. Policymakers think that increasing the amount of currency in circulation will rectify the problem of velocity, but history has proven otherwise. The problem with Powell & Co. is that they subscribe to the view that the German bankers had it "right," but they just did not do enough of it. Welcome to the world of "Never let a good crisis go to waste."

Copper prices are extremely overbought on a near-term basis, and while I remain bullish looking out to 2022 and beyond, the danger in Dr. Copper's message is that the policymakers use it as an excuse for a policy "pivot." With bond yields now rising at an alarming rate, the danger for all of us irreparably ensconced in the "inflation trade" is that in the middle of the night, under cover of darkness, the Fed steals the vault, the jewels and the food in the fridge with a move to tighten. And while I can hear the screams of denial as to the dozens of reasons the Fed cannot tighten, you assume they know what they are doing, and that would be the weakness in the argument.

The precious metals remain a true dichotomy and a walking embodiment of positive divergence, as silver remains in its rebellious uptrend while gold continues to be the doormat of the money-flow proponents. The gold miners are a sorry lot, with leader Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) trading down to 2016 prices and Newmont Corp. (NEM:NYSE) in a bear market (-21.46% from its 12-month high) despite a 3.88% yield and ballooning free cash flow and a pristine balance sheet.

The silver miners are faring better, but my greatest fear dates to my early years of training, and one of the rules has always been "Gold miners lead gold bullion." So if this ongoing correction in the gold miners is a premonition of metal prices six months from now, how can it be that the gold-to-silver index is hitting new lows in what is always a precursor of high prices across the entire complex?

These are very strange times, and I must confess that I have no easy explanation for these oddities, other than the ongoing recognition that the central banks remain hostile to precious metals, ambivalent (for now) in the cryptocurrencies, and openly in love with stocks. One look at a chart of all three confirms everything in that last statement. Sad, but very painfully true.

If there is one dominant theme that I wish to impart today, it is that the behavior of today's stock markets is anything but unusual. If you are confusing the bull market in Bitcoin with extraordinary investment acumen ("brains"), know this: Obsession with stocks has always been a preoccupation and a time-tested defense for those with savings in countries victimized by hyperinflation. The Weimar Republic 1921-23 is one example; Hungary, Zimbabwe, Argentina and numerous others have followed, and there is not a shred of evidence that the multiple manias of 2021 are a departure from those very behaviors.

If unelected and elected officials demonstrate policies showing zero respect for the sanctity and preservation of a nation's currency, there is then zero reason for its citizens to show any reverence for holding their own currency.

What Dr. Copper is screaming from the rooftops is that "Cash Is Trash, so invest accordingly." But always beware the thief in the night.

Originally published Feb. 20, 2021.

Follow Michael Ballanger on Twitter @MiningJunkie.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

[NLINSERT]Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Barrick Gold. My company has a financial relationship with the following companies referred to in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.