A Multi-Decade Setup Meets One of the World's Largest Gold Projects

John Newell of John Newell & Associates explains why he thinks Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT) is designed to outperform in a rising gold price environment.

Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT) is not a typical gold stock. It is a long-duration leverage vehicle designed to outperform in a rising gold price environment, and the chart suggests the market is starting to recognize that again.

Seabridge Gold trades on the TSX under the symbol SEA and on the NYSE under SA. For more than two decades, the company has focused on acquiring and advancing large, high-quality gold and copper assets in safe North American jurisdictions, with the objective of growing ounces in the ground faster than shares outstanding.

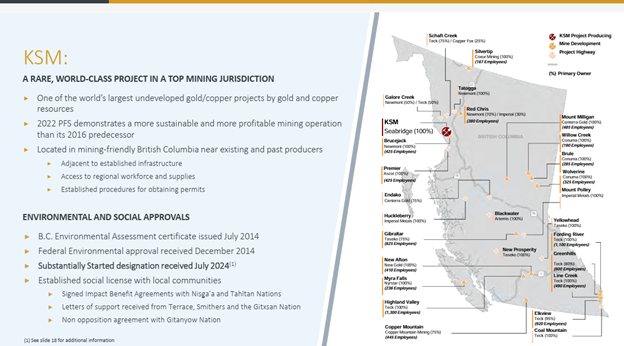

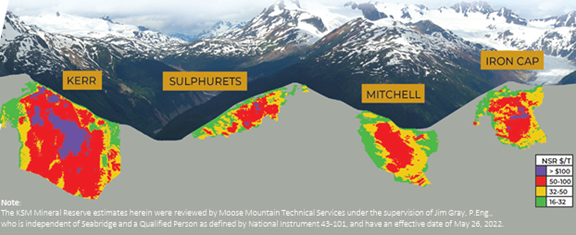

The centerpiece of the company is its 100%-owned KSM Project in northwestern British Columbia, which today hosts the largest publicly disclosed undeveloped gold resource in the world. Measured and indicated resources exceed 88 million ounces of gold, along with substantial copper and silver, positioning Seabridge as one of the most leveraged gold optionality plays in the sector.

About the Company

Seabridge Gold was founded in 1999 with a clear strategy: acquire large gold deposits when prices are low, expand them through disciplined exploration, advance them through engineering and permitting, and ultimately monetize them through partnerships or asset sales rather than building mines themselves.

That strategy has played out consistently. From 2003 through 2024, Seabridge increased its total gold resources by more than 1,000%, while shares outstanding rose far less, a point the company emphasizes repeatedly in its disclosures.

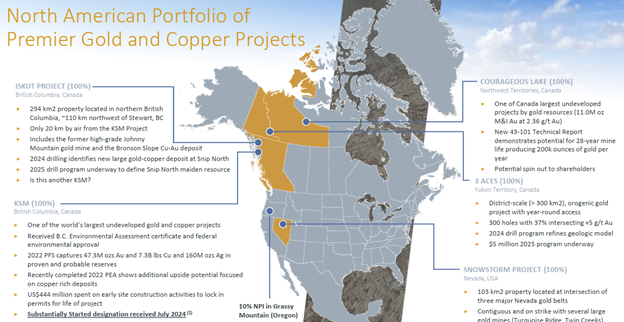

Today, the company owns five 100%-controlled projects across Canada and the United States:

KSM in British ColumbiaCourageous Lake in the Northwest TerritoriesIskut in British Columbia3 Aces in YukonSnowstorm in Nevada

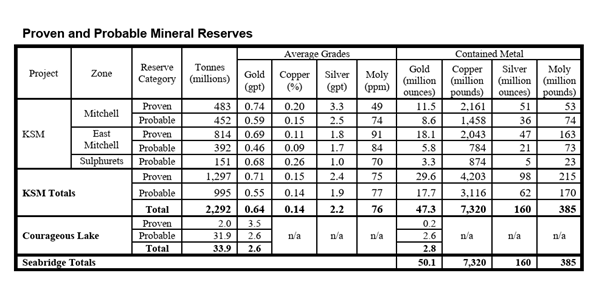

Among these, KSM is the value driver. A 2022 Preliminary Feasibility Study outlines Proven and Probable reserves of 47.3 million ounces of gold, 7.3 billion pounds of copper, and 160 million ounces of silver.

The study models a 33-year open-pit mine producing roughly one million ounces of gold annually, with meaningful copper by-product credits and all major environmental approvals already in place.

Management

Seabridge Gold Inc. is led by Rudi P. Fronk, Chairman and CEO, who co-founded the company in 1999. Fronk holds degrees in Mining Engineering and Mineral Economics from Columbia University and has more than four decades of industry experience.

What stands out in conversations with Fronk is consistency. He has repeated the same message for years: size matters, permitting matters, and patience matters. Under his leadership, Seabridge has advanced KSM through one of the most rigorous environmental and social approval processes in Canada, securing provincial and federal permits and achieving "Substantially Started" status in 2024, effectively locking those approvals in place.

The exploration team is another strength. Seabridge has built a reputation for finding large gold-copper systems, not just refining existing resources. That capability is now being demonstrated again at the Iskut Project, where recent drilling at the Snip North target has delivered hundreds of meters of continuous gold-copper mineralization, raising the possibility of a second KSM-scale system in the same district.

Valuation Perspective

From a valuation standpoint, Seabridge Gold stands out as one of the most discounted large-scale gold developers in the public markets today. Independent sell-side research estimates the company is trading at roughly 0.08x net asset value at spot prices, or well under 10% of NAV, compared to many advanced developers and producers that routinely trade at 40% to 55% of NAV once permitting and financing visibility improves.

This valuation gap is particularly striking given that Seabridge's flagship KSM project is fully permitted and ranked among the largest undeveloped gold and copper assets globally. Importantly, much of the company's economic work has been modeled using gold prices closer to US$1,700-US$1,850 per ounce, meaning today's gold market is not yet reflected in reported project economics.

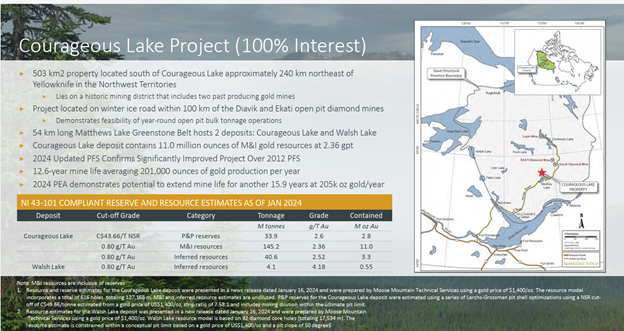

The planned spin-out of the 11 million-ounce Courageous Lake Gold Project further sharpens this disconnect. In effect, investors are acquiring exposure to two substantial gold companies for the discounted price of one, while retaining full upside to KSM. For U.S. investors, the opportunity is enhanced by the additional discount often applied to the NYSE-listed shares relative to Canadian peers.

The setup is like a real estate investor buying a large parcel, subdividing it, and realizing value that was never recognized in the original purchase price. In our view, as partnerships, spinouts, and updated economics move forward, the conditions are in place for a meaningful re-rating toward peer valuation multiples.

Share Structure

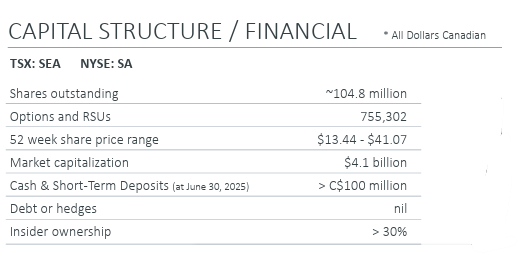

As of December 2025, Seabridge has approximately 104.8 million shares outstanding, with a fully diluted count only modestly higher due to a small option and RSU balance. Insider ownership exceeds 30%, aligning management with long-term shareholders.

The shareholder base includes some of the most respected institutional names in the resource sector, including VanEck, Kopernik, Sprott Asset Management, and Ontario Teachers' Pension Plan. The company carries no debt and reports more than CA$100 million in cash and short-term deposits, giving it flexibility while it advances partnership discussions.

This is not a serial diluter. Seabridge's entire investment case rests on per-share value growth, and the historical data support that claim.

Technical Analysis: A Long-Term Breakout with Room to Run

The long-term chart of Seabridge Gold tells a story that fundamentals alone cannot.

After peaking during the 2006-2011 gold bull market, SEA spent more than a decade building a massive base. That period coincided with falling gold prices, rising capital costs, and investor fatigue across the sector. Importantly, that base formed while the company continued to improve the underlying asset quality at KSM.

The current advance represents a decisive breakout from that multi-year consolidation. Price has pushed above long-term resistance zones that capped rallies for more than a decade, supported by expanding volume and strong relative performance versus gold itself.

From a classical technical perspective, this type of structure often precedes powerful trend extensions. The chart also highlights the potential for a short-term pause or consolidation following the recent vertical move, which would be normal and healthy. However, the larger pattern suggests the market is repricing Seabridge as gold enters a new secular phase.

Using historical measured moves and prior cycle behavior, the chart supports a big-picture target near CA$63, which would still leave Seabridge trading at a fraction of the embedded value of its KSM asset at current gold and copper prices.

This is not a short-term trade. It is a long-term re-rating.

Conclusion: Optionality Is Finally Being Recognized

Seabridge Gold Inc. has always been about optionality. For more than two decades, the company has assembled, permitted, and advanced one of the largest undeveloped gold-copper projects in the world while waiting for the right market environment to emerge. That environment now appears to be arriving, both fundamentally and technically.

KSM remains the cornerstone asset. It is fully permitted, supported by strong Indigenous agreements, and positioned to become a multi-decade producer at a scale few projects globally can match. In a rising gold and copper price environment, the embedded leverage in KSM is substantial, and the long-term chart suggests the market is beginning to reprice that reality.

What changes the story meaningfully today is that Seabridge is no longer a single-asset optionality play. At press time, the company announced plans to spin out the Courageous Lake Gold Project into a new publicly listed company, Valor Gold, with shares to be distributed directly to Seabridge shareholders. This move addresses a long-standing issue: Courageous Lake has effectively been given no value inside Seabridge's valuation, despite being one of Canada's largest and highest-grade undeveloped open-pit gold projects.

On a Proven and Probable reserve basis alone, Seabridge shareholders are backed by roughly half an ounce of gold per share in the ground, before assigning any value to copper, silver, exploration upside, or the proposed Courageous Lake spin-out. With gold prices trading near record levels, this embedded leverage is becoming increasingly difficult for the market to ignore.

The proposed spin-out gives shareholders a second, distinct path to value creation. Courageous Lake carries a robust 2024 feasibility profile with strong economics at higher gold prices, meaningful exploration upside through satellite deposits, and a capital intensity that contrasts well with KSM's scale. By separating the two, the market is given a clearer framework to value each asset on its own merits.

From a technical perspective, Seabridge shares are emerging from a multi-year base that spans more than a decade. Breakouts of this magnitude are typically driven by fundamental re-rating events, not short-term momentum. The combination of rising gold prices, advancing partnership discussions at KSM, and a clear plan to unlock value from Courageous Lake creates a rare convergence of factors.

Seabridge Gold is a Speculative Buy at the current price of approximately CA$42.56 for investors who understand the power of scale, scarcity, and optionality in a new gold cycle. With two world-class assets now on separate paths, and a long-term chart pointing higher, Seabridge offers leverage that is increasingly difficult to find in the gold sector.

For additional information, readers are encouraged to visit their website here.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Seabridge Gold Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.Author Certification: [John Newell of John Newell and Associates] holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.