A Needed Corrective Pause For Gold

After a 3-month rally, gold could use a brief "pause that refreshes".

It looks like the metal may get this needed relief in coming days.

Gold's larger recovery trend should remain fully intact, however.

For the first time in several weeks, gold is starting to show signs of vulnerability as a key short-term trend line is being tested. This is despite recent weakness in the U.S. dollar, which has prompted many investors to wonder if the gold market is simply suffering from a state of exhaustion after three months of rallying without a major pullback. In today's report, we'll look at the latest signs which still support a bullish intermediate-term (3-9 month) outlook in spite of the metal's signs of weakness on an immediate basis. We'll also discuss the supply problem facing buyers of U.S. silver bullion coins and how this favors a continuation of gold's multi-month recovery.

Gold has delivered gains of nearly 15 percent to investors since hitting a one-and-a-half-year low last August. That's an impressive performance for an asset that has the reputation of being slow-moving, if not stodgy, over the longer term. Yet gold's outsize rally since last summer's low also argues in favor of a "pause that refreshes" for the gold price in the very near term. After all, prices can't continue to trend higher consistently without a corrective pause or pullback at some point along the way. This provides refreshment for the market and allows prices to continue rising; otherwise, a rally would quickly exhaust itself and evoke its own reversal.

Market pullbacks also help to increase short interest levels, which in turn also help keep the uptrend alive. One of the problems facing the gold market recently has been the news that short interest in a popular gold-tracking ETF, the SPDR Gold MiniShares Trust (NYSEARCA:GLDM), fell nearly 87% last month. Small investors and institutions alike have increased their positions in GLDM and other gold ETFs in recent weeks, and this is a potential short-term danger to gold's rising trend. For when too many participants become bullish on gold, it increases the risk of a price decline due to the erosion of short interest. Another way of saying this is that gold's "wall of worry" is probably in need of some temporary repairs.

Until recently, gold's rally was supported by a plethora of worries about the fragile state of the global economy due to the U.S.-China trade war and the ongoing Brexit debate in Britain. While these worries haven't completely subsided, the latest positive developments on the global trade front have also given investors an incentive to turn to risk assets while lightening up on safe havens such as gold. Again, this is not to say that gold's intermediate-term recovery prospects are in question, only that its immediate-term (1-3 week) outlook is less certain in light of the latest news.

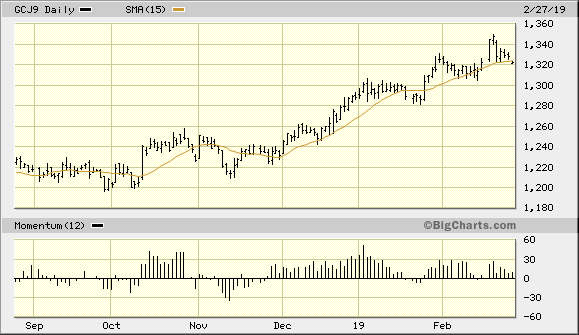

Shown here is the 6-month performance of the April gold futures price. The key to discerning gold's immediate-term price strength, in my estimation, is the 15-day moving average. As long as the gold price keeps above this important trend line on a weekly closing basis, gold's immediate upward trend can be considered safely intact. However, as can be seen below, gold is now testing this trend line and may soon close decisively below it on a weekly basis for the first time since January. If it does, we'll have confirmation that the "pause that refreshes" mentioned here is underway.

Source: BigCharts

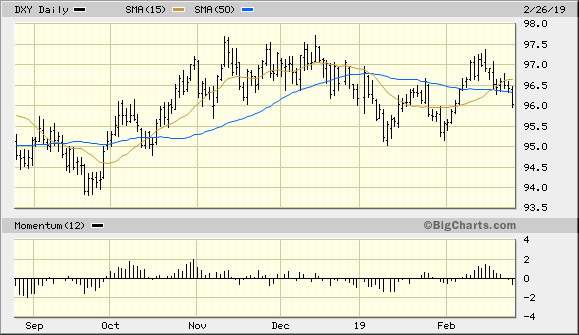

Even if gold temporarily reverses its immediate-term trend, however, the major recovery since the August low will be safe as long as the U.S. dollar index (DXY) remains range-bound. The dollar's trading range in recent months can be seen in the graph below. The strength or weakness of the dollar is the single most critical factor for determining gold's intermediate-term trend since the metal is priced in dollars. As you can see here, DXY is still below its 15-day and 50-day moving averages. That's a good indication that the dollar's technical picture is still weak enough to support a buoyant gold price, even if the precious metal pulls back a bit in the coming days. As long as DXY remains under its previous high from November, gold's intermediate-term recovery should continue without encountering headwinds from the dollar.

Source: BigCharts

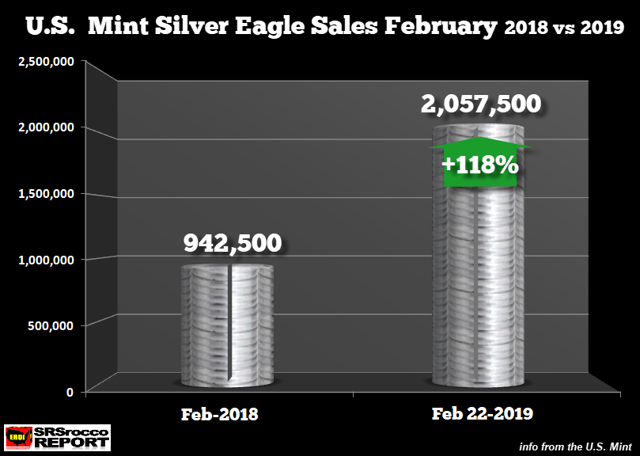

Meanwhile, gold's sister metal silver has been experiencing something of a supply issue. According to reports, the U.S. Mint has suspended silver bullion coin sales after the mint ran out of 1-ounce American Eagle silver coins on Feb. 21. Silver is often referred to as the "poor man's gold" and it's not uncommon to see silver coin demand spike after an extended upside move in gold's price as small retail investors seek cheaper alternatives to participate in the rally. Viewed from this perspective, the recent surge in silver bullion coin demand is another reason why the precious metals market likely needs a short period of recuperation as there appears to be too many bulls in the market right now.

However, the recent strong demand for silver coins is also encouraging from a longer-term standpoint. This is in contrast to previous years when bullion coin demand was subdued for long stretches despite periodic rallies in the gold and silver prices. Increasing appetites for owning physical silver is one reflection of a positive shift in the supply/demand equation for the metals. As such, it can be considered as another supporting factor for the continuation of the intermediate-term recovery in both gold and silver.

Source: SRSrocco/U.S. Mint

Source: SRSrocco/U.S. Mint

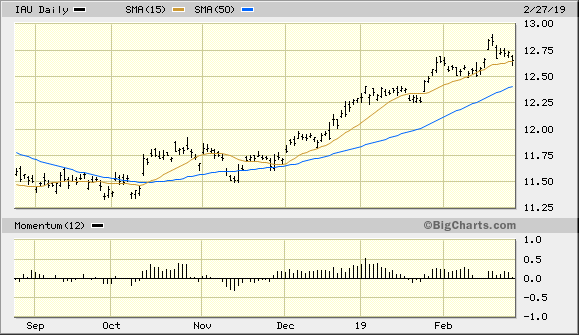

Turning our attention to my favorite gold-tracking ETF, the iShares Gold Trust (NYSEARCA:IAU) remains on a buy signal that was flashed back in October per the rules of my trading discipline. As mentioned above, only if the ETF closes decisively under its 15-day moving average on a weekly closing basis will its immediate-term uptrend be compromised. That said, I continue to recommend using a stop-loss for this trading position at slightly under the $12.50 level on an intraday basis. As long as IAU remains above this stop, traders are justified in maintaining a long position in the gold ETF.

Source: BigCharts

While it's starting to look like the gold price may soon violate its immediate-term uptrend, any such violation of this trend is likely to be short-lived. The bullish factors discussed in this report - especially the recent weakness in the U.S. dollar - support gold's more important 3-9 month rising trend, which remains intact. Based on the current weight of technical and fundamental evidence, investors are still justified in maintaining some exposure to gold regardless of the metal's performance in the coming days.

Disclosure: I am/we are long IAU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts